After months of suspense, the Federal budget is finally on the table. During the 2021 Federal election campaign, the Liberals proposed the creation of a tax on financial institutions called the “Canada Recovery Dividend”. This tax would help reduce the deficit that had accrued through the pandemic. During these past two years, with the benefit of the economic stimulus that supported consumers and businesses, the banks and Insurers did not experience the delinquencies and losses that potentially could have occurred. Rather, the government witnessed a 17% growth in the profitability of the banks. Hence, in recognition of the government’s assistance in their fast-paced return to profitability, this new tax was proposed. Under this plan, Canadian Banks and Insurance companies would fund billions of dollars through higher taxes.

As one would expect, the prospects for higher taxes targeting the financial industry will affect earnings and stock prices.

Better than Expected

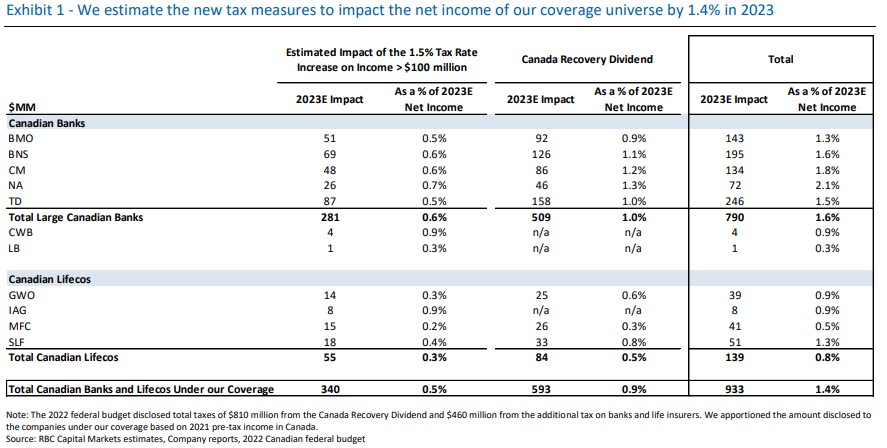

In the budget, a 1.5% tax rate increase was introduced for those banks and life insurers that have taxable income over $100 million. Further, a one-time 15% tax will be imposed on earnings that exceed $1 billion in the 2021 tax year which will be paid in equal installments over 5 years.

The overall tax burden does not appear to be as high as the 3% surtax that was originally proposed back in the summer of 2021. With this lower rate, the government is expecting to collect $ 460 million of taxes from the increase in tax rate and $810 million of taxes from the ‘Canada Recovery Dividend’.

Overall, we view these 2 tax measures announced in the budget as less detrimental than what the Liberal government had previously proposed. The taxes announced appear to be $400MM less per annum than originally ‘feared’. Although the overall tax dollars are lower, the previous $ 1 billion income threshold has now been reduced to $100MM, therefore several small banks and insurers will now have a higher tax burden.

Our banking analyst is expecting a 1.4% impact on average on net income in 2023. Some banks may be affected more than others. See the chart below for the estimated impact for each institution.

Another slight positive development coming out from the budget is that the regulator OSFI will remain an outsider through this new tax regime introduced by the Liberal government. This continues to allow OSFI to be as independent as possible.

Potential Longer-Term Impact

Some analysts have expressed concern that the government has set a dangerous precedent by using this windfall tax to target banks and life insurance companies. Bank earnings can be highly cyclical but the government may be ignoring the earnings downsides experienced during a recession and are instead, ‘punishing’ banks when their earnings recover. This expectation may have a much longer-lasting effect on future cycles and could harm valuations over the longer term. The additional tax could also change how the banks decide to deploy capital and can even make them reluctant to lend if they expect their profitability to be burdened by additional taxes.

The Canadian Banks have been a core holding for many Canadian investors. Tax regimes have changed and will continue to change. Looking over time, we have not seen this hinder the banks from growing their earnings and dividends. Rather than putting too much weight on the tax impact proposed by the budget, we feel monitoring economic fundamentals, the shape of the yield curve, and the health of the consumer are better drivers for bank stock performance.