As the 2021 tax return deadline rolls around, I’ve received inquiries from investors asking about their RRSP contributions and deductions on their tax return. Although this year’s RRSP contribution deadline has already passed (March 1, 2022), there is still time to figure out your deductions for your tax return. Here are some answers to a few common questions.

What is the Difference between Contributions and Deductions?

RRSP contributions are the funds transferred to the RRSP account that you hold with a financial institution. This can be done easily through online transfers or cheque deposits. Subject to your contribution limit, these contributions can be made in a lump sum or automatic deposits throughout the year. The amount that you contribute to your RRSP can be deducted from your taxable income and result in less tax being paid. An important thing to note is that the contributions you make do not have to be deducted from your taxable income in that same year. Your RRSP deductions can be carried forward to future years in whole or in part. Some investors may decide not to use the full deduction in the current year as they may be saving these deductions for future years where their income is higher and they are at a higher marginal tax bracket.

How much can you contribute and deduct?

Shortly after you file your tax return for any given year, the Canada Revenue Agency (CRA) should provide a Notice of Assessment (NOA) by mail or in your CRA Account.

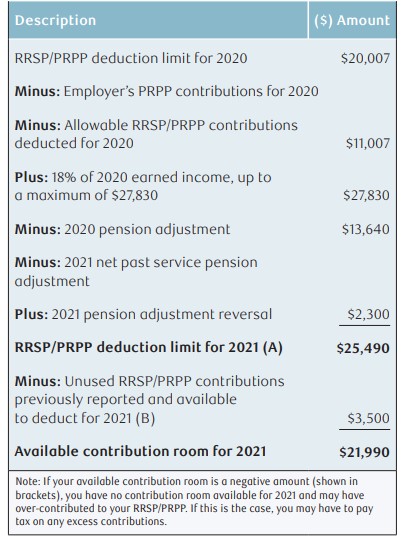

The image below is a sample RRSP deduction limit statement on the NOA. This example is what you would have received last year in 2021 after you filed your 2020 income taxes.

The table starts with the previous year’s ending tally of available deductions. To arrive at the deduction limit for this year’s tax return, adjustments are made by taking into consideration the deductions used last year, employer & pension adjustments, and new contribution room earned through last year’s earned income. The sub-tally called “RRSP/PRPP deduction limit (A)” provides you the amount that you can deduct for this year’s tax return.

If you made RRSP contributions during the first 60 days of 2021 (i.e. the year you are filing taxes for), these should have been reported on Schedule 7 of last year’s income tax return, even if you did not deduct them. If they were not deducted, the CRA will report these as unused RRSP contributions (marked by the letter (B) on the sample statement). This figure is subtracted from the deduction limit (A) to arrive at your total available contribution room. This was the contribution amount that you were able to make up to this year’s contribution deadline. As discussed, this year’s contribution deadline has already passed (March 1, 2022).

What happens with over-contributions?

If your NOA indicates that your available contribution room is negative, then you have over-contributed into your RRSP. Although this may sound bad, the CRA permits over-contributions of up to $2,000 without any penalties. However, over-contributions in excess of $2,000 are subject to a 1% per month tax calculated from the month you first exceeded your contribution limit. With this in mind, some investors purposely over-contribute by up to $2,000 as there are no penalties and it allows more assets to grow tax-deferred for a longer period of time. Before considering this strategy, one should be careful to double-check their contributions to ensure they are within the $2,000 available threshold.

Tax season can be a confusing and stressful time. The notes above are just a rough overview of RRSP contributions and deductions, but there could be more nuanced tax-planning strategies and tips to consider. Speak to your advisor to figure out how to best position yourself during tax season.

The content in this article is for information purposes only and does not constitute tax advice. It is imperative that you obtain professional advice from qualified tax advisors before acting on any of the information in this article. This will ensure that your own circumstances are properly considered and that action is taken based on the most current legislation