March Highlights |

Global equity markets have been trending higher in recent weeks, with non-U.S. markets performing particularly well. There has been additional focus on the employment situation and recent comments from the Bank of Canada and the US Federal Reserve. Both institutions reiterated the need for patience as we await further evidence that inflationary pressures are being contained. The possibility of a soft landing has become increasingly likely, and the likelihood of a short-term US recession has diminished.

U.S. Economy Continues to be Resilient

- The S&P 500 reached an all-time high on Wednesday March 20th.

- US economic data improved, showing signs of a slight acceleration in recent months. There are also recessionary signals that are being reversed, such as rising manufacturing activity, rising durable goods orders and falling inventory levels relative to sales.

- Rate cuts are still expected in the second quarter of 2024, which could contribute to economic growth.

- One of the main consequences of a soft landing could be its effect on inflation. Such circumstances would help to sustain a strong labour market, stable consumer spending and high corporate pricing power.

Although forecasts of a U.S. recession have become increasingly optimistic as of late, uncertainty may still prevail over the coming year. Inflation risk, US elections and geopolitical risks are all potential catalysts that could suddenly change the game.

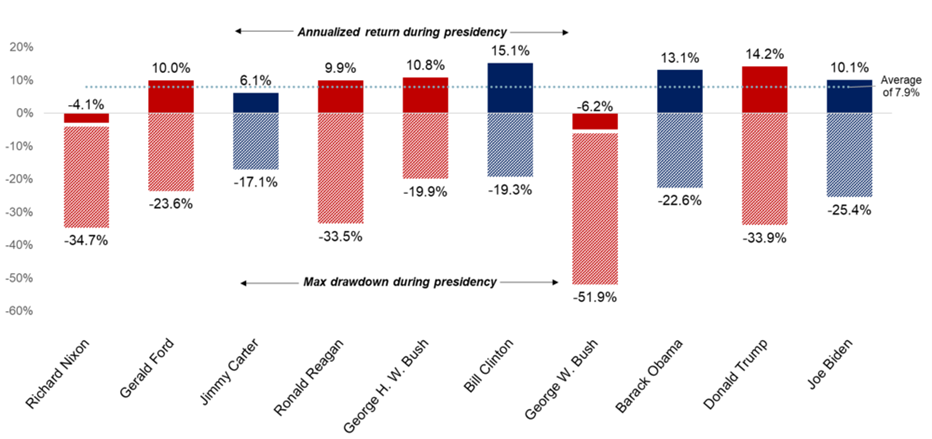

What's more, there are still several months to go before US citizens head to the polls in November, and a lot can happen between now and then. Donald Trump's trials, President Biden's age and policy clarity are all variables that will be hotly debated in the months ahead. If Joe Biden were to be re-elected, we would theoretically see fewer changes. A Trump presidency, on the other hand, could bring more volatility to the markets. Whoever wins, the outcome of the US election is unlikely to have a significant impact on long-term portfolios. As can be seen below, both the Republican and Democratic leaders have enjoyed attractive returns over different periods.

Average Annual Return and Maximum Drawdown by U.S. President

Source: RBC GAM, Morningstar. Period from January 20, 1969, to March 4, 2024. Performance of S&P 500.

Key take-aways

- Democratic mandates have returned an average of 11.1%, compared to 5.8% for Republican mandates.

- Presidential terms have posted an average drawdown of 28.2%, while offering an average annualized return of 7.9% since 1969. This highlights the intermittent volatility that short-term markets can display, but also the consistent positive returns that long-term markets can deliver, regardless of the president.

Our strategy

Fixed income

Toward the beginning of 2024, global returns were volatile. Global inflation indicators continued to improve, but fears of stagnant progress led markets to rule out interest rate cuts in the short term. However, modest cuts by the major central banks are still expected later in the year. Although the yields on offer have fallen considerably from the peaks reached at the end of 2023, they remain well above the averages of the last 20 years. We therefore remain alert for any rise in yields in order to add to our bond portfolio, as we did last autumn.

Equities

We still maintain that a well-diversified portfolio should be exposed to equities, but we are vigilant. Corrections cannot be ruled out, but early signals of bear markets are not yet visible. Moreover, while the likelihood of a US recession has diminished, it cannot be entirely disregarded. This risk will be reflected in stock selections by tilting portfolios toward higher-quality equities and growing dividend payments to shareholders.

That said, it's important to keep a long-term perspective and not focus on intermittent noise. We continue to focus on finding high-quality investments at affordable prices. The price we choose to pay is the single most important determinant of the success of our investments, and we always maintain sufficient liquidity in our portfolios to take advantage of opportunities that may arise.

"Someone is sitting in the shade today because someone planted a tree a long time ago."

- Warren Buffett, legendary investor

As always, we will be happy to answer your questions.

Yours sincerely,

Benoit Legros, B.A.A., CIM, FCSI

Portfolio Manager and Senior Wealth Advisor