Dive into this month's issue for a concise analysis of market dynamics and strategic perspectives.

Let's start with the big picture. The economy has been incredibly resilient, growing at above-average historical rates in the first three quarters of last year, even as key interest rates reached their highest level in over twenty years. Historically, higher interest rates would have discouraged companies from building plants and purchasing equipment. However, capital spending has been particularly strong thanks to public subsidies and tax credits aimed at facilitating the energy transition, especially for battery and electric vehicle manufacturing, as well as for the semiconductor industry. Indeed, there is an order book of over $500 billion worth of projects that should continue to support the economy for several years to come. Market movement has been relatively moderate in recent weeks, contrasting with the significant gains seen towards the end of 2023. This moderation can be attributed to a series of slightly stronger global economic data that have prompted investors to reassess their expectations for interest rate cuts. We believe that the timing and extent of rate cuts will be hotly debated this year.

Unlike the Federal Reserve, the Bank of Canada does not provide explicit projections of future rates. Despite this, investors expect Canada's central bank to move towards interest rate cuts as well. The market is forecasting rate cuts of around 1.4% this year from both the Bank of Canada and the Federal Reserve, with the latter expected to cut rates as early as March and the former as early as April. Despite market expectations, there is reason to believe that the Bank of Canada may act sooner than its American counterpart. This is because it began raising rates earlier, and because Canada is more sensitive to interest rates due to higher household indebtedness and shorter mortgage terms.

Ultimately, the two factors that should determine the timing and extent of interest rate cuts are inflation and employment trends. Over the past year, the pace of inflation has steadily declined in both Canada and the U.S., but some pressures remain. One example is the cost of housing, which includes categories such as rent and mortgage interest, which has shown few signs of abating, particularly in Canada.

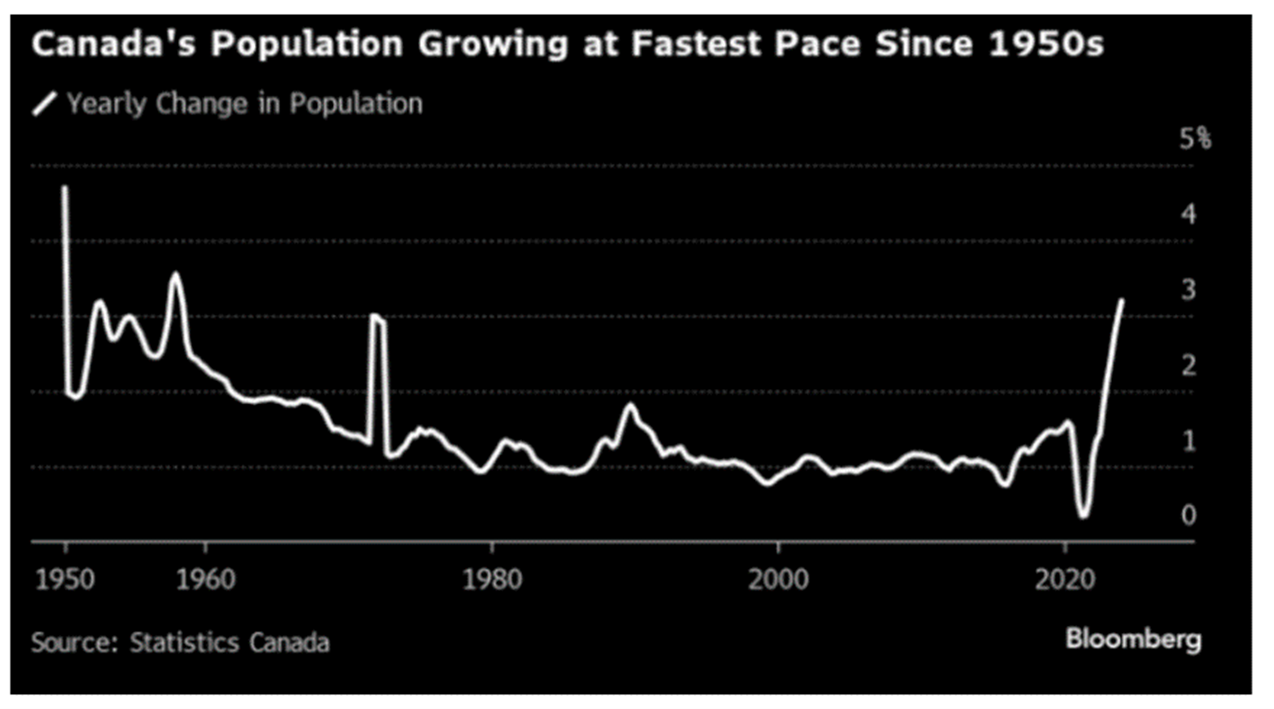

Finally, Canada's population is booming. The country recorded a record increase of 1.25 million people over the past year, while the 3.2% growth rate is one of the fastest in the world and the highest in Canada since the post-war baby boom of 1958. While ambitious immigration targets have stimulated economic growth, rapid population growth is also exacerbating housing affordability. What's more, many of the stocks we own benefit greatly from the influx of newcomers to Canada, such as banks (RBC), grocery stores (Metro) and telecommunications (BCE).

Our strategy

We believe that equity returns in 2024 will largely depend on whether the US economy succumbs to recession or suffers a soft landing. The year-end rally seems to indicate the latter. However, our leading economic indicators continue to send mixed messages, and it appears that the lagged effect of the Fed's aggressive rate hike campaign could, at the very least, dampen consumer spending and US GDP growth in the quarters ahead. What's more, the S&P 500 has risen in every presidential re-election year since 1944. That's 16 out of 16, including recession years like 2020. A president seeking re-election has in the past been concurrent with above-average annual performance. This is probably due to the fact that monetary and fiscal policies are more favorable prior to a president's re-election.

We maintain strong diversification and positioning in equities in general, to balance the risks of a U.S. recession against the possibility of avoiding one. In addition, we maintain our view that portfolios composed of high-quality segments of the equity market, including companies with strong balance sheets, sustainable dividends and reliable cash flow generation, are the way forward. Perhaps the most compelling reason to focus on resilient, quality companies is that the gathering economic and market valuation headwinds will, in our view, run their course and probably dissipate completely later in 2024 or early 2025. Equity markets generally anticipate the start of a new economic expansion several months before it begins. Portfolios that have maintained their value to an above-average extent will be best equipped to take advantage of the opportunities that are bound to arise when a stronger pace of economic growth reasserts itself.

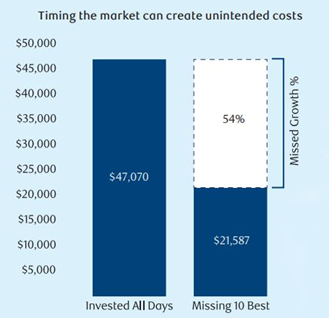

That said, while some days may look bleak for the markets, it's important to bear in mind that in the long term, staying invested and staying the course will always win the day. There will always be events that affect equity markets in the short term. In the long term, however, markets are historically winners (as illustrated in the chart below).

Source: RBC GAM

To conclude this month's publication, we'd like to remind you that the deadline for RRSP contributions is Thursday, February 29, 2024. For the 2023 tax year, you can contribute 18% of your earned income, to a maximum of $30,780, less any pension adjustment.

In addition, the maximum contribution allowed this year for your TFSA is $7,000, bringing the total to $95,000 since 2009. As a reminder, all investment income earned in a TFSA is tax-free, even when withdrawn.

It's a good idea to check your RRSP and TFSA contribution room on the CRA's My Account site to avoid an unfortunate over-contribution penalty.

"I don't try to predict the market my efforts are devoted to finding undervalued securities.”

Warren Buffett

As always, we'll be happy to answer any questions you may have.

Yours sincerely,

Benoit Legros, B.A.A., CIM, FCSI

Portfolio Manager and Senior Wealth Advisor

Benoit Legros Group