Don't Just Sit There - Do Nothing!

by Emmanuel Athanassakos

Over the past couple weeks, I have had a lot of conversations with clients about the potential impacts of a Canada-US tariff war. Clients are understandably concerned about their investment portfolio, which for many of my clients, makes up the bulk of their life savings. Folks I work with have spent years accumulating a nest egg, and just because they trust me to help them grow and preserve it, doesn’t mean they don't worry in the face of uncertainty. In fact, I expect a level of worry when it comes to the news cycle. So, I felt it timely, now more than ever, to hammer home one of the most important qualities in a good long-term investor – the ability to sit there and do nothing.

Let’s undergo a fun activity. Imagine this: you came to me in 2015 with $1,000,000 to invest. I then had a crystal ball that could predict all the major world events, but this crystal ball did not show us how the stock market would perform. It only showed us the social, political, and cultural events to come. I then told you the following would happen:

- Brexit will happen

- Donald Trump will be elected as President of the US

- Trump will then enter into a "trade war" with China

- The US President will shut down the US Government

- The Yield curve will invert, and historically, this economic indicator has led to a recession every time it occurs

- COVID - The WHO will declare a global pandemic and health emergency

- Governments all around the world will go into lockdown and enforce travel restrictions

- Civil unrest and riots will spark in the United States and around the world

- We will see supply and labor shortages in virtually every industry

- There will be a US election during a Global Pandemic, and when Trump loses the election, the results will be contested

- The US capitol will be stormed

- Russia will invade Ukraine and we will see atrocities take place paired with Nuclear threats

- Inflation will spike - reaching 10%+ in the Western World

- Interest rates will see the most aggressive increases in 40+ years

- Bonds will see the worst one-year decline in 40 years

- Every economist will be predicting a recession at the end of 2022

- The US Debt ceiling will be reached

- There will be devastation in Israel and Gaza

- President Trump will run for President again

- There will be an assassination attempt on Trump during his campaign

- When Trump wins the election, he will threaten to impose sweeping tariffs and suggest Canada should become the 51st state

- Canada's Prime Minister will resign in shame, and parliament will be prorogued during this period

Forgive me, but there is no way you would say “lets go ahead in invest it all”. You would likely want to hold onto your cash, assuming that a cycle of events such as these would cause stock prices to fall for a sustainable period of time.

If you had done that, you would have missed out on one of the greatest 10 year runs in stock market history.

Stock market returns over the past 10 years

US stock market: 14% per year

Canadian stock market: 9% per year

International developed stock market: 7% per year

International emerging stock market: 6% per year

A market weighted basket of global stocks (this includes all the above, weighted by market cap) would have generated 12% a year from 2015 to 2024. That $1,000,000 you gave me in 2015 is now worth $3,105,848.

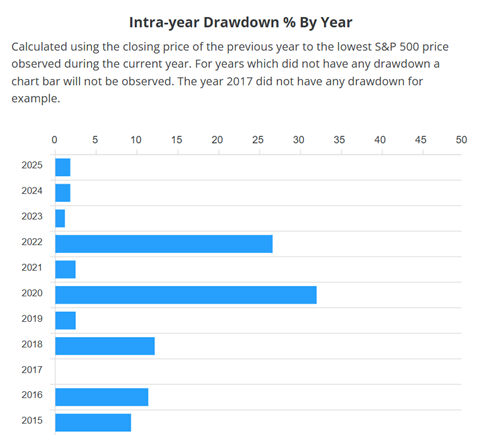

With that said, let's make sure we respect the path. It wasn’t a walk in the park. Those events did cause some volatility along the way, some bumps in the road. Here is a chart that shows the intra-year drawdowns of the US stock market from 2015 to 2024:

Source: Slickcharts

2015 to 2019 gave you some garden-variety corrections. Remember, the market corrects by 10% once every year on average. So, 2015 to 2019 was fine. But US stocks experienced a 30% correction in 2020 and a 25% correction in 2022. And you had to ride those out, stomach the pain, and wait for the pot of gold on the other side. It wasn’t easy, but if you did nothing, and you let your portfolio take the hit and recover over time, you were rewarded handsomely.

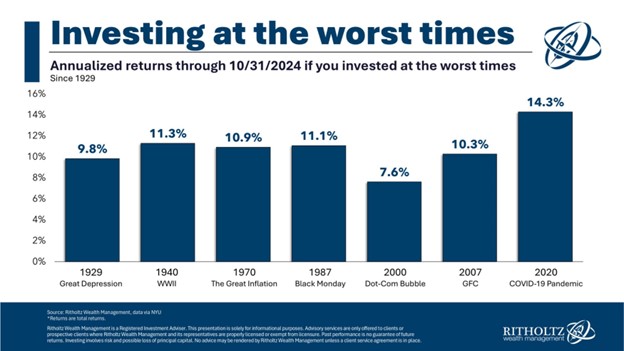

Now, you might say to me: “What if I missed the five years prior? It is nice to get five strong years of performance before a big market correction, but what if I invest that $1,000,000 right before the bottom falls out? What if I don’t get five years of strong performance to help cushion the blow?” What you would be asking me is the following: “What if I invest at the absolute worst time?” I will let the next chart do the talking. It shows you what your annual returns in the US stock market would have been if you invested at the top, right before all the major market corrections that have occurred over the last 100 years. Literally the day before.

So, if you have a long-term horizon, not only is perfect timing not a requisite to success, but you could actually have THE WORST timing and still do well, at least historically.

Doing nothing can sound silly, even lazy. But we don’t recommend always doing nothing. We recommend you do something very important at the start; you diversify. You diversify across asset classes, geographies, investment styles, sectors, and companies. Think of it like preparing for a storm. You don’t know when the storm is coming, but you know it is coming at some point. Could be next year, could be next decade. But you build your ship as if the storm is coming tomorrow, and when that storm comes, you rely on the fortifications you put in place long ago. Then, when the storm comes, yes, you do nothing.

Let me go into this a bit deeper. I mentioned you diversify across many segments, but let’s look at the most important segment that you need to diversify: asset allocation. We can use asset allocation to create trade-offs. We can say, okay, if the global stock market has given you 8% a year over the past thirty years, but your portfolio was down 40% a couple times along the way, what can we do to reduce the pain, while still capturing enough upside to meet your financial goals? Well, we can diversify our asset classes by shifting part of the portfolio from stocks into fixed income. Fixed income (or bonds) are an asset class where you lend money to a borrower (could be a company, or a government) in exchange for interest, and the promise of principal repayment after a period of time. Remember, when you buy a stock, you own a piece of that company. You are subject to expectations, earnings, revenue, profits, management, and just about anything that could impact the long-term prospects of that company. But with a bond, you are simply lending them money. The major risk is they don’t pay you interest on time, or they don’t pay you your principal back, and this risk, especially in the world of large publicly traded companies or sovereign governments, is quite low. So, we make a shift that looks like this:

And historically, fixed income/bonds have done a good job protecting capital, and many times, appreciating in value, during major stock market downturns. Here is a table that shows how US stocks and bonds have performed during major market crashes:

Source: Ben Carlson, A Wealth of Common Sense

So, lets get back to our example. The 100% global stock market portfolio that gave us 8% per year with a 40% drawdown along the way, what happens once we make the shift to a more balanced asset allocation? A portfolio that is 55% global stocks, 45% fixed income gave us 7.7% per year with a 20% drawdown along the way. It almost sounds too good to be true. And to be fair, we don’t know if the last thirty years of stock and bond returns will hold up for the next thirty years. In fact, we know they won’t. Maybe the 100% stock market portfolio gives you 7% while the more balanced approach gives you 6%. Maybe its 10% and 7%. We don’t know. But we use history as our guide, and we put our faith in the fact that diversification is the only free lunch in the world of investing. And we maintain confidence in the global markets, in the power of human beings to solve problems, build new technologies, and generate profits.

But I digressed. Back to the one of the most important qualities in a good long-term investor – the ability to sit there and do nothing. Nothing doesn’t have to mean literally nothing. For my clients, a large part of our team’s portfolio models are actively managed. We utilize independent money managers from around the world to manage a small slice of the pie. Our portfolios are like a hockey team – our clients are the owners of team, I am the general manager who selects the players to put on the ice, and the players are the investment managers, tasked with making decisions as the game is played. So, we may see some of our trusted managers make some changes at the margins in response to macroeconomic shifts. Perhaps with the threat in tariffs, and the escalation of trade tensions, our Canadian equity manager may see fit to reduce exposure to Canadian companies who generate 50% or more of their revenue from the US. If they had 40% of the portfolio in companies that met this condition, perhaps they scale it back to 30%. Small changes, at the margins, to add incremental value to the risk-return of the overall portfolio. So, if we acknowledge that these types of changes are happening outside of your control, we then focus on what IS in your control. And the biggest and most important levers you can pull, as an investor, are the following:

- To start investing or to wait

- To sell your investments, or to stay the course

- To continue adding to your portfolio, or to keep cash in reserve, waiting for a better time to invest

These are the decisions I refer to when I say the following – sit there and do nothing. Stay invested and continue to invest new money as you were before, as is in line with your financial plan. And if you are feeling anxious about the markets or the amount of risk your life savings has taken on, do the following: call your advisor, and book a meeting to discuss. As an advisor, what would I do at this meeting? I would run a hypothetical scenario in your financial plan where your portfolio goes down by whatever it has peaked out in the past, showing a worst-case scenario happening tomorrow. And we would determine, can you financially afford for this to happen? Next, we would discuss what that event might feel like, how you would be emotionally impacted by it, and we would answer the question, can you psychologically handle it? If the answer to both is yes, we do what I always hope we can do – nothing. If the answer is no to either or both, then we can begin to discuss and explore our options together.

Because remember, there will always be a reason to sell, a reason to question the stock market. And this chart really hammers that home.

When you read about something online or you hear about something in the news, and you feel tempted to change your investment strategy as a result, I hope you hear my voice in your head saying the following: “Don’t just sit there, do nothing!”

What am I Enjoying Right Now?

This is the best show no one is talking about. Absolutely incredible. Fassbender is amazing, Richard Gere is back, and this might be my favorite espionage show since Homeland.

All my clients own it, so I thought it appropriate to go deep on the story of the largest company in Canada! A great read so far, I am sure it will be a movie some day.