Investing at All-Time Highs - is it Something to be Afraid of or Embraced?

By Emmanuel Athanassakos, Investment & Wealth Advisor, RBC DS

Everyone loves a bargain. You don't go to the grocery store to find the most expensive item, you go to find the item you want for the best possible price. However, when it comes to investing, cheap isn't always a good thing. If a particular company is "cheap", it is likely for a good reason. Perhaps the company had a bad quarter of earnings, or perhaps their balance sheet has deteriorated, or perhaps the environment in which they operate has some strong headwinds. This may present a buying opportunity, but it also may present a value trap. It is always hard to figure out the difference, and this is what makes value investing so difficult. But I digress. Just as cheap stocks are cheap for a reason, expensive stocks are expensive for a reason. Just because something is expensive, doesn't mean it can't get more expensive for a very long period of time. So, investing purely based on valuation is a big mistake. It can be an input into your decision making, but it can't be the sole driver. Companies like Apple, Microsoft, and Alphabet have been expensive on a valuation basis for a very long time, and they have continued to outperform the market. If you haven't owned big technology companies in the US for valuation reasons, you have likely under performed just about every important benchmark when it comes to personal investing.

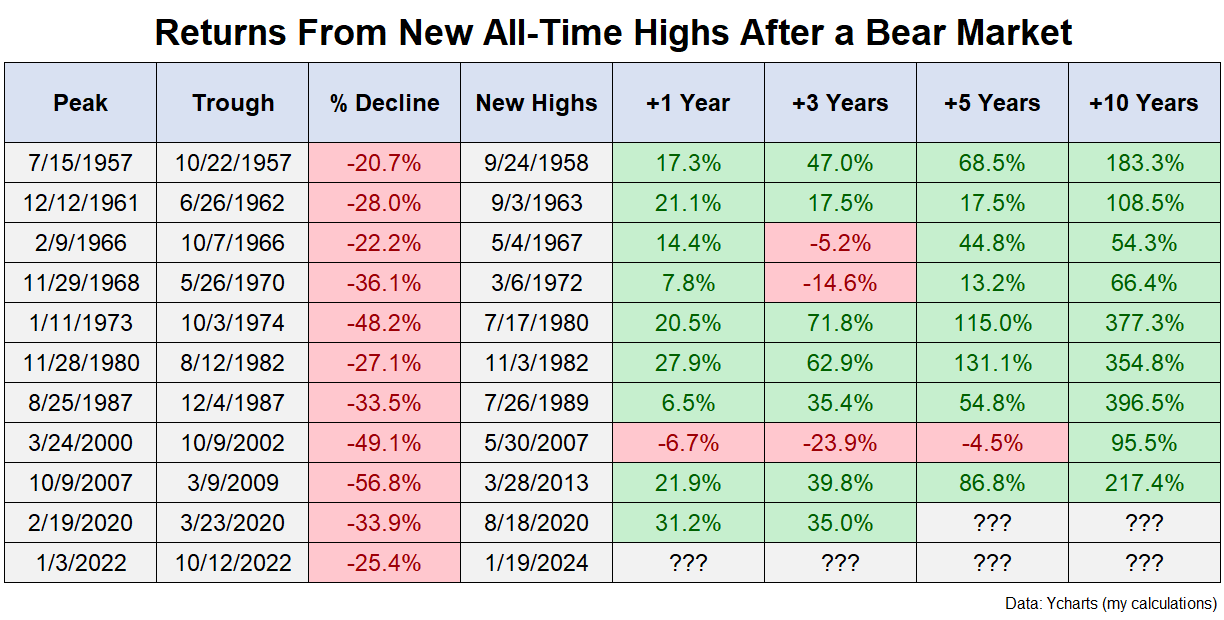

Many investors see the equity markets at all-time highs today, and they become afraid of putting new money to work. Our intuitive bargain hunting mindset kicks in and we get scared. The idea is that the equity market is "expensive" and due for a correction. I won't argue the former, but I will certainly argue the latter. Is it due for a correction? Historically, that has not been the case. Look at the table below. It shows the one, three, and five year returns of the S&P 500 after we see a 20% correction from the top (bear market), and then we eventually get back to all-time highs. These are not returns from the bottom of the correction. These are returns after the markets have fully recovered. As you can see, markets do very well once all-time highs are eclipsed.

Source: A Wealth of Common Sense by Ben Carlson

The 2022 bear market hasn't been any different. The S&P 500 has been roaring since getting back to its all-time high in January of 2024, up almost 10% on the year, and we are only in April. Only time will tell what happens next, but I like the odds when I look out three and five years.

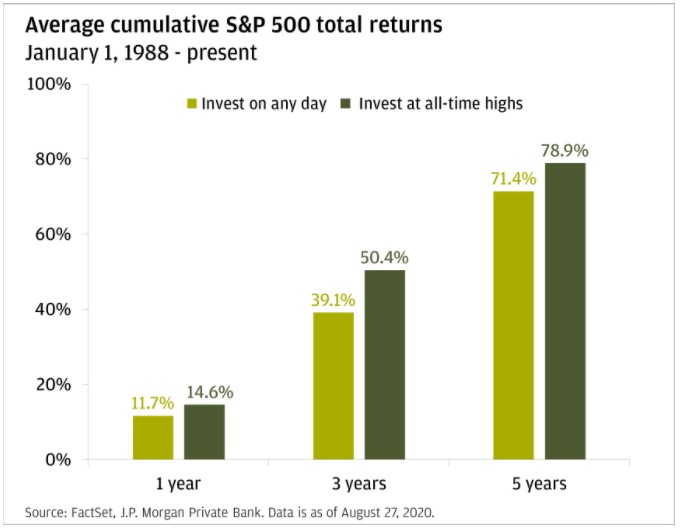

Here is another great chart from JP Morgan. It shows what your forward returns would be if you invested on days where markets hit all-time highs versus all other days. As you can see, investing at all-time highs has never been something to be afraid of, but embraced.

Image Source: A Wealth of Common Sense by Ben Carlson

It is pretty intuitive when you think about it. Markets have reached all-time highs for a good reason. That good reason doesn't just evaporate or get fully priced in once all time highs are eclipsed. No, markets tend to keep going until they have a reason not to. This is the nature of momentum, and anyone who ignores momentum investing does so at their own peril. Now, the market will eventually stop going up. And once this happens, you get consolidation or a correction. As we know, markets correct 10% every year or so, and have corrected 20% or more about twelve times since 1950. So, an all-time high doesn't imply that a correction will never happen again. I am not here to tell you that investing at all-time highs guarantees you a positive outcome. I wish it were that easy. However, what I am here to tell you is that investing at all-time highs is not a reason to not invest or be afraid. If anything, it should actually get you a bit excited.

Stocks Versus Real Estate

By Joseph Wu, RBC Portfolio Advisory Group

The Canadian residential real estate market has enjoyed a prolonged period of strong price appreciation. Understandably, this has inspired debate among investors in recent years as to whether the stock market or real estate has been a better long-term investment. On balance, we believe the historical data paints a more nuanced picture than commonly perceived. In this report, we compare the long-term total return performance of the S&P/TSX Composite Index to that of residential real estate markets across major Canadian cities. Though we acknowledge that comparing real estate to stocks is fraught with many pitfalls, we believe the analysis provides a few high-level, but noteworthy, takeaways.

Both the stock market and real estate have delivered attractive long-term returns. The persistent strength of many Canadian housing markets over the past decade has left many people with the impression that real estate is a more compelling long-term investment vehicle than other asset classes such as equities. Over the past two decades, however, both the stock market and real estate have delivered attractive long-term returns, in our view. As the chart shows, the S&P/TSX Composite has generated annualized total returns since early 1999 that are in line with, or better than, various Canadian real estate markets, including Toronto and Vancouver, which have experienced some of the most robust house price appreciation in recent years.

However, the table reveals that home price gains in a number of major Canadian cities have outpaced the performance of the Canadian equity market in recent years. While it may be tempting to extrapolate from housing’s recent strong run when forming future expectations, we note that time horizon matters and the S&P/TSX Composite has more than kept pace with many local real estate markets as time horizons are lengthened.

Although one of the main topics of discussion at dinner parties in recent years has been how much each person’s home has appreciated in value, most people purchase their homes as primary residences, and thus price appreciation may not be their primary focus. In contrast, investing capital in the stock market is typically done with the goal of having that capital appreciate over the long term to meet the investor’s financial objectives. That said, there are others who look to residential real estate as a potential investment vehicle. While comparing housing and equities may seem reasonable on the surface, we believe there are numerous factors that make a direct comparison difficult, if not outright misleading.

As a start, it is crucial to take the need for liquidity and diversification into account, in our view. Real estate can seldom be quickly liquidated for cash. This lack of liquidity compared to other types of assets (such as equities and bonds) makes real estate generally unsuitable for investors with ongoing or expected cash flow requirements. Except for those with sizeable amounts of wealth, it can also be quite challenging for investors to attain an appropriate level of diversification in their real estate holdings.

Additionally, real estate comes with potentially onerous barriers to entry, including down payments, access to affordable mortgage financing and insurance coverage, and an array of transaction costs such as agent commissions, legal fees, and land transfer taxes. The long-term costs of home or real estate property ownership, including, for instance, property taxes as well as repair, maintenance, and renovation expenses, is another consideration that is often underappreciated, as investors tend to place too much emphasis on the initial purchase price. In contrast to real estate, it is typically less arduous for investors to gain exposure to the stock market in terms of initial capital requirements, transaction costs, and achieving a suitable level of diversification across geographies, sectors, and industries.

We have omitted some other important considerations, such as the impact of leverage (mortgage) on returns, differences in the taxation of capital gains, and whether a primary residence should be viewed as an investment, but our main takeaway is that any direct comparison between the stock market and residential real estate is likely to be a flawed exercise.

Understanding the tradeoffs and differences between the stock market and real estate is crucial, in our opinion. While the stock market tends to be considerably more volatile, a review of historical performance supports the view that equities have been an equally effective means for investors to build wealth over the long term relative to residential real estate in Canada. It is also worth noting that investments in real estate and stocks are not mutually exclusive, and a residential property can certainly play a role in one’s overall investment portfolio. The choice of what mix of assets to invest in and own over the long term ultimately depends on an investor’s financial objective, time horizon, and risk capacity and tolerance.

Favorites - What am I Reading and Watching?

What am I Reading? Dune by Frank Herbert