There is always a reason to not invest. Ignore the noise and invest. Then invest some more. You’ll thank me later.

By Emmanuel Athanassakos, CIM, CFP, Investment & Wealth Advisor, RBC DS

It seems to me that every time I turn on the news or start scrolling on social media, I come across a new reason why the world is messed up. The last half-decade saw us endure a global pandemic, a war in Eastern Europe, a contested presidential election followed by a riot on Capitol Hill, an inflation spike, and then another war in the middle east, just to name a few. We also live in the golden age of misinformation. Everyone who can create an online profile of some sort has a platform, for better or for worse. Younger generations are arguably more anxious than ever. During the 1900’s, our brightest minds were inventing new ways to travel the world, creating antibiotics, and putting a man on the moon. Now, our brightest minds work at Meta, Instagram, and Google in hopes of creating the most addicting algorithm they possibly can so that younger people experience maximum FOMO. On top of all that, the largest economy in the world, the United States, is arguably the most politically divided it has been since the Civil War. The world is messed up, I know. But it always has been. In one way or another, the world has always been full of terrible circumstances, people, and events. We shouldn’t ignore these issues because they are incredibly important on a human level. As someone famous once said, those who don’t study history are doomed to repeat it. I have no idea who originally said that, but I do truly believe it. However, the key is the following: do not let the news of the day guide your investment behavior. Digest it, learn from it, but don’t you dare go near your investment account. Let’s look at some incredibly compelling data.

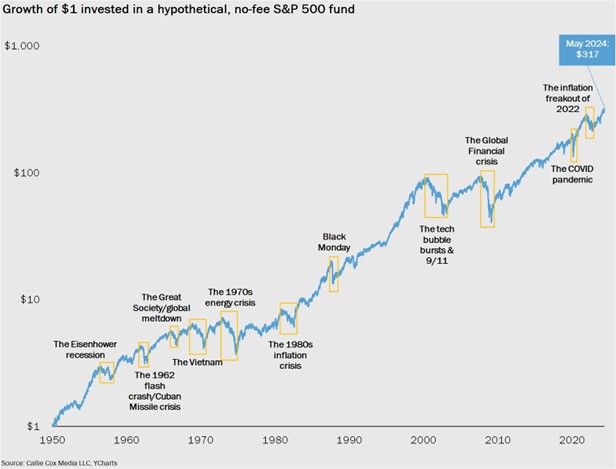

Below here you can see that $1 invested in the S&P 500 (which represents the 500 largest companies in the United States) at the beginning of 1950 would be worth $317 today, despite all the terrible events that occurred along the way. Did short term corrections occur? Of course. In fact, some of these corrections lasted months or years. However, the market always recovered, and eventually made new highs.

Source: Ritholtz Wealth Management

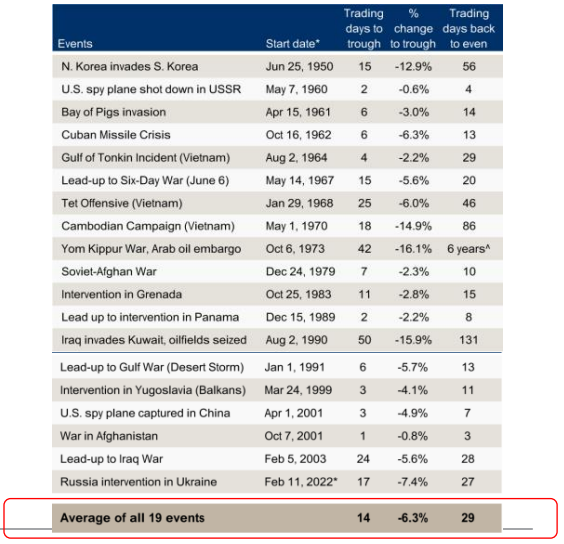

Below here is a history of all post-World War II geopolitical conflicts. Though each conflict presented a short-term correction, if you add them all up, it took an average of 29 trading days for the markets to bounce back. Yes, you read that correctly; one month for the markets to recover from war. And these wars tended to drag on for months or years. But by the time they were over, the markets hadn't just recovered, they had left those initial trading levels in the dust.

Source: RBC Wealth Management

If you think you can predict major events, stop investing/sell your investments before they begin, and then begin investing again once things normalize, then you are likely signing up for the hardest game on the street. Major corrections like the one we saw in 2008 are categorized as black swan events. A black swan event is an unpredictable event that is beyond what can be reasonably expected. The global pandemic in 2020 is another good example of a black swan event. If you asked 50 stock market analysts in 2019 to list their top 10 risks to watch in 2020, zero of them would have said a global pandemic. To quote another famous person that I can't name, the biggest risk is the one you don’t know about. So, the idea that you can predict these types of events is impossible

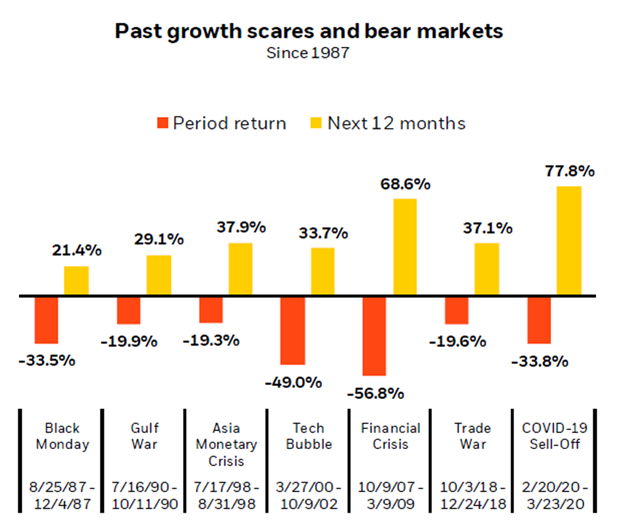

Then you might say the following: Fine, forget about black swan events. I understand those are impossible to predict and just as hard to act around. But surely we know when we have entered an economic recession. A technical recession is when we get consecutive quaters of contracting GDP. So, why don’t I just stop investing once a recession begins? Then I will start investing again once the economic data improves and the recession is over. However, you would be setting yourself up for failure. That’s because markets usually top out before the start of recessions and bottom out before their conclusion. In other words, the worst is over for stocks before it’s over for the rest of the economy. In almost every case, the S&P 500 has bottomed out roughly four months before the end of a recession. And if you don’t invest during a recession, you might be missing out on one of the best periods of performance the stock market has ever seen. Here is a chart showing stock market returns during a bear market, and then the 12 months following it. Look at the yellow. If you miss out on the yellow, you might as well take your ball and go home, because you may never catch up.

Everyone remembers COVID. It took one month for the stock market to recover, and we all know that it did not take one month for us, as a society, to recover. The aftermath of COVID and the effects it had on individuals, families, small business, and broader society, were catastrophic and are still being felt today. If you stopped investing once cases started spiking, and began investing once cases fell, or hospitals weren’t at capacity, or when restaurants reopened, you would have been left in the dust by the markets.

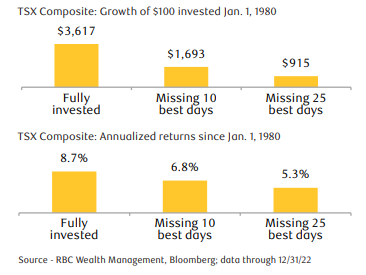

Ultimately, when you don’t invest, every day you aren’t in the market, you run the risk of missing out. You might think one day doesn’t matter in the grand scheme of the long term, but unfortunately that isn’t the case. If you invested $100 in the Canadian stock market in 1980, it would have been worth $3,617 by the end of 2022. What if you missed the 10 best days each year? It would be worth less than half that! $1,693 is what you would have by the end of 2022. Half your returns wiped out from 10 days each year. Look at the graph below.

In conclusion, I am not telling you that major events don’t matter. They do, on a human level. And they may even impact the value of your portfolio in the short term. However, my message is this: don’t let the unfortunate happenings of the outside world guide your investment decisions. Create a plan where you allocate your long-term savings into an investment strategy that has your goals and risk tolerance front of mind. Automate it so that you send your money somewhere and it gets invested without you having to make a decision. Then, rest easy, watch your wealth grow, and make time for the things in life that bring you joy.

What am I enjoying right now?

If you are looking for a binge-worthy drama, look no further. Jake Gyllenhal is incredible as the hyper-successful narcissist who has his whole world come crumbling down around him. This show has good acting, great production value, and is based off of a famous novel, so you know it will be full of twists and turns.

If you know me, you know I love podcasts that cover the financial markets in a way that is engaging and topical. Scott Galloway is a professor of marketing at the NYU School of Business, but he is also a successful entrepreneur who started a company that he eventually sold for more than $150 million. He brings both academic and real-world business success to the table. My favorite thing about this podcast? Scott's co-host is 25 years old, and is as sharp as a knife. This show has a successful boomer and an aspirational Gen Z'er providing different perspectives on key topics, and I can't recommend it enough.

Your Market Update

As 2024 began, we expected the major global stock market averages would soon move into new all-time high ground. Between early January and April, all mostly did with the China and Hong Kong markets the notable exceptions. Eventually even the laggard small-cap indexes began to advance on a trend basis.

Our confidence was bolstered by supportive “breadth” readings indicating that most stocks were trending higher, in sync with the broad large-cap indexes. That was especially true for the bellwether S&P 500. The term “market breadth” refers to measures that try to indicate whether the market trend is being determined by a “broad” majority of stocks moving in the same direction or by a “narrow” selection of heavily weighted favorites. The two breadth measures most commonly referred to are the advance-decline line and the unweighted index.

Expanding breadth is an important indication that a market advance is on a firm footing. The solid uptrends traced out by advance-decline lines and unweighted averages, if they were to continue, would strongly suggest to us the broad stock market advance that kicked off in October 2023 could have further to run.

However, there are two factors which, if they were to appear, would suggest a more challenging environment ahead for equity markets. The most important would be a negative de-coupling of breadth readings from the upward path of the market. In other words, breadth measures roll over and head lower even as the capitalization-weighted indexes such as the S&P 500 continue to move higher. So far, no such negative divergence has appeared.

The second would be an extended period of extreme bullishness / complacency on the part of investors.

While market sentiment readings indicate investors are a lot more optimistic than they were at the October 2023 lows, they are still not fully into the ultra-bullish territory which had, in the past, signaled the approaching end of major market uplegs. Moreover, sentiment is often weeks or months at or near those very elevated levels before the market succumbs.

However, while sentiment may not yet be over the top, investors seem willing to ignore the fact that stock valuations overall are no longer compelling. To be clear, valuation is a poor timing tool because stocks can always move far enough to become cheaper or more expensive than seems reasonable to investors or can be justified by either arithmetic or history. However, in this case, we would say the very big changes in the U.S. stock market valuation over the past 18 months should be acknowledged.

In late October 2022, at the bottom of what had been a painful 10-month market correction, the S&P 500, at 3500, was trading at just 16x the last 12-month earnings of about $217 per share. Despite heavily marked-down prices, buyers were hard to find; gauges of investor sentiment were deeply pessimistic.

Now, 20 months later, S&P 500 earnings per share are up a paltry 4%, but the index is ahead by a rip-roaring 51%, trading at a much richer 23.4x last 12-month earnings. Investors seem to be attracted by rising prices and rich valuation as much as they were put off in the fall of 2022 by bargain prices. And interest rates are not the explanation: as things stand today, the 10-year Treasury bond is yielding modestly more than it was 20 months ago while the fed funds rate is almost 250 basis points higher than it was. If anything, higher rates argue for lower price-to-earnings ratios, not higher.

It would seem investors must be confident about the outlook for future earnings. Consensus projections are for S&P earnings to rise by 11% to $244 this year from $220 in 2023. That would put the market at 21.6x this year’s earnings, still rich enough that any setback for earnings expectations might not be greeted gracefully by investors.

If the bullish earnings outlook is more or less borne out by actual results, it could be enough to keep this market moving higher, especially if a Fed rate cut continues to look like the most plausible next step for monetary policy.

We are paying close attention to market breadth and sentiment for any signs that a more defensive posture should be considered. Until then, in our assessment, a watchful commitment to equities in a global balanced portfolio is called for.