Investing through U.S. Election Uncertainty – Does it Matter?

The U.S. stock market is the largest in the world, as it now accounts for nearly 70% of the global stock market. The U.S. is also the most influential power player on the global stage. As a result, many of us tune in to watch the circus once every four years. During election season, you tend to hear a lot of pundits and talking heads reference how one candidate might impact the economy versus the other. Naturally, we then begin to ask ourselves: will the result of this election impact my investment portfolio? Is there something I should do to my portfolio to prepare for one candidate versus the other?

Who remembers 2016? No one gave Donald Trump a chance of getting elected. As election night heated up, the markets began to digest the news that Donald Trump would be the 45th president of the United States. The markets collapsed at first, and then spent the next two years marching higher on the back of his corporate tax reforms, among a few other things.

Election years do bring increased levels of volatility around election time. Headlines tend to grab investor focus, and the markets attempt to price in upcoming government policy. I suppose that this is the trap: thinking that the short term fluctuations around election season are long term (or even medium term) in nature. They are short term, and they can’t be predicted. The danger is acting on them, and getting left behind.

You might hear a pundit say: “A republican will mean (blank) for the stock market, while a Democrat will mean (blank) for the stock market.”

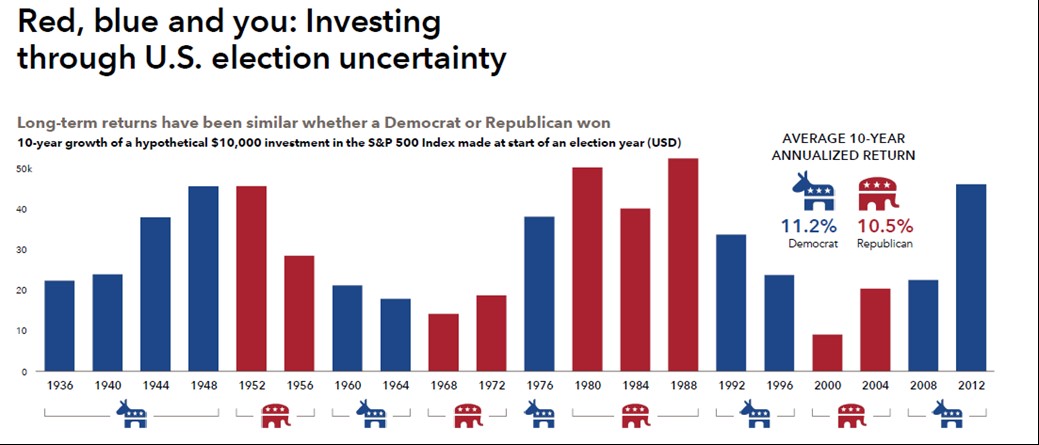

Well, historically, that is a load of rubbish. Here is a chart that shows that long term returns have been similar whether a Democrat or Republican won:

Image Source: Capital Group

So, as election season picks up, and you tune into the circus, remember one thing. The winner of this election does not determine your investment success; only you do.

More to Come

by Jim Allworth (RBC Global Insight)

The hard versus soft landing debate about the expected path of the U.S. economy is still going strong. We don’t think it will be settled definitively until we get an official recession “start date” decision from the National Bureau of Economic Research. However, this typically comes about a year after the fact which makes it largely unhelpful from an investor’s tactical standpoint.

For our part, we are persuaded that the combination of high rates and restrictive bank lending standards in place today makes a U.S. recession the most probable outcome. It is important to note that the Federal Reserve had already been cutting funds rates immediately before the start of nine of the past 10 recessions since the 1950s, so the arrival of the first Fed cut should definitely not be interpreted by itself as “Recession Avoided.”

Meanwhile, the presence of similar conditions, i.e., high interest rates and restrictive lending, is already taking a toll in Canada, the UK, and the eurozone. GDP growth in all three was no more than a shadow of U.S. growth over the first nine months of 2023.

Of course, one can never rule out the possibility this time will be different. The extreme supportive monetary and fiscal policies introduced in response to the pandemic could conceivably linger long enough to keep the all-important household spending (70% of U.S. GDP) from outright retrenchment. Instead of a multi-quarter decline in GDP, the U.S. economy may do no worse than slow down this year.

That could be enough to keep S&P 500 earnings growing, although probably not by as much as the current consensus estimate for 2024 ($244 per share, up approximately 11% from 2023’s expected $220) would suggest. (RBC Capital Markets’ estimate sits at $234, up a more modest 6.4%.) We think any earnings growth would leave room for share prices to advance between now and the end of 2024, even if the path for getting there remains in debate.

For now, we recommend remaining sufficiently committed to stocks to take advantage of the distinct possibility of the S&P 500 and other major indexes reaching a new all-time high ground in the coming few months. However, we would consider limiting individual stock selections to companies an investor would be content to own through a recession, which, in our view, is the most probable economic outcome in the coming quarters. For us, that means high-quality businesses with resilient balance sheets, sustainable dividends, and business models that are not intensely sensitive to the economic cycle.

Perhaps the most compelling reason for focusing on resilient, high-quality businesses is that the economic and market valuation headwinds gathering will, in our view, run their course and probably fully dissipate later in 2024 or early 2025. Equity markets typically have anticipated the start of a new economic expansion several months before it gets underway. In our opinion, portfolios that have held their value to a better-than-average degree will be best equipped to take advantage of the opportunities that are bound to present themselves when a stronger pace of economic growth reasserts itself.

Favorites - What am I Reading and Watching?

What am I Reading? The Wager - A Tale of Shipwreck, Mutiny, and Murder by David Grann

What am I Watching? Severance - on Apple TV