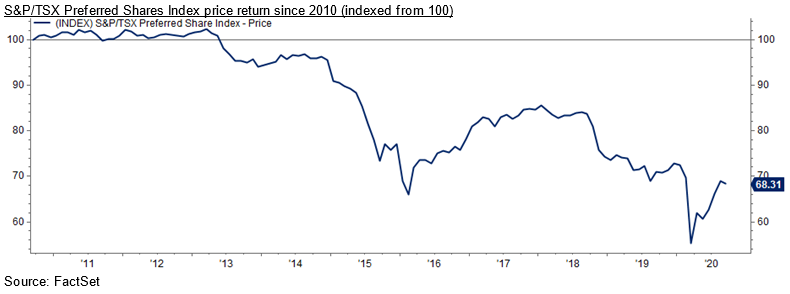

Canadian preferred shares have developed a bad reputation over the past 10 years, and perhaps rightfully so. The broad preferred market in Canada lost over 30% of its value since 2010 (price return, not total return – total return includes dividends).

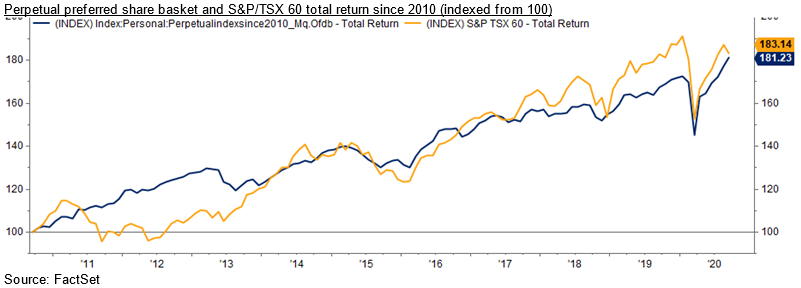

The preferred share market is heterogeneous and not all types of preferreds were such lousy investments. Perpetual issues, which pay the same dividend into perpetuity, performed quite well. In fact, perpetual preferred shares nearly matched the S&P/TSX 60 on a total return basis over the past decade. The chart below graphs an index of all perpetual preferred shares in Canada that were issued prior to 2010 (blue) and the Canadian equity market - S&P/TSX 60 (orange) over the last 10 years. The preferreds had a total return of 81% versus the TSX of 83%. Not only did the perpetual preferreds nearly provide the same return as the TSX but they experienced significantly less volatility.

The divergence in performance between perpetual preferred shares and in the index is due to the index’s composition. The majority of the issues in the index pay a dividend that is linked to interest rates and the dividend adjusts periodically. As rates declined over the past decade the dividend yields on these types of issues adjusted lower and lower, resulting in significant price depreciation. Perpetuals, however, pay the same dividend into perpetuity which actually becomes relatively more desirable when interest rates decline.

These charts highlight two important points:

First, perpetual preferred shares have been an excellent source of income and total return over the past decade and will likely continue to play an important role in fixed income portfolios. The 30-year Government of Canada bond yield is 1.06% and probably won’t even serve to fully preserve the buying power of capital after inflation. As well, with yields being as low as they are, the outlook for capital gains is diminished (when yields go down bond prices go up – how much lower can yields go?). It’s also important to note that bonds pay interest whereas preferreds pay dividends. To get the same after-tax return from a 5% dividend (which is around perpetuals’ current yield), you would need a 6.5% bond yield thanks to the dividend tax credit.

Second, the preferred share market in Canada is not homogenous. There are many types of issues that have different features and characteristics. This additional layer of complexity presents an opportunity for active managers to utilize their expertise and be selective. The first chart demonstrates the risk of passively owning the preferred share index to gain exposure to this asset class. Though researching and building positions in individual preferred issues can be an arduous process that managers oftentimes avoid, we think it is worthwhile and will benefit our clients over the medium to long term.