Would you buy a GIC yielding 7.6%?

Unfortunately, that’s not possible, but perhaps there’s an appealing alternative...

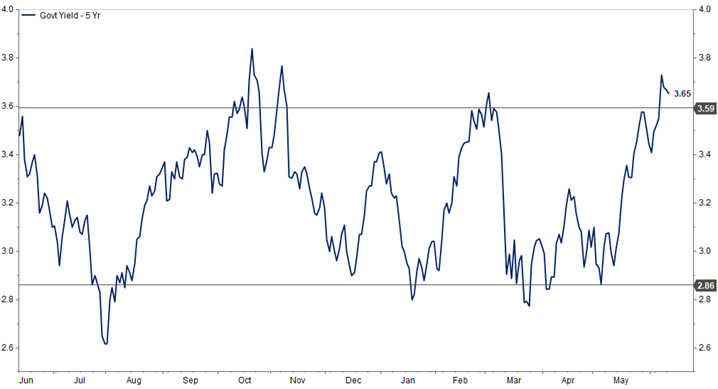

Discount bonds are something we’ve been favourably disposed to for the better part of the last year. Following the Bank of Canada’s resumption of its hiking cycle, interest rates are back to the upper end of their 12-month range (chart below). We think it’s timely to revisit corporate bonds, and particularly those trading at a discount to par.

Government of Canada 5-year Bond Yield

Corporate bonds play an important role in our diversified portfolios, and the bonds themselves vary by issuer, maturity, and credit quality (although most are A rated or higher). An especially attractive bond that we own is the Bank of Nova Scotia 1/10/2025 note. Details are below.

This note’s yield (yield to maturity) is attractive at 5.59%, a premium to 1-2 year GICs which currently offer ~5.40%. Unlike most GICs, this bond also offers daily liquidity.

At 1.57 years, the term is very short. This means price changes due to interest rate fluctuations will be minimal. The short term combined with the high credit quality of Bank of Nova Scotia makes this a very low-risk investment. Not quite as low as a GIC that has CDIC protection, but not that far off.

Perhaps the most appealing feature of this security is the Taxable Equivalent Yield. For Canadian investors owning this Bank of Nova Scotia bond outside of a registered account, the after-tax return is equivalent to a GIC paying a yield of 7.69%. The reason being is this bond trades at a steep discount to par ($100) and most of its return will come from capital gains which are taxed at a much lower rate than interest (calculator/assumptions in appendix).

A high Taxable Equivalent Yield is not unique to this security and is prevalent among many Canadian corporate and government bonds of varying maturities. We have constructed diverse bond ladders out to as far as 2031 to lock in attractive yields for many of our clients.

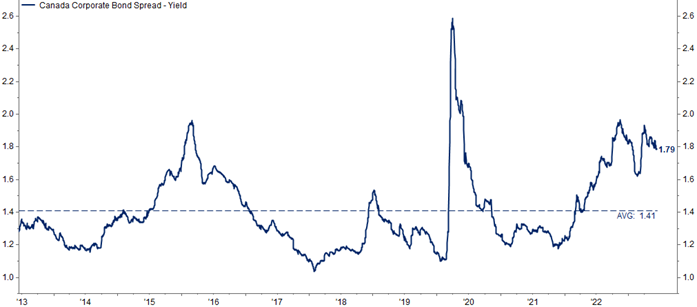

Two charts that reinforce our positive view on Canadian corporate bonds are below.

The first is Canadian corporate bond spreads, which measures the yield premium that corporate bonds offer over Government of Canada bonds. It is currently well above the average level seen in the past decade.

Canada Corporate Bond Yield Spread

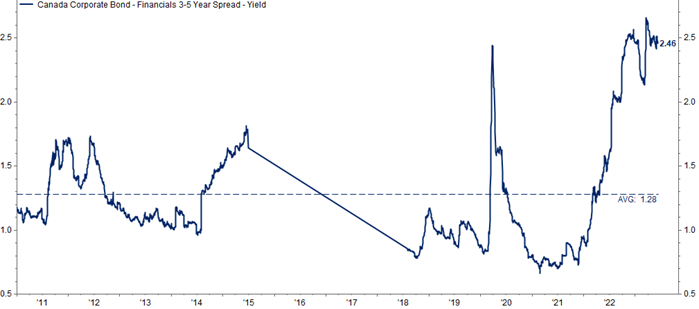

The second is a measure of Canadian financial sector bond yield spreads for 3-5 year maturities. This is the yield premium of short to medium term Canadian financial corporate bonds relative to Government of Canada bonds. As you can see, its near the highest level in 13 years.

Canadian Financial Sector Corporate Bond Yield Spread

Appendix