...catchy theme song from a movie beloved by the Cushing children seems to capture the spirit of financial markets rather well just now. Not only have risk assets including equities powered higher through November, but cyclical stocks have taken over equity market leadership, strongly outperforming perennial growth favourites such as the Big Tech companies.

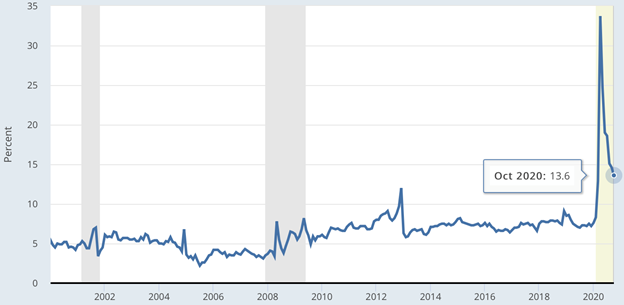

Looking solely at the macroeconomic picture for a moment, everything does indeed look pretty awesome. For starters, the ever-important US consumer remains in very good financial health. This is perhaps best evidenced in the personal savings rate (chart below), which remains at a higher level than at any pre-pandemic point in the last two decades, due to the reduced outlets for spending.

US Personal Savings Rate (as % of Disposable Income): Jan 2020 - Present

Source: St. Louis Federal Reserve, US BEA

Remember that this is an annualized rate, which means that every passing month leads to the accumulation of more financial firepower by consumers to support future spending. Also recall that thanks to government stimulus, personal income is actually 5% higher today than it was immediately prior to COVID – not only is the savings rate up, it is up on a higher income number.

The foundation of the income number, though, is jobs and here too the news remains very good. Labour figures to be released this Friday are likely to show that the US added another 500k jobs in November, sending the unemployment rate down to around 6.5% (RBC Economics estimate). Yet another positive is that this economic resiliency doesn’t change a thing for the Fed, which has already clearly signalled its intent to keep interest rates low and allow the economy to run-hot for the time being. Biden’s selection last week of former Fed Chair Janet Yellen as his Treasury Secretary also suggests that monetary and fiscal policy may also be more harmonized in the coming years.

Of course, arguably more important than all of this is the fact that mass vaccination campaigns appear set to begin by December 12 in the US and possibly earlier in the UK. With antibodies taking approximately one month to fully develop from Pfizer’s vaccine and 50 million doses of the 2-shot regimen expected to be produced by the end of December alone, perhaps 25 million people could be immunized by, say, mid-February. Adding that to the 13 million Americans who presumably have antibodies after successfully recovering from COVID, the math suggests something like 12% of the US population could be immunized within a couple of months. That’s before accounting for other vaccines and before adjusting the percentage for seemingly low-risk populations like children – although in fairness, it is also before adjusting for logistical issues. Meanwhile, though, the US and countries in Western Europe appear to have “bent the curve” once again on new cases.

Daily new COVID cases with 7-day average: Italy (left) and USA (right)

Source: Worldometer

While unfortunately it seems that us Canadians are going to have to wait longer than others for the vaccine, one can see why enthusiasm abounds in global equity markets right now. Everything is awesome! Everything, that is, except for valuations. Following November’s rally, the S&P 500 now trades at 21x consensus earnings estimates for 2021. That wouldn’t seem unreasonable if next year’s estimates were somewhat depressed to reflect that COVID will still dent at least part of the year. However, analyst estimates on average call for S&P earnings of $170 in 2021, which is 8% higher than in 2019. Estimates for 2022 anticipate another 15% growth on top of that.

S&P 500 Earnings, actuals & estimates: 2013 – 2022 (left); Next year P/E Ratio: 2014 - Present (right)

Source: Bloomberg

Given that fairly high earnings predictions are being multiplied by a fairly high P/E ratio, it is very difficult to argue that equity markets are broadly cheap anymore. That helps explains part of the recent stampede into cyclical stocks: they are (or were) the cheapest of what was left.

Despite full valuations, it is very feasible that share prices continue to rise along with the communal sense of euphoria that we’ll no doubt all feel as normalcy returns to our lives in the coming months. It is also feasible that the same euphoria may continue to float “bubbly” pockets of the market, like electric vehicles and tech IPOs (expect Airbnb amongst a host of others in the coming weeks). But unless a bubble mentality forms more broadly – which seems unlikely coming out of a recession, especially when central banks would welcome the excuse to raise rates from 0% – from our perspective equity markets are now set up for more air pockets and whipsaws than usual in 2021. Ironically, the first of those could come if the Democrats complete the Blue Wave by winning both Senate seats in Georgia this January, with the implication being higher corporate taxes. Whatever the triggers, next year looks like one in which it will pay to be nimble and opportunistic. But in the meantime, as we roll into an otherwise odd Holiday Season, it is worth taking a moment to revel in the current awesomeness.