The First Home Savings Account (FHSA), launched by the federal government in 2023, is a registered account to help Canadians save for a first home, while enjoying important tax advantages. Even if you already own a home, the FHSA may still benefit your younger family members.

This type of account is a mix between a Registered Retirement Savings Plan (RRSP) and a Tax-Free Savings Account (TFSA). Here are some tips to help you decide if an FHSA is suitable for you.

1. You don’t necessarily have to be a first-time homebuyer to open an FHSA

You’re eligible to open an FHSA if you’re considered a first-time homebuyer, meaning you or your partner have not owned a home you’ve lived in this year or at any time in the preceding four calendar years.

Even if you or your partner have bought a home, if the purchase didn’t occur in the previous four years, you’re technically considered a “first-time homebuyer” and you can both open FHSAs. You must also be a Canadian resident over the age of majority (which can vary by province and territory), who will not be older than 71 on Dec. 31 of the year the account is opened.

2. Maximize tax benefits

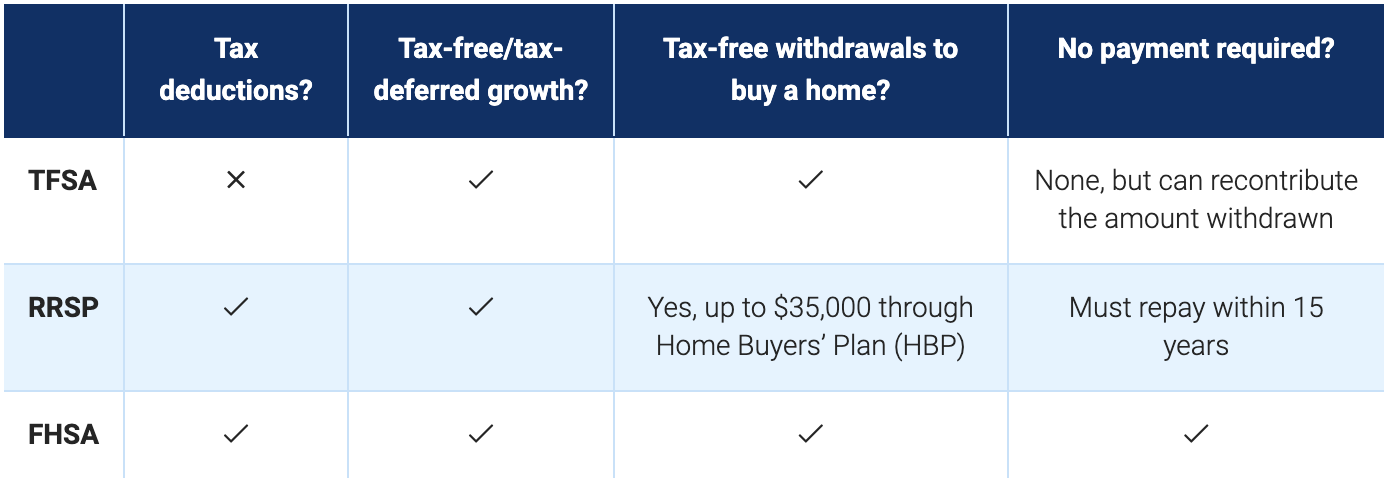

The FHSA combines the features of an RRSP and a TFSA in that it works like an RRSP when you’re contributing and acts like a TFSA when you’re making withdrawals. This means contributions are tax-deductible while qualifying withdrawals are non-taxable. You can invest in the same sort of investments as your RRSP or TFSA, and the investment growth is tax-free on qualifying withdrawals—your money will have the opportunity to grow faster in an FHSA than it would in a traditional savings account.

How different accounts can help you save for a home

3. Don’t wait to open an FHSA

You can contribute a maximum of $8,000 to your FHSA a year, up to a lifetime limit of $40,000. If you’re not able to make contributions each year, you can carry forward any unused contribution room to the next year, up to a maximum of $8,000 for a total contribution of $16,000 for the year.

Contribution room only starts to accumulate once you open your FHSA, so consider opening one even if you don’t contribute right away. When you do make a contribution, you don’t have to claim a deduction for that year. Instead, you can carry forward un-deducted contributions indefinitely and deduct them in a later year. This approach can be taken if you want access to tax-free growth immediately, but you expect to be in a higher tax bracket in a future tax year and would benefit from a deduction then.

4. Set up automatic contributions

By setting up a regular investment plan, funds can be withdrawn automatically from your account and deposited into your FHSA. Ideally, those funds are then used to purchase whatever investment solutions you have in your FHSA.

Automatic contributions are an easier way to save—you give a fixed amount of money at regular intervals instead of a larger amount all at once. Then, you regularly invest those contributions to take advantage of “dollar-cost averaging.” When market prices are down, you buy more. When market prices are up, you buy less. Over time, this helps lower your average purchase price.

5. Help family members purchase their first home

Even if you already own a home, an FHSA may still benefit your family members.

You can gift money—that may otherwise be exposed to your higher tax rate—to a family member who can then invest in their FHSA. You can also gift funds to your partner, in which case normal attribution rules do not apply (assuming your partner makes future qualifying withdrawals).

6. Use your FHSA together with your Home Buyers’ Plan (HBP)

The FHSA can work together with the HBP through your RRSP to increase the amount you have available for a down payment. Under the HBP, you can withdraw up to $35,000 from your RRSP to buy or build a home without triggering immediate tax consequences.

You can make both FHSA and HBP withdrawals for the same qualifying home purchase, maximizing withdrawals up to $75,000 in capital plus any growth in the FHSA to use toward a purchase of a home.

7. Use your FHSA to boost your RRSP/RRIF

Your FHSA must be closed fifteen years after opening, or when you’re 71 years old, whichever comes first. At this point, if you haven’t purchased a home, you can transfer assets from your FHSA to your RRSP or Registered Retirement Income Fund (RRIF) tax-free. Essentially, you can gain additional RRSP contribution room.

You can also transfer any unused FHSA savings tax-free to your RRSP/RRIF (eventual RRSP/RRIF withdrawals will be taxed as usual).

8. Consider designating your partner as the successor account holder

If your partner is named as the successor holder, they would become the new holder of the FHSA immediately upon your death, provided they meet the eligibility criteria to open an FHSA. In this case, the account can maintain its tax-exempt status.

If you name anyone other than your partner as the beneficiary, the funds will need to be withdrawn following your death and paid to your named beneficiary. Amounts paid to your beneficiary will be included in their income, and subject to withholding tax.

This document has been prepared for use by the RBC Wealth Management member companies, RBC Dominion Securities Inc.*, RBC Phillips, Hager & North Investment Counsel Inc., RBC Global Asset Management Inc. Royal Trust Corporation of Canada and The Royal Trust Company (collectively, the “Companies”) and their affiliate, Royal Mutual Funds Inc. (RMFI). *Member – Canada Investor Protection Fund. Each of the Companies, RMFI and Royal Bank of Canada are separate corporate entities which are affiliated. “RBC advisor” refers to Private Bankers who are employees of Royal Bank of Canada and licensed representatives of RMFI, Investment Counsellors who are employees of RBC Phillips, Hager & North Investment Counsel Inc., Portfolio Managers who are employees of RBC Global Asset Management Inc., Senior Trust Advisors and Trust Officers who are employees of The Royal Trust Company or Royal Trust Corporation of Canada, or Investment Advisors who are employees of RBC Dominion Securities Inc. In Quebec, financial planning services are provided by RMFI which is licensed as a financial services firm in that province. In the rest of Canada, financial planning services are available through RMFI, Royal Trust Corporation of Canada, The Royal Trust Company, or RBC Dominion Securities Inc. Estate and trust services are provided by Royal Trust Corporation of Canada and The Royal Trust Company. If specific products or services are not offered by one of the Companies, clients may request a referral to another RBC partner. The strategies, advice and technical content in this publication are provided for the general guidance and benefit of our clients, based on information believed to be accurate and complete, but neither the Companies, RMFI, nor Royal Bank of Canada, nor any of its affiliates nor any other person can guarantee accuracy or completeness. This publication is not intended as nor does it constitute tax or legal advice. Readers should consult a qualified legal, tax or other professional advisor when planning to implement a strategy. This will ensure that their individual circumstances have been considered properly and that action is taken on the latest available information. Interest rates, market conditions, tax rules, and other investment factors are subject to change. This information is not investment advice and should only be used in conjunction with a discussion with your RBC advisor. None of the Companies, RMFI, Royal Bank of Canada nor any of its affiliates nor any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. In certain branch locations, one or more of the Companies may carry on business from premises shared with other Royal Bank of Canada affiliates. Notwithstanding this fact, each of the Companies is a separate business and personal information and confidential information relating to client accounts can only be disclosed to other RBC affiliates if required to service your needs, by law or with your consent. Under the RBC Code of Conduct, RBC Privacy Principles and RBC Conflict of Interest Policy confidential information may not be shared between RBC affiliates without a valid reason. ® / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2024. All rights reserved.

RBC Wealth Management is a business segment of Royal Bank of Canada. Please click the “Legal” link at the bottom of this page for further information on the entities that are member companies of RBC Wealth Management. The content in this publication is provided for general information only and is not intended to provide any advice or endorse/recommend the content contained in the publication.

® / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2024. All rights reserved.