Dear Clients,

Recent market movements have been impacted by policy developments under President Donald Trump. Concerns over tariffs and their impact on the economy have contributed to increased volatility and overall declines in financial markets. While such fluctuations can be unsettling, history has shown that markets tend to recover and grow over the long run.

The key words is, of course, long term. Staying invested in the face of recent news is hard. Between the tariff war, the tweets out of Mar-a-Lago/Washington and the general economic atmosphere, being an investor requires patience and discipline.

In 1972, the late (and great) Ben Graham wrote “The investor’s primary interest lies in acquiring and holding suitable securities at suitable prices,” Graham wrote. The speculator, on the other hand, cares mainly about “anticipating and profiting from market fluctuations.”

Hence my constant harping on finding good businesses and trying as best I can to ignore what I call “the noise”, i.e.: CNBC, the pundits, friends/neighbours/brother-in-law, etc.

Now, this doesn’t mean that we don’t react and blindly wait for things to work out. I’ve long believed that the most important indicator was the health of the US economy. In other words, when is the next US recession? If none is on the horizon, smooth sailing, but if one is around the corner, we’re in for some very choppy water.

Furthermore, the policy (if you can call it that) of the Trump administration will most likely bring forward the start date of the next recession. Why?

Because recessions are a fact of life, and the current expansion was getting long in the tooth, but the uncertainty for businesses and consumers caused by the Trump administration slows down any productive decisions to be made. It’s true that financial markets have generally greeted the incoming Trump Administration with applause (markets tend to like deregulation and tax cuts, while ignoring the long-term cost of these and dismissing the obvious dangers of tariffs on the economy).

But this weekend, if you’re the CEO of a company, you’re thinking what’s coming my way next week and how do I source whatever input (raw material, talent, etc.) I need to grow my business.

The best example is Mary Barra, CEO of GM. She’s generally perceived to have done a great job running the company in what is a very competitive field. Their results are certainly better than Ford, Stellantis, Honda, Nissan, Volkswagen, etc. I do not know Mrs. Barra personally, but something tells me that these days she isn’t thinking about how to keep beating her competitors in the next decade. She’s thinking about short-term issues like parts. Power steering and door trim panels built in Mexico, rear lighting units built in Canada, airbag modules built in Germany, centre stack displays fabricated in Japan, etc.

Same for Jim Farley at Ford. In 2024, Ford sold approximately 732,100 units of the F-Series pick-up truck. It’s their most important vehicle, with an estimated profit margin of $10,000 to $13,000 per truck. And 100% of them are made out of Quebec aluminum. That’s what Jim Farley is thinking about. Not GM or Toyota, but aluminum.

Without a clear policy process, you slow down an awful lot of decisions that would have positively impacted economic growth. This uncertainty has a cost, whether the Trump administration likes it or not.

The bad news is this: Recessions cause bear markets.

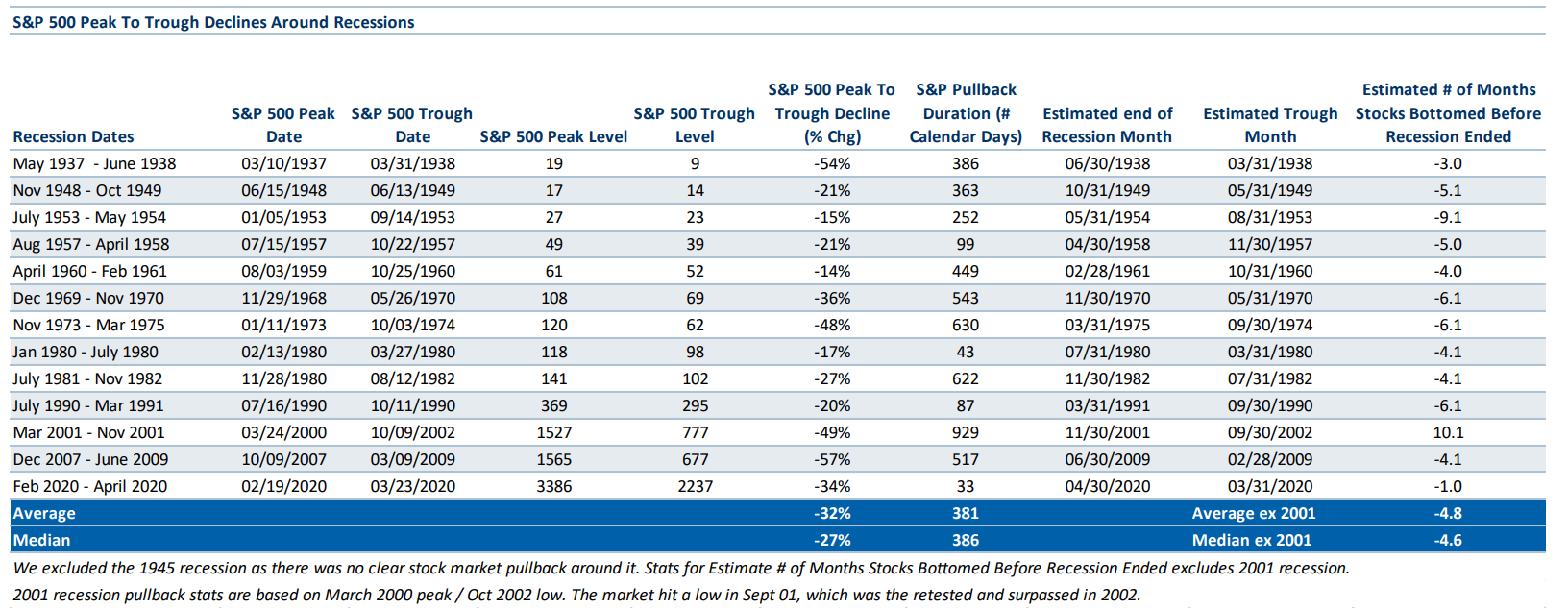

When growth fears turn out to be legitimate, the rule of thumb is that the S&P 500 tends to lose around a quarter to a third of its value. This is a rough guide. Since the late 1930s, recession-related drawdowns in the S&P 500 have ranged from 14% to 57% peak to trough, with an average drop of 32% and a median drop of 27%.

With this thought framework, what are we doing?

Investing is about controlling the controllable (I know, a very Rumsfeld expression!). We can’t control the markets, but we can control our own behavior. Our future success may depend less on what markets do, and more on figuring out which great business is on sale or will be on sale. It also means putting some calm and serious thought into managing your investments.

Too many people say, “Clearly…” or “It was obvious to me that…” or “Everybody knew that…” when discussing their portfolio. However, simply owning the Mag 7 or all the Canadian banks is not managing your investments. It’s FOMO at best or lazy at worst.

Last Friday (March 28, 2025) was a very bad day in the market. All markets really took a tumble. And so did most of the stocks we own. But quite a few went up. Year to date, an even larger group of stocks are still up. Showing that diversification works. It’s not a miracle cure, but it cushions the blow. George Gatch of J.P. Morgan Asset Management once said, “the only free lunch in investing is diversification”. Don’t ignore this piece of advice.

Other controllables?

Bonds. GIC and cash in the bank is fine, but they don’t go up in value with a full fledge flight to safety going on amongst investors. A one-or two-year bank term deposit has

completely different characteristics than a bond. The difference is important. Too many people confuse the two.

Dividend income. Most people I meet know their portfolio value but have little clue about how much in dividends they receive. Quality businesses will continue to pay their owners (you, fellow shareholders) a dividend.

Having a financial plan. This serves as a road map. Where and how am I going to pay for retirement? Knowing is power. Which source of income am I using to fund next years living expenses? A bond maturing, dividends, government-sponsored pension. The answer should be clear and have nothing to do with a rising or falling stock market.

Life insurance. Knowing exactly how much you’ll leave your heirs, regardless of stock price. For those of us for which this is important, it’s reassuring.

Another controllable is understanding the difference between short-term volatility vs. long-term growth.

Market (over)reactions to political and economic uncertainty are common. However, staying invested through volatility has historically been the most effective strategy for long-term wealth accumulation. Equity markets have consistently delivered positive returns despite short-term disruptions and attempting to exit and re-enter the market at the right moment is a recipe for disaster.

Therefore, our approach is to be generally defensively positioned but not doing anything radical in the face of the current uncertainty. We have raised some cash and may do more depending on how the next several weeks and months play out. But mostly, it’s about keeping our emotions in check and preparing a sort of shopping list of great companies when we are offered an opportunity.

For the moment, our main portfolio, the Global 35 is holding well, being down by less than 1%. The other portfolios are also doing well, especially compared to the hyperbole that you might get from various media.

Nevertheless, I think the road ahead of us will be more challenging in the short term.

So, we continue to monitor the evolving policy landscape and its potential effects on the economy and your investments. Our focus remains on maintaining a disciplined, diversified investment strategy tailored to your long-term goals.

While uncertainty can be unsettling, history suggests that patience and discipline are rewarded. Previous periods of market stress—whether due to policy shifts, geopolitical tensions, or economic downturns—have ultimately been followed by recoveries.

That's why I invite you to look less often at your portfolio, to remember your investment horizon and, if you have significant cash in the bank, to send it to us. That's ammunition we can use at the right moment.

If you have friends and family members that are worried about their investments, please feel free to share this memo and give them my name. We welcome your introduction.

Warmest regards,

Charles