It's been quite a ride so far in 2025. Tariff talks drove a big part of the negative performance early in the year and now the focus have moved to GDP and corporate earnings growth. In Q2 companies continued to demonstrate resiliency with stronger-than-expected earnings results. As of early August about 80% of companies have reported Q2 results, exceeding expectations by an average of 8%, with an average year over year profit growth of 12% - largely driven by companies in the AI sector.

Corporations will likely see increased challenges as it relates to trade policies, inflation and shifts in consumer demand. As much as Trump would like America to believe tariffs are the best thing for the U.S. economy, tariffs will have a significant impact on corporate earnings in certain sectors.

The One Big Beautiful Bill Act (OBBBA) was signed into law on July 4, and the extension of tax cuts and higher spending under the OBBBA will likely increase the national debt by roughly $4–$5 trillion over the next decade, undermining the cost-cutting efforts by the Department of Government Efficiency (DOGE).

While we are currently experiencing a rather challenging and confusing period in the markets, our focus continues to be on the higher quality names with solid and sustainable earnings growth. Although we do expect to see an increase in volatility, we continue to believe a U.S. recession is unlikely as the base case scenario over the next 12 months

This chart sums up the ups and downs we’ve felt so far this year.

“Buy low and sell high. It’s pretty simple. The problem is knowing what’s low and what’s high” – Jim Rogers

Very few of us likely expected we’d be at all-time highs in August, especially after all the tariff talk and uncertainty plaguing the market but the market has shown resilience with strength from both the economy and corporate earnings.

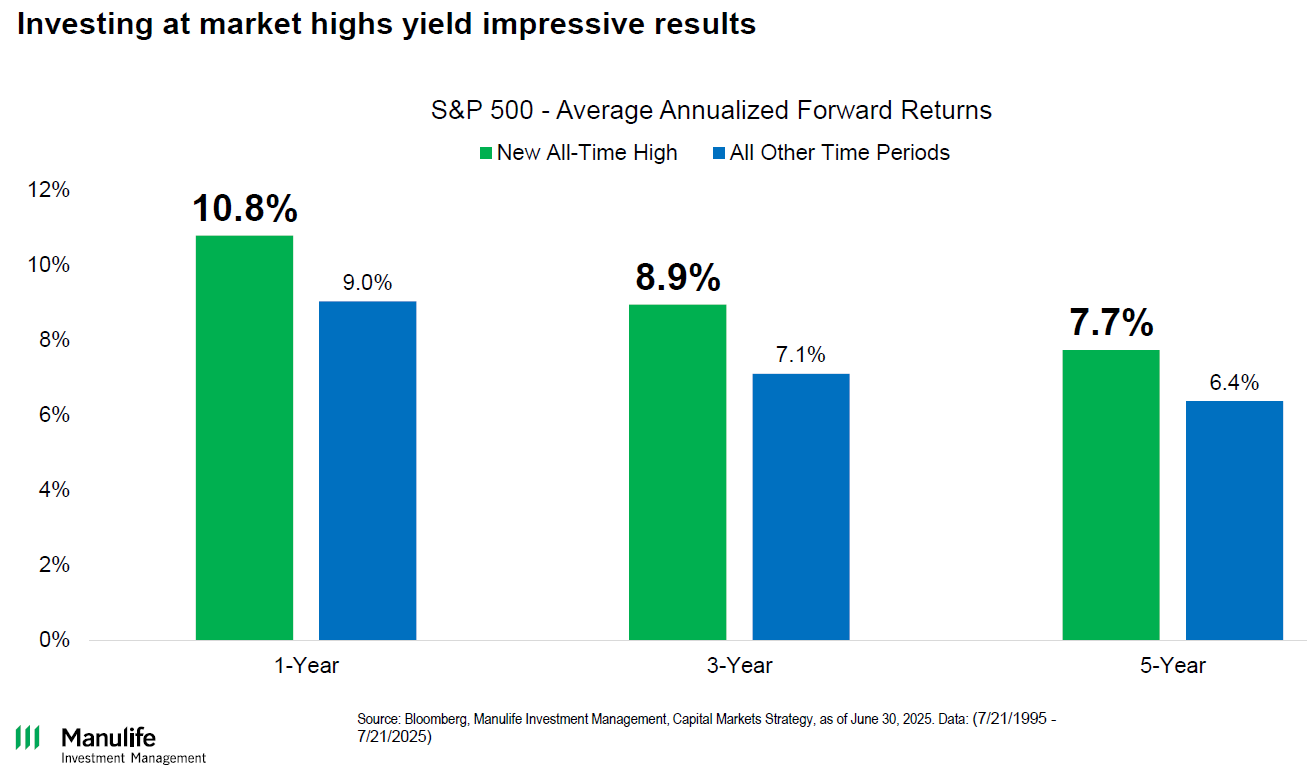

One of the most common questions we often get at this stage is whether we should be investing in times like these or pulling back and taking a more conservative approach. Ironically, investing at all time highs is actually a good thing. If we’re at all time highs, that typically means the market is running on all cylinders with some momentum and growth prospects. Though past results are not a guarantee of future returns, the following chart shows, it’s actually better to invest at market highs than it is at all other time periods.