Q2 Overview

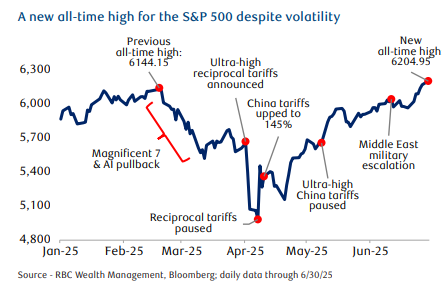

Global stock markets battled uncertainty this quarter with a multitude of new Tariff announcements followed up by the “One Big Beautiful Bill”, as well as some geopolitical uncertainty.

Even though there were many reasons for the market to be jittery, broader markets finished the quarter higher than where they started with the S&P 500 up 5.5%, and the TSX up 9% YTD. Perhaps the bigger surprise this year has been the strength of the Canadian dollar relative to the US dollar, up 5.73% so far in 2025.

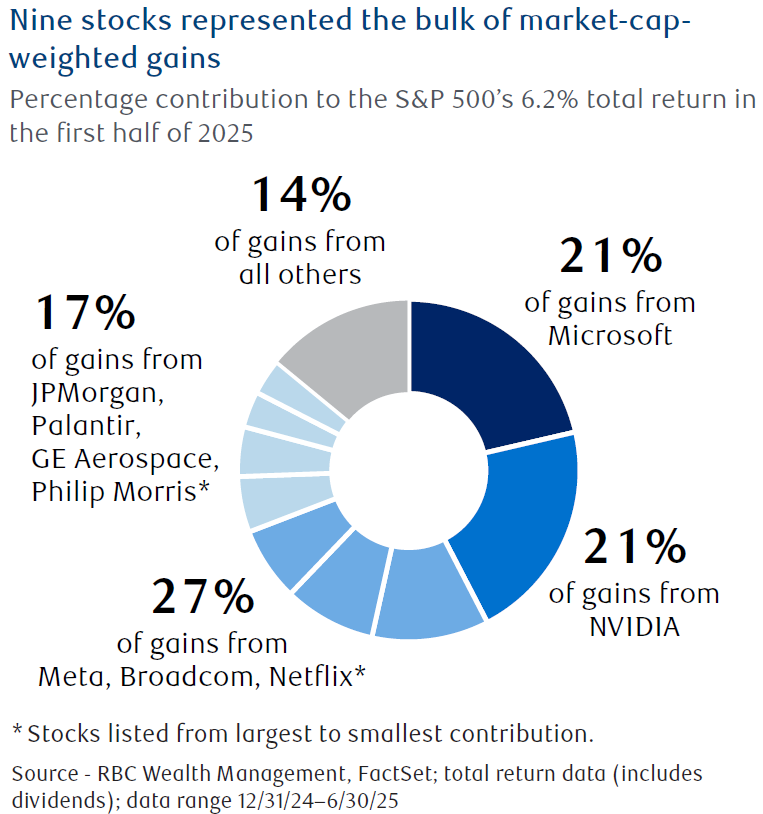

The lack of breadth in the market has been a continuing theme as over 42% of the total market gains came from just two stocks, NVIDIA and Microsoft.

Deficits, Tax Cuts and Tariffs

Continuing to dominate the headlines, President Donald Trump’s on-and-off again tariff policies have added to overall volatility. Some key negotiations included the U.S. and China agreeing to a lower tariff environment, while Canada and Mexico were hit with high reciprocal tariffs. We should see more clarity on this in the coming weeks as Donald has promised that letters will be going out to various countries “informing them of the tariffs they will pay”.

Trump has made it clear that with higher tariff revenues the U.S. will have the ability to lower income taxes for all Americans. I don’t believe it is that simple. Tariffs are essentially another form of tax, and at this stage it’s unclear who will foot the bill—foreign goods suppliers, domestic producers and services companies that use foreign goods as inputs, intermediaries and retailers, households, or some combination thereof.

In 2024 the U.S. ran a deficit of 7.7% of GDP, the highest of any major economy. With his promises of additional tax cuts I can’t see how this ratio gets much better in 2025. This issue could get kicked down the road for years, or this lack of financial flexibility could have an impact on financial markets sooner than later. Time will tell.

One Big Beautiful Bill

The centerpiece of Trump’s economic agenda has been narrowly passed through the Senate. Although the tax relief slotted for this bill, could actually bring relief to the US stock market, it will also have a significant impact on Canadian’s investing in the U.S. The bill includes proposed legislation on the “Enforcement of Remedies Against Unfair Foreign Taxes.” This provides a tool for the U.S. government to retaliate against countries that have implemented, in their view, an “unfair foreign tax.

There are a lot of unknowns right now on the impact to Canadian investors but rest assured, we will keep you updated as this bill progresses and more information becomes available.

While the tariff saga has not yet been fully resolved and more news is likely in the coming months, we think much of the drama associated with Washington policies is in the rear view mirror. The market’s attention in the second half of 2025 and 2026 will likely be on the impacts of tariffs already in place and the “Big Beautiful Bill” on the economy and corporate earnings.