It has been a rough start to August with the market selling off, adding volatility to a market that has been remarkably stable through the first 7 months of the year. The recent volatility can be attributed to a number of factors, most notably a general concern that the U.S. may indeed be headed towards a recession, and that the Federal Reserve may be a bit behind on lowering rates. As we know, the Bank of Canada has already cut rates by 50 basis points whereas the U.S. has yet to begin their easing cycle.

These concerns have been on the rise as a result of weak U.S. employment data last week and unemployment data increasing, indicating an early warning sign for the U.S. economy.

For a quick and comprehensive view of the economic data over the past month and its’ impact on the markets, please click here. For the remainder of this article I’m going to focus on a few other key points that I believe are most relevant to you, our clients.

Key points to remember:

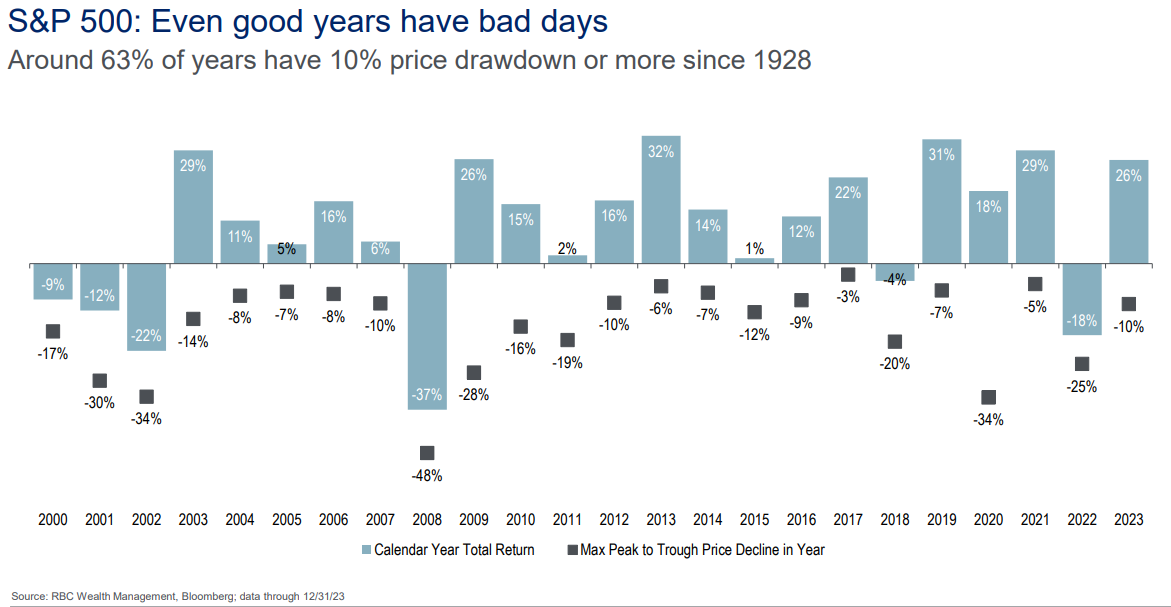

- Market selloffs like this are normal. We go through a period like this quite often, in fact most years have a 10% + market pullback at some point throughout the year. Our focus is on the long term, and ensuring we hold good quality companies that will stand the test of time.

-

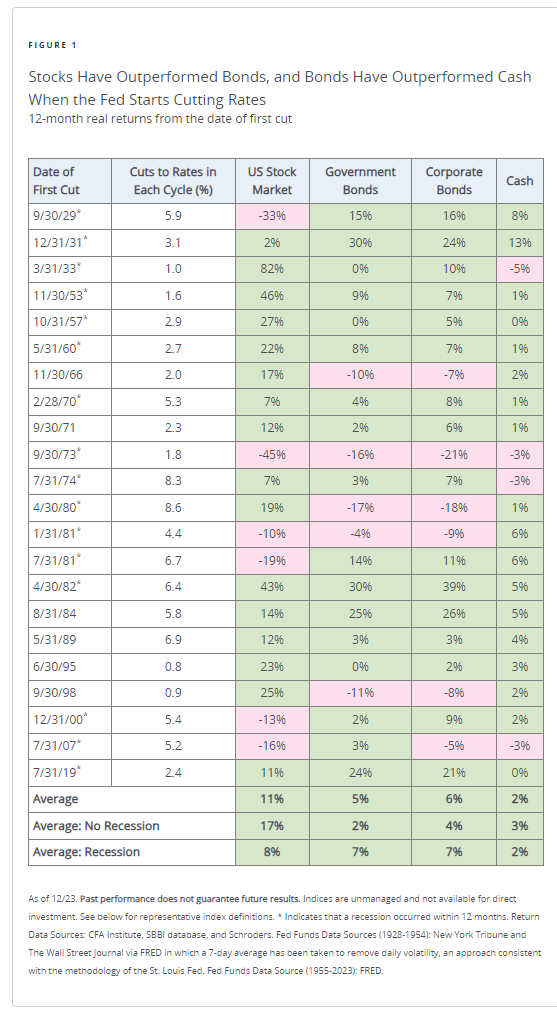

Federal Reserve rate cuts are a positive for markets. In the 12 months following a Fed rate cut the average return in the U.S. market has been 11%. Rate cuts are often viewed as a wind at our back which bodes well for returns over the coming year.

Source

Source -

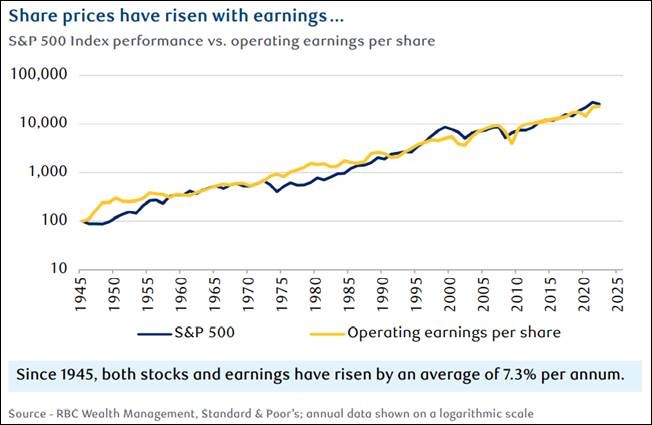

Earnings Matter! We talk about this all the time, but earnings do indeed drive the market. A decline in earnings expectations for the Magnificent 7 has definitely been a contributing factor for this recent decline but for the most part earnings growth has continued at a strong pace. Consumer debt and the impact on consumer spending could be the next hurdle for corporate earnings growth.

-

Playing defense in a volatile market. Although it is too soon to tell whether we are headed towards a recession or whether this is more of a growth scare, the Fed policy will definitely play a role. We continue to focus on a defensive position in our portfolios with an emphasis on high-quality dividend-paying shares.

If you have any questions or comments, please don't hesitate to reach out to our team.