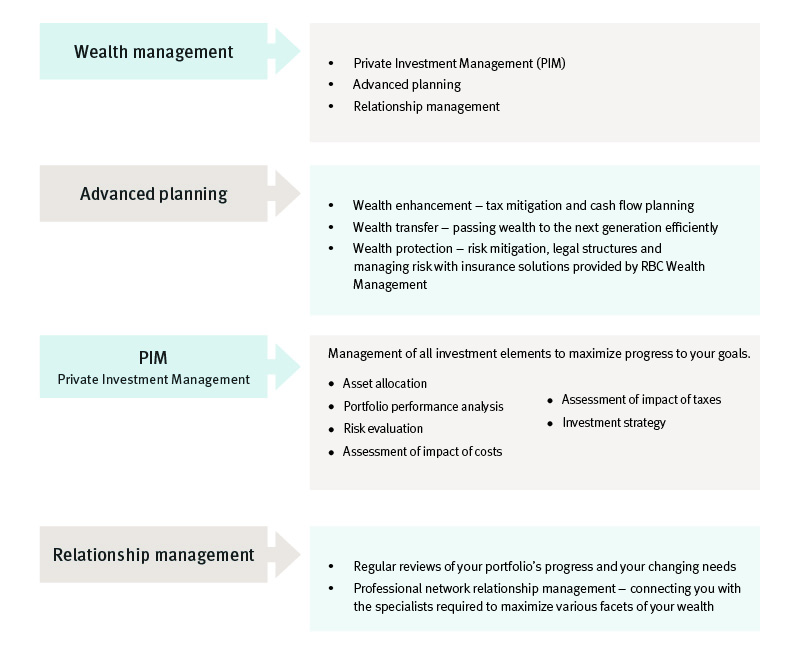

Investments are an important facet of financial planning but tax and estate planning are also critical to preserving your family's wealth and building your legacy. We engage the services of both internal and external professional advisors in the areas of taxation, legal counsel, estate planning and insurance. We provide advanced tax and estate planning services to business owners, executives, professionals and family stewards through RBC Wealth Management specialists.

Wealth Enhancement

Taxes can have a significant impact on your wealth and estate. One of the key benefits of RBC Wealth Management is collaborative thinking across investment strategy and tax planning. We can help you plan the most tax-efficient ways of holding your investments and overall assets, while guiding you through changing tax regulations. In addition, we will work closely with our wealth and estate planning specialists, as well as your own accountant and other tax professionals, to mitigate or eliminate tax.

Wealth Transfer

We work closely with you and qualified specialists to develop a framework that ensures your estate passes to your intended heirs efficiently and in accordance with your wishes. This framework includes estate tax strategies to optimize your wealth transfer.

Legacy Planning

We can provide you with guidance to implement planned giving strategies, from donation of shares to creating a foundation. We work closely with the individuals and institutions involved in creating your family legacy.