China retaliated with tariffs of its own on various Canadian agricultural exports in response to Ottawa’s tariffs last fall on Chinese electric vehicles and metals.

The new tariffs mark an escalation in trade tensions between Canada and China, with the risk tilted to the upside. It comes as the agriculture sector is already experiencing challenges posed by the trade uncertainty with the United States.

Another hit to Canadian exporters

China imposed 100% tariff on Canadian exports of canola oil, canola oil-cake, and pea imports, and 25% duties on pork and aquatic products, which is expected to hit some industries and provinces hard.

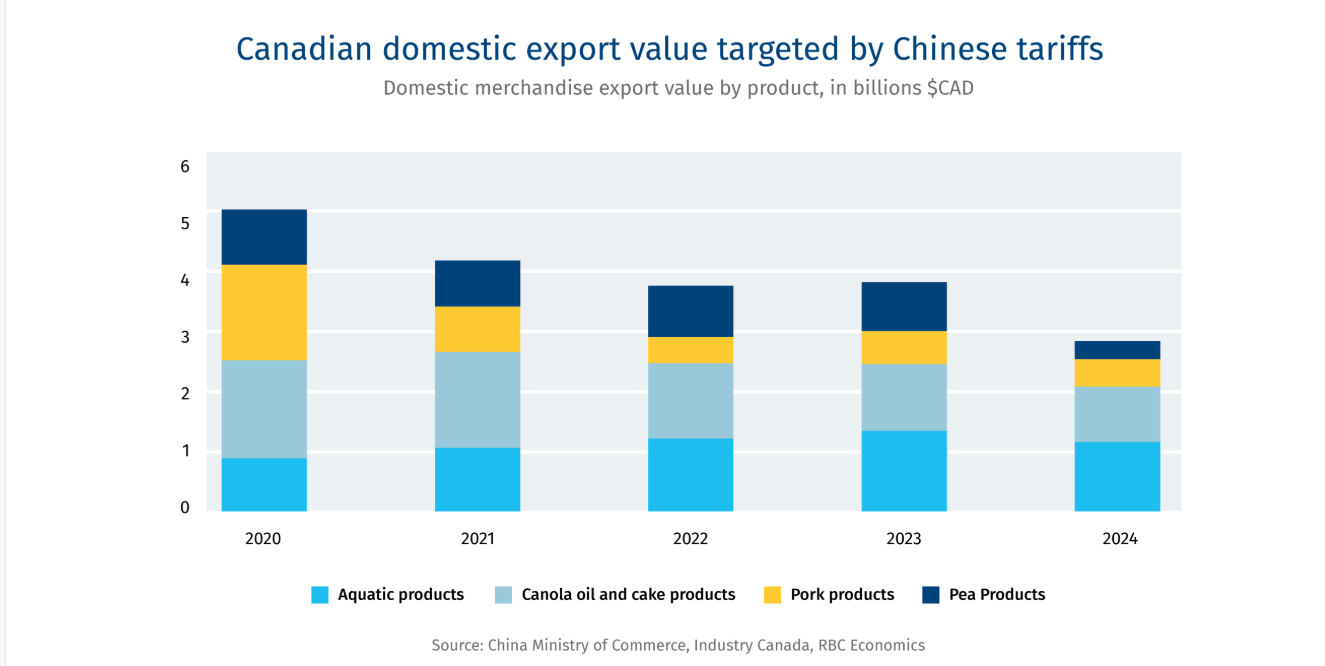

The tariffs are expected to affect approximately $2.9 billion of domestic exports (in 2024), with seafood products making up the largest share at nearly $1.2 billion, followed by canola oil and cake at $938 million, and pork products ($467 million). China is also Canada’s second-largest export market for listed pea products ($306 million).

While the tariffs are expected to target only a small share of total Canadian domestic merchandise exports—roughly 0.4% in 2024—they are likely to pose challenges for some Canadian agricultural exporters.

Although China remains an important Canadian market for these products, its share of total exports has declined in recent years. In 2019, China accounted for roughly $3.8 billion (25%) of the export value of these goods, which has since declined to $2.9 billion, or 14%, in 2024. Over the same period, Canadian exporters have shifted to the U.S., with exports for these goods rising from $7.2 billion (47%) in 2019 to $12.3 billion (60%) in 2024. But that pivot to the U.S. could prove to be costly if Washington rolls out tariffs on Canadian exports as part of its April 2 trade “liberation day,” or later this year.

Atlantic provinces in the eye of the storm

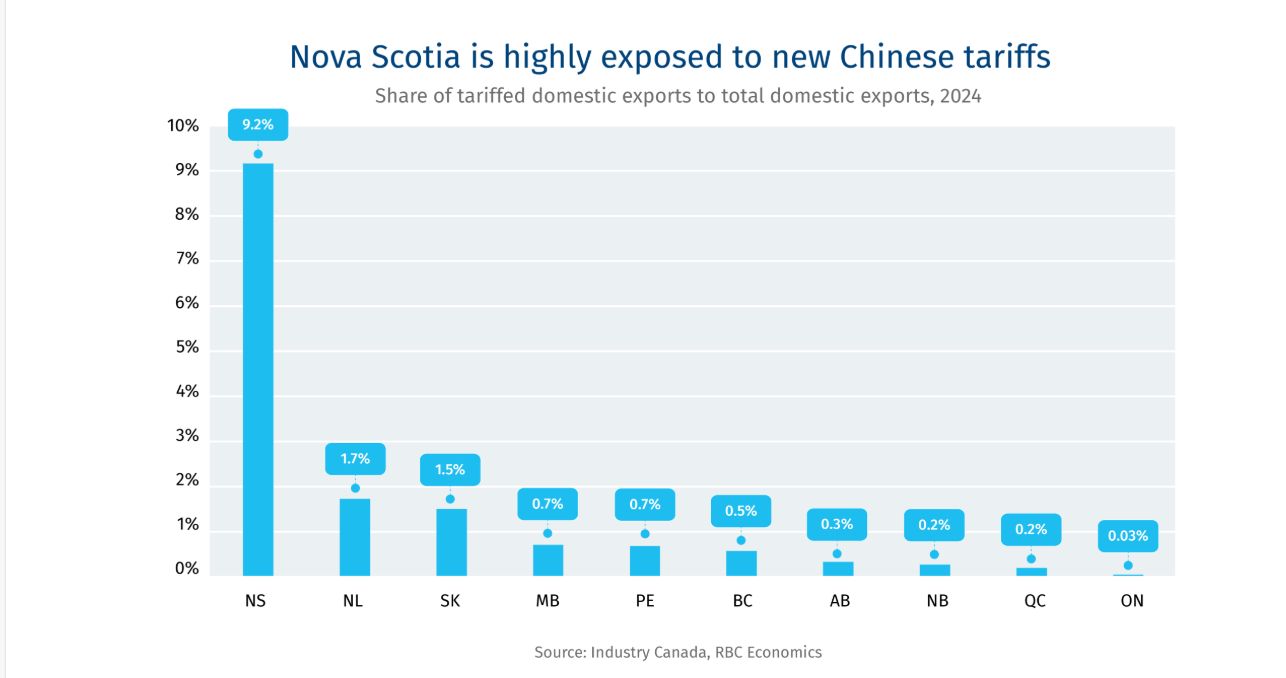

Among provinces, Nova Scotia is most exposed to these tariffs. The affected goods account for approximately 9.2% of the province’s total domestic exports. Notably, China is Nova Scotia’s second-largest export market for lobsters, which amounted to nearly $452 million in export value in 2024.

Newfoundland & Labrador shrimp exporters ($105 million) and Saskatchewan’s exporters of canola oil and cake ($515 million) are among the most exposed within their respective provinces. The listed tariffed goods account for approximately 1.7% and 1.5% of their total domestic exports, respectively.

China whips out an old playbook

China’s newly imposed duties on Canadian agricultural exports are not unprecedented. In 2019, China’s import restrictions on some Canadian canola exporters, led to a sharp decline in imports of Canadian canola seeds to the world’s second largest economy.

The restrictions are estimated to have contributed to significant losses for Canadian exporters, on reduced export volumes and the prices received for their products. The Canola Council of Canada estimated that between March 2019 and August 2020, China’s actions cost the domestic industry between $1.54 billion and $2.35 billion in lost sales and lower prices.

If the tariffs persist for some time, canola farmers fear job losses, declines in production volumes, and capital cuts beyond the projects that are already under way, according to an industry executive.

While the new tariffs could trigger losses for the targeted industries, the more significant risk stems from the potential escalation of the trade conflict. The latest measures, introduced on March 20th, followed China’s anti-discrimination investigation into Canada’s tariffs on Chinese EVs and metals. Meanwhile, China’s ongoing anti-dumping investigation into Canadian canola (including seeds) and chemical products raises the possibility of additional trade barriers. Given that China remains Canada’s largest export market for canola seeds – valued at approximately $4 billion in 2024 – any further restrictions could have significant economic repercussions on the industry.

Beth Arseneau, FMA, CIM

Portfolio Manager

416-960-4592

beth.arseneau@rbc.com