Q1 Economic Summary

Equity returns were positive in the first quarter of 2024. The S&P/TSX, S&P 500, and MSCI EAFE Indexes were up about 7%, 13% and 7% respectively (Figure 1, Returns in CAD$). In Canada, Energy and Materials leading the way, while Energy and Communication Services (including members of the Magnificent 7) were leaders in the US. Bonds significantly underperformed equities as the Canadian Broad Bond Composite declined by 1%.

Figure 1: Index Returns (total return in CND $)

| Index | Q1 |

| S&P/TSX | 6.6% |

| S&P 500 | 13.0% |

| MSCI EAFE | 7.3% |

| Cnd Broad Bond Composite | -1.2% |

Source: RBC Capital Markets Quant Research

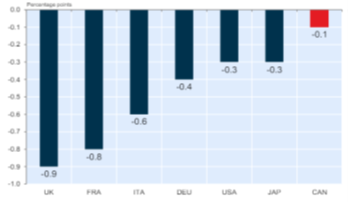

Disinflation was a key driver of equity prices in Q1. Core inflation rates were down close to 2.0% in Canada and 3.8% in the United States, getting nearer to central bank targets. Investors are eagerly awaiting indication of a monetary policy change and an accompanying decline in interest rates; however, expectations were tempered recently by hotter than expected economic data. While we have made progress on inflation reduction, parts of the Canadian economy are showing signs of weakness. The unemployment rate rose to 6.1% over the past three months, and Canada now has the least tight labour market relative to other G7 countries (Figure 2). That is measured by our current unemployment rate relative to the equilibrium level.

Figure 2: G7 Unemployment Rate vs Equilibrium Level

Source: Bespoke Investment Group

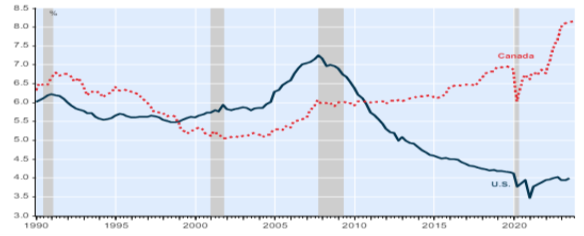

The deterioration appears not to stem from job losses but rather high immigration levels. Canada added 75,000 jobs in the first quarter but welcomed a higher number of newcomers to the labour force. While it is not (yet) a serious cause for concern, Canada’s economy has noticeably weakened relative to the U.S. economy. Canada now has 0.6 job openings for each job seeker versus 1.36 in the U.S. (Figure 3). Put differently, the labour force south of the border is better positioned to weather a potential economic slowdown.

Figure 3: U.S. Job Openings per Unemployed Person

Source: FactSet

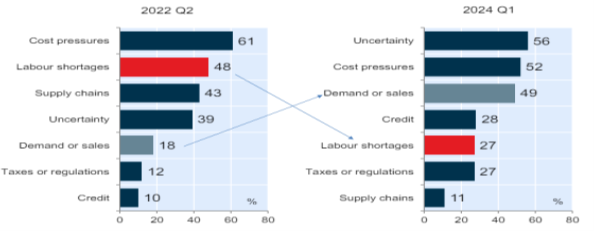

The Q1 2024 Canadian Business Outlook Survey confirms the weakness we have seen of late. Uncertainty, demand, and credit have emerged as chief concerns among Canadian businesses. Two years ago, the biggest issues included labour shortages and supply chains (Figure 4).

Figure 4: Concerns Reported by Canadian Businesses

Source: Bank of Canada Business Outlook Survey

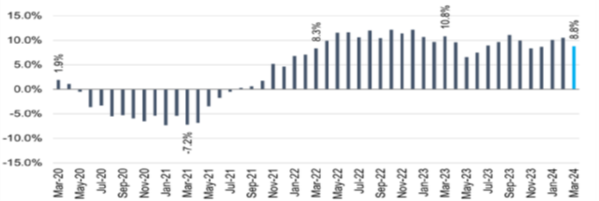

We do not see a near-term reversal of this weakness. High interest rates will continue to take a toll on our heavily indebted households (Figure 5). While we do see interest rate cuts on the horizon in Canada, they will likely only reduce the level of restrictiveness and not push monetary policy into accommodative territory. Near term, the Bank of Canada’s hands are still tied. Headline inflation remains high at 2.9% (up from February’s (2.8%), and the large housing component will continue exerting upward pressure due to intense shortages. Mortgage renewals at much higher rates are ramping up and rental inflation is still running hot at 8.8% (Figure 6).

Figure 5: Canada & U.S. Mortgage Debt Service Costs as a % of Disposable Income

Source: NBF Economics and Strategy (data via Statistics Canada, U.S. BEA, and Federal Reserve)

Figure 6: Canada’s Change in Average Asking Rent

Source: Urbanation Inc, Rentals.ca Network Board of Governors; FHLMC

U.S. households remain in better shape financially due to the long-term fixed nature of their mortgage market. Most U.S. homeowners utilize 30-year mortgages, the rise in borrowing costs has not flowed through to affect debt service costs (Figure 7).

Figure 7: U.S. Mortgage Rate (red) and Debt Service Payment as % of Disposable Income (blue)

Source: Board of Governors; FHLMC

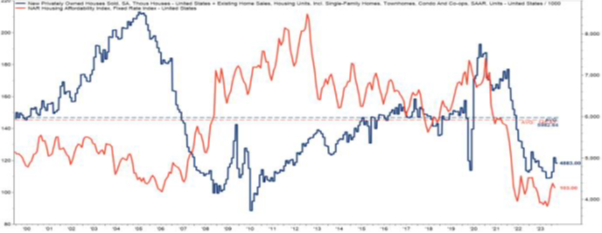

That is not to suggest the U.S. housing market is immune to higher rates. Home sales volume is highly depressed and close to 2008 levels, and affordability is near all-time lows (Figure 8). The U.S. housing market is very much in limbo and likely to remain there until borrowing costs come down.

Figure 8: U.S. New + Existing Home Sales (blue), and U.S. Housing Affordability (red, left side)

Source: FactSet

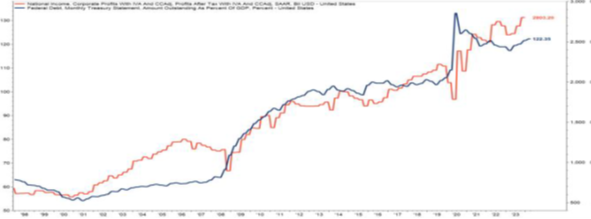

We think it is necessary to acknowledge these risks amid the current buoyant market. Perhaps the biggest risks of all, and the most challenging to quantify, are found in the very difficult world political situation and future of government deficits. The latter has certainly had an impact on corporate profits (Figure 9). We did not anticipate the largest non-recessionary fiscal deficit on record from the United States in 2023. Especially considering that borrowing costs for the U.S. Treasury were at 15-year highs (and still are today). Given the politics involved, making budgetary predictions is something of a mug’s game. With upcoming elections in both Canada and the United States, appetite for curbing public spending will likely be limited.

Figure 9: U.S. Debt to GDP % (left side) and U.S. Corporate Profits (right side)

Source: RBC Capital Markets Quant Research

Investment Summary

The value dividend investments have not performed well during the recent aggressive interest rate cycle. In the latter half of 2023 market participants were indicating that six rate cuts from the Fed would be likely during 2024. The Fed held rates in May, as expected, and the odds of a rate cut at the September meeting have fallen to roughly 50% with the market now pricing in less than 30 bp of rate cuts by the December meeting. In Canada, the situation is different, the Bank of Canada held is benchmark interest rate steady at the April meeting, amid signs that inflation is easing, with officials acknowledging that a June cute is “within the realm of possibilities.”

The value dividend investments have not performed well during the recent aggressive interest rate cycle. In the latter half of 2023 market participants were indicating that six rate cuts from the Fed would be likely during 2024. The Fed held rates in May, as expected, and the odds of a rate cut at the September meeting have fallen to roughly 50% with the market now pricing in less than 30 bp of rate cuts by the December meeting. In Canada, the situation is different, the Bank of Canada held is benchmark interest rate steady at the April meeting, amid signs that inflation is easing, with officials acknowledging that a June cute is “within the realm of possibilities.”

Over the next weeks, depending on market conditions. portfolios will be positioned to be more inline with our models. While being cognizant that seasonal volume changes and economic conditions will update in real time, we will manage the implementation of the trading as we always have, waiting for the selected stocks to enter a range of trading that we view and a reasonable entry point.

Leveraging the asset location benefits afforded by the different tax treatment of different account types, the TFSA accounts will have a growth tilt and we will locate the dividend payers to the accounts requiring income generation.

In general, the Utilities, REITs remain undervalued, Canadian equity valuations are at a discount to US equity valuations, but the Canadian economy could be facing more headwinds without interest rate relief. The models are positioned to access the US market in two ways, through direct ownership of US equities but preferably by diversified earnings from our Canadian holdings, that way we maximize the benefit of the dividend tax credit which became relatively more important through changes in the recent budget.

Beth Arseneau, FMA, CIM

Portfolio Manager

416-960-4592

beth.arseneau@rbc.com