It has been 54-days since the U.S. House of Representatives has been in session. We thought it would be useful to provide House members with a quick recap of some of the things that have taken place since the last time they deigned to go to work.

- Sean Dunn, who is a true “steely-eyed missile man”, was found not guilty by a jury of his peers of assaulting a CBP officer with a sandwich. While Dunn admitted to launching the ham, yellow American, pickles, onions, hot peppers, mustard, little bit of salt and pepper, hold the mayo on a hero, not toasted at the officer, he denied that it amounted to a “forcible assault”. Jurors agreed – acquitting him of all the charges brought by former Fox News host and current U.S. Attorney Jeanine Pirro (every time we write this sentence, an angel loses its wings). However, the jury did note that Dunn’s decision to get a sub from Subway as opposed to the much better options that were readily available in the neighborhood amounted to a breach of good judgement and thus sentenced him to 5-days in a maximum-security prison anyway.

- The Department of Defense is now known as the Department of War because nothing says, "Nobel Peace Prize" like renaming something "WAR", so come on Swedes or Netherlandians or whoever gives out the trophy – just do it already. Also, the Department of Agricultural will now be known as the Department of Crops that do not get picked because we have deported almost everyone that picked them - note that this is Joe Biden's fault. Further, the Department of the Interior will now be known as The Department of Oil and not Solar or Wind, especially not Wind because those darn things are bad for birds and other stuff. Also, the Department of Education will now be known as - hah, kidding, there will no longer be a Department of Education.

- We are at war with Venezuela because of fentanyl, even though Venezuela does not produce any fentanyl. We are not at war with them because they have the largest heavy oil reserves in the world and we have heavy oil refineries that currently get their heavy oil from Canada, but we don’t like Canada anymore and it is not because of this, so stop asking.

- The Dodgers won the World Series, so eat it Canada. Yes, we know, The Dodgers play in Los Angeles, which means “The City of Devils” in Spanish and we generally do not celebrate anything that happens in California as their governor is a BAD GUY, who is NOT SMART and who PULLS THE LABELS OFF OF MATRESSES, but we beat Canada, so there.

Okay, now that Congress is up to speed, let’s pivot to the Canadian budget and the economy:

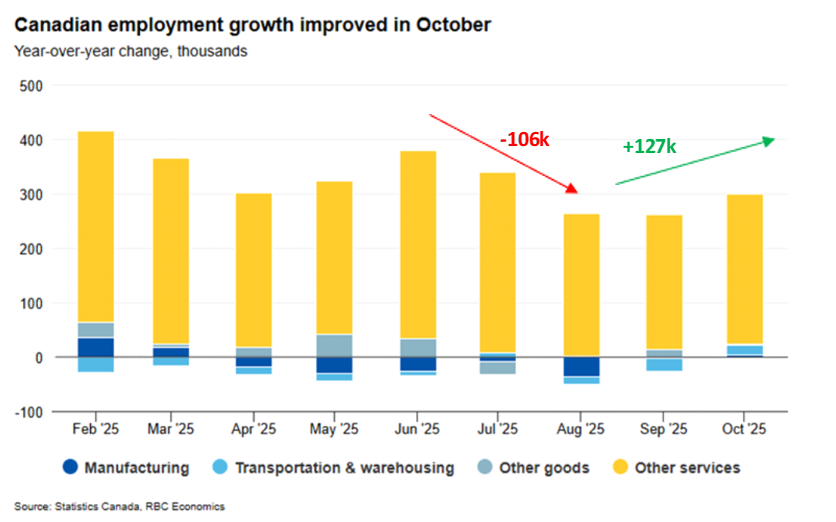

Canada’s economy is improving: Hey, some good news out of the homeland – the economy has definitely turned a corner. Let’s look at a chart and then comment:

First, the jobs market, which lost more than 100k jobs over the summer, has seen a nice rebound over the past two months to the tune of more than 125k net jobs created. The two biggest beneficiaries were trade and manufacturing, which also happened to be the areas that took the biggest hits in the wake of Liberation Day. Add to this a modest recovery in GDP growth and the Canadian economy appears to be on firmer footing as we head into 2026. While we had hoped to see more from the budget (more below), we remain cautiously optimistic that the worst is behind the Canadian economy and the next four-quarters will bring improvement.

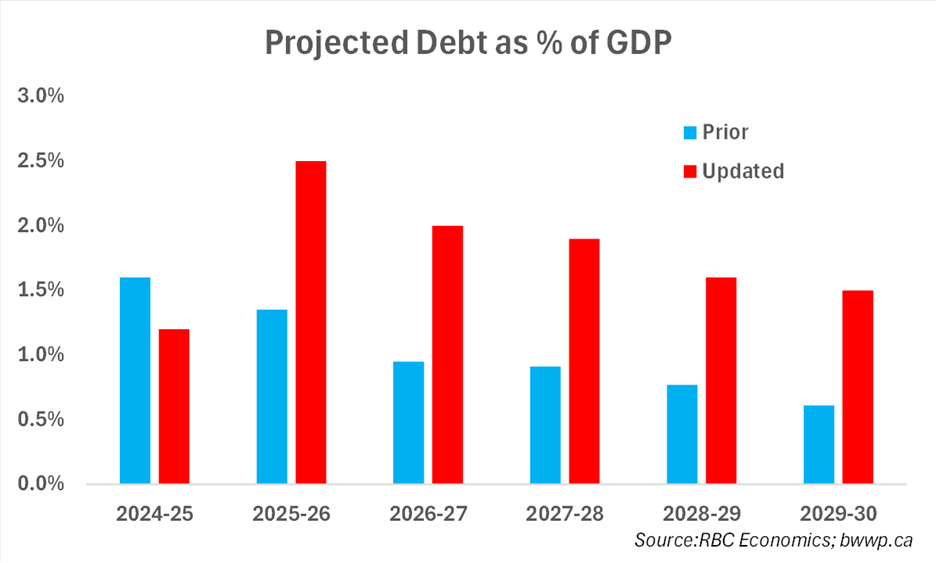

The Canadian budget was worrisome, but not bad: Again, let’s start with a chart and then comment:

The Canadian budget was big on new debt with projected annual debt-to-GDP ratios rising throughout the next five years vs. prior forecasts. In all, there was $178 billion of new spending in the budget, offset by $42 billion of savings, bringing the net new spending to $126 billion. The prior goal of bringing down debt-to-GDP was largely abandoned as it is expected to remain at around 43% over the forecast period. Now, we have harped for some time on the need for Canada to invest more in the economy and this budget endeavors to do so to the tune of ~$32 billion through 2029-30. However, this still leaves another $94 billion of new spending that is not geared toward investment, which continues a worrisome 10-year trend. Overall, here is how we would break it down:

- Positives: large increase in spending geared toward Defense, Infrastructure and Housing. Further, there is a definite effort to try to attract private investment to go along side public investment, which has been sorely missing over the past 10-15 years. The government has a lofty goal of attracting $500bn of private investment – we are skeptical this will happen without a significant relaxing of the red tape that still exists throughout the country, but this is directionally the sort of thinking we like to see.

- Negatives: in addition to the layering on of more and more debt, there is no real effort to lower the tax burden. Over the past decade, the U.S. has moved to reduce personal income taxes and corporate taxes, while Canada has largely gone the other direction. Prior to 2018, Canada’s corporate tax rate was ~26% while the U.S. was ~35%. This gave Canada a competitive advantage when trying to attract businesses. However, since 2018, while Canada remained at 26%, the U.S. rate has dropped to 21%, which effectively wiped away any advantages Canada had. If the ultimate goal is to attract capital to the country, a less burdensome tax regime would be a good start, especially given the reduced U.S. burden. Further, while the Trump tariffs get most of the headlines intra-provincial trade barriers remain far more burdensome for most Canadian businesses. While some efforts have been made on this front – Bill C-5 removes most federal barriers to internal trade – the provinces still remain a mishmash of regulations and barriers to free trade.

Bottom Line: Some green shoots as it relates to the Canadian economy; although, it remains too early to see that the Canadian economy has found firm footing. The budget was a decent start and had some positives. However, we continue to believe that Canada needs a bold vision of the future, one that looks to exploit the competitive advantages the country has and one that looks to diversify away from reliance on our neighbors to the south. The budget fell short of this on many fronts.

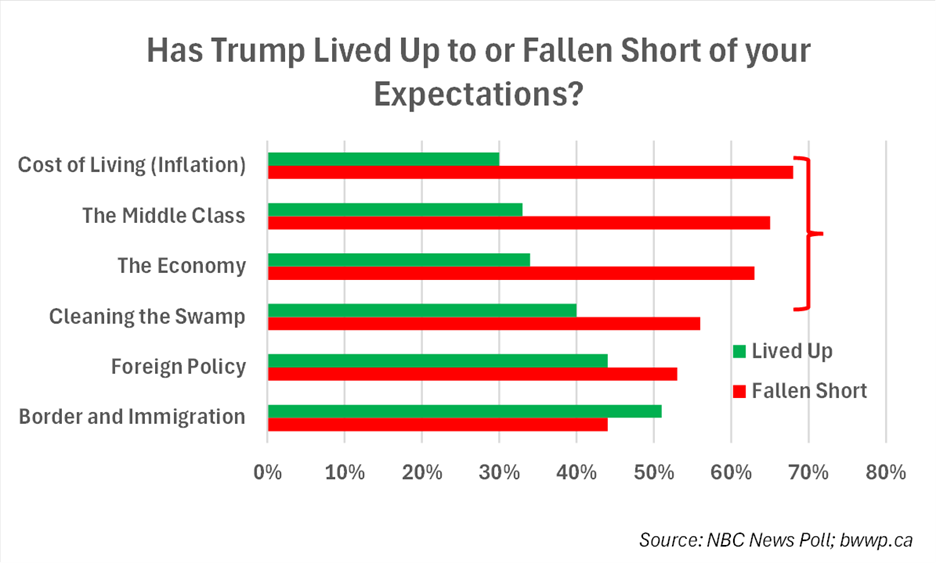

Next, let’s pivot to the U.S. election from last week, which was marked by large Democratic gains, albeit mostly in blue states. If someone asked us – what was the key message of the elections? Our answer would simply be – Donald Trump has lost the narrative on the economy, and he needs to find it soon or else 2026 could get messy. Let’s start with a chart and then comment:

The above is from a poll conducted by NBC News at the end of October of registered voters across the U.S. While Trump “met expectations” on the issue of the border and immigration, he is deeply “underwater” as it relates to issues of the economy, helping the middle class and most importantly – inflation. Now, returning to “the narrative”, one of the hallmarks of Trump 1.0 was that while he was generally unpopular overall, his ratings on the economy were almost always favorable. In fact, were it not for Covid (we realize this is a bit like saying “were it not for THAT, Mrs. Lincoln, how was the show?”), it is entirely possible that Trump would have cruised to reelection in 2020 as a strong economy is generally the strongest driver of election results.

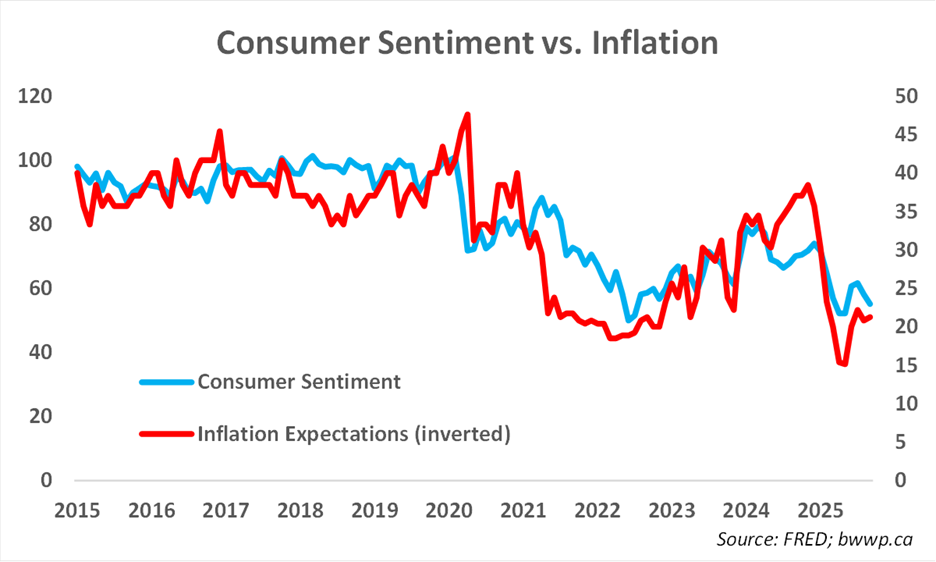

We will not rehash our inflation views other than to say that we believe another inflation flare-up is the biggest risk we face in 2026. This alone poses a major problem for the Republicans as the midterm elections approach, as consumer sentiment and inflation tend to be joined at the hip:

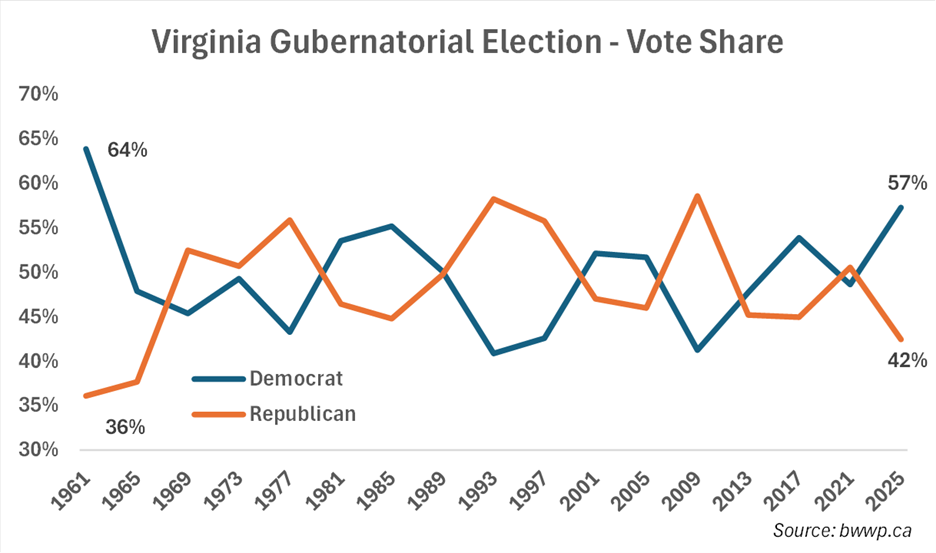

Okay, let’s now focus a bit on the actual results of the election to see if we can get any sense of what 2026 might look like. We will begin with Virginia, which had a term-limited Republican governor (governors are only allowed to serve one term in Virginia, which is strangely refreshing). Kamala Harris won Virginia in 2024 by about 3-points and Democrat Abigail Spanberger was expected to win last week with most polls putting her 5-6-points ahead. Let’s look at another chart and then comment:

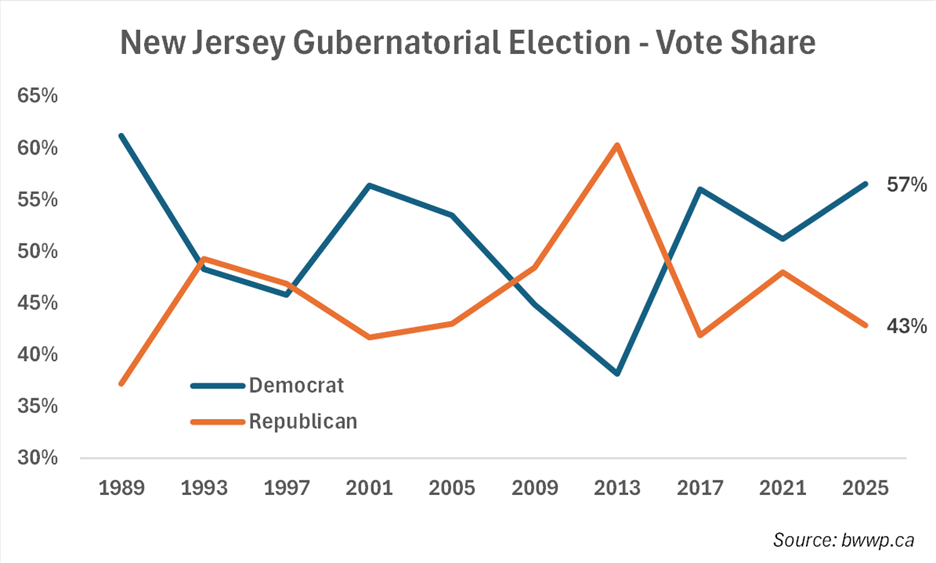

As you can see, Spanberger won by 15-points, which was not the “close-ish” contest that most expected. In fact, her vote share was the largest a Democrat candidate for governor of Virginia had gotten since 1961. Now, it is possible that the Republican candidate was just bad (Republican Winsome Earle-Sears was shall we say “interesting”) but achieving something that had not been done since before The Beatles released their first single (“Love Me Do” by the way) speaks to the magnitude of Spanberger’s victory. And while not quite as “unprecedented”, the New Jersey gubernatorial race saw something that had not happened since the year before Boys to Men released their seminal debut album Cooleyhighharmony:

Now, you hear much talk in the U.S. media about “wave elections” where one party has so much momentum that they see gains almost across the board and these gains even upend races in which the other party was thought to be safe. The most famous example of this was the 1994 election when the so called “Republican Revolution” saw the GOP pick up 54-seats in the House of Representatives, eight Senate seats (giving them joint control of Congress for the first time in more than 40-years), ten governorships and a majority of state legislatures. Last week probably fell short of the standard of a wave election as there were really only two states in play, but considering the Democrats won both gubernatorial races by wide margins, netted 13-seats and 5-seats respectively in the Virginia and New Jersey state legislatures, and saw California’s redistricting effort (more on this in a moment) pass easily and the GOP should at least be concerned that things do not augur well for 2026.

Redistricting is great, but …: Over the past several months, there has been a concerted effort to “redistrict” in order to pick up more seats. Redistricting is typically done at the beginning of each decade to coincide with the census. However, most states do not have rules that inherently prevent mid-decade redistricting and with the GOP nursing a narrow majority, Donald Trump moved to pressure Texas governor Greg Abbott to redistrict Texas’ Congressional districts mid-cycle. For those who do not know (warning- this is a mouthful) - redistricting involves taking a safe seat and sacrificing some of its safety margin by altering its borders thus transferring some of that safety margin to another district where your party is a few points behind.

For example, an R+15 district that is next to a D+4 district might alter the borders of both districts such that the R+15 becomes an R+7, but the D+4 becomes an R+4 - in theory, you have netted your party a seat. While Texas is fairly red, it did still send 12 Democrats to the House of Representatives in 2024, which is more than every other state save for California, New York, and Illinois. By moving around some borders, which the Texas legislature voted to do, the Republicans have, in theory, netted five seats that are currently held by Democrats. This has led to a tit for tat in which California responded with a redistricting vote of its own with other states not far behind.

The risk in redistricting lies in the broader election. The problem is - if you get a wave election, then not only are you less likely to net the adjacent seat (the R+4 in our example), but you also might actually bring the “safer seat” into play (the R+7, which used to be an R+15, in our example). Even with a wave election, an R+15 is unlikely to fall, but R+7 is a different story. While last week’s election does not mean 2026 will be a blue wave, the risks of such certainly seem greater than existed before last week’s historic blowouts.

Bottom Line: Donald Trump and the Republicans need to “get right” with the electorate as it relates to the economy and inflation. This is going to be hard to do as most of their policies are likely to continue to fuel inflation and even if inflation were to slowdown (i.e. our thesis is wrong, which we acknowledge is possible), prices are still likely to remain high, which may not translate into more support from the electorate (eggs that are $8 that are no longer going up in price are still $8 eggs). There are, of course, no guarantees that a blue wave is coming (2022, which was also marked by high inflation and an unpopular President was thought to be a potential red wave and none materialized), but for those unhappy with the current state of affairs, things look a bit brighter than they did prior to last week’s election.