We are going to start with the convergence of two events that truly changed lives (at least ours) – one for the better, one for the worse. Let’s begin with the latter event, which occurred 40-years ago last week when Martin “Marty” McFly got into Doc Brown’s DeLorean and traveled 30-years back in the past to 1955. Okay, right off the bat, there’s an elephant in the room here - why does a 17-year-old high school student have a best friend who’s a 50-something nuclear physicist? For the record, my brother was 17 in 1985, and he was friends with a guy who could juggle (kind of cool) and a guy who owned a moped (amazingly cool), but neither were rocket scientists, let alone 50-something rocket scientists. Anyway, without Marty, there would be no time-travel (let’s face it – Doc Brown was not going to figure this out on his own), no rock n roll (Chuck Berry probably becomes a carpenter) and no “Power of Love” (just a banger from Huey Lewis and the guys).

A decade before, but the same week – we lost Alex. We are, of course, referring to poor Alex Kintner, who was probably the second victim of a great white shark off the coast of Amity, New York. We say “probably”, because Pipit the dog disappeared that same morning as Alex and while we like to think that Pipit simply ran away from home and became a successful sheep herder in the hills of Shropshire, we fear that he was a pre-lunch snack for the aforementioned great white. Anyway, Alex went swimming that day 50-years ago and he did not come back. We wonder if Marty had instead gone back 10-years rather than 30 and had shown up on the beach that morning and said to Mrs. Kintner – “maybe take Alex bowling today, Mrs. Kintner”, we might still have Alex to kick around (we would note that he would roughly be Marty’s age in 1985, which is another beautiful convergence).

Speaking of futures, we are going to spend the rest of the summer predicting the future. In the interest of your sanity (and ours), we are going to break this up into three pieces to be released over the next 8-weeks. We will start with the first three and hope to release part 2 in early August.

Bold-Adjacent Predictions (Par 1)

- U.S. growth surprises to the upside: Look, we think the One Big, Beautiful Bill should have probably been called the One Giant Bag of Everything Republicans Ever Wanted That Creates A Potential Debt Bomb, but we grant that the actual name rolls off the tongue a bit better. Regardless, while we are nervous about the long-term impacts of the OGBOEWTCAPDB (you see what we did there?), we would hand it to the GOP on this front – the 2026 mid-term elections are right around the corner and the OGB… (you get the point) frontloads all of the good stuff and backloads most of the bad stuff. Let’s first hit on a few of the things that the OBBB does:

- Permanently extends 2017 Trump tax cuts – recall that the 2017 cuts were originally allowed to sunset (revert back to pre-2017 levels) in 2025 largely because if they did not sunset, the GOP would have required 60 votes in the Senate to pass the 2017 tax law as the cuts blew a giant hole in the long-term budget. Have no fear, the GOP changed the rules this time around and basically said – since the 2017 tax cuts are now current law, we will use that as the baseline, so extending them permanently actually has no impact on the future budget as they are already the law of the land. An analogy might be – I am buying a Porsche this year, which blows up my budget, but I am not buying one next year, so I don’t need to worry about the impact on next year’s budget. But then next year rolls around and I say, “well, I buy Porsche’s every year, so it’s a part of my budget, so actually, my budget this year includes a new Porsche.”

- Tax breaks on tips, overtime and Social Security, oh and you can deduct some car interest too – look it, we are all for giving tax breaks to folks in the service industry as well as seniors – but this is doubling down on haves and have nots – what we mean by this is – a blackjack dealer in Vegas is going to get a nice tax cut because a chunk of his/her compensation comes in tips, but the guy/gal flipping burgers at McDonalds is fresh out of luck because he/she doesn’t get tips (at least from most people). Also, borrowing money from everyone else to give seniors a tax break on Social Security, which is supposed to be self-funding, is probably not great.

- Companies will be allowed to accelerate depreciation on a permanent basis – this basically means that when they invest, companies will be able to deduct the expense from earnings at a faster rate, which will lower their tax bill.

- The debt ceiling is raised by $5 trillion – we are on the record that the debt ceiling may be the dumbest law in a sea of dumb laws – the good news is – we won’t have to talk about it for at least an hour.

- Gutting the IRA – Biden’s much ballyhooed Inflation Reduction Act (IRA) has been significantly neutered with most of the clean energy policy stuff severely rolled back. And as the tragic floods in Texas demonstrate, there is clearly nothing to worry about as it relates to the environment.

- No Section 899 – we wrote about this puppy dog a few weeks back as a potential stress point for Canadian investors – the good news is – it was not part of the final bill.

Okay, with that out of the way, let’s look at a chart and then comment:

Let’s unpack what we are looking at – everything above the zero-line is stimulus, while everything below the zero-line is cuts. The spending cuts are largely a sharp reduction in Medicaid with the IRA the other piece. Notice though that while the stimulus gets started immediately with the pro-rated 2025 impact adding close to 0.5% to GDP and the 2026 impact totaling more than 1% of GDP, the spending cuts do not really get a head of steam until 2027/28. In other words – a lot of the good stuff now and a lot of the bad stuff after the 2026 midterms.

All this adds up to what is likely to be a pretty decent growth spurt from the U.S. in the back half of 2025 and into 2026. Since a chunk of the stimulus is basically just an extension of existing policy, it is likely less than the chart above suggests, but the fiscal side should still be a net positive for at least the next 12-18 months before becoming a drag. As we have seen over the past decade whether through the original tax cuts, the COVID stimulus and/or the IRA, when the government puts the pedal down, the equity market is going to generally react favorably.

- Donald Trump (POTUS) names a shadow Fed Chairman (FCOTUS) to replace Jerome Powell: On August 14th, 2014, the world was shaken by one of the most controversial and frankly disgusting acts of, umm, fashion that had ever been witnessed. We are, of course, referring to the time that then President Barrack Obama had the temerity to wear a tan suit at a news conference focused on terrorism. Can you imagine? Congressman Peter King noted, “there's no way, I don't think, any of us can excuse what the president did yesterday. I mean, you have the world watching”, while Fox News nearly imploded from the audacity of Obama with the late, not so great Fox Business host Lou Dobbs calling it “shocking to a lot of people.” Reports had the earth temporarily no longer spinning on its axis, while cats and dogs were seen living together. Anyway, somehow, we survived the Tan-Suit-Gate only to graduate to this:

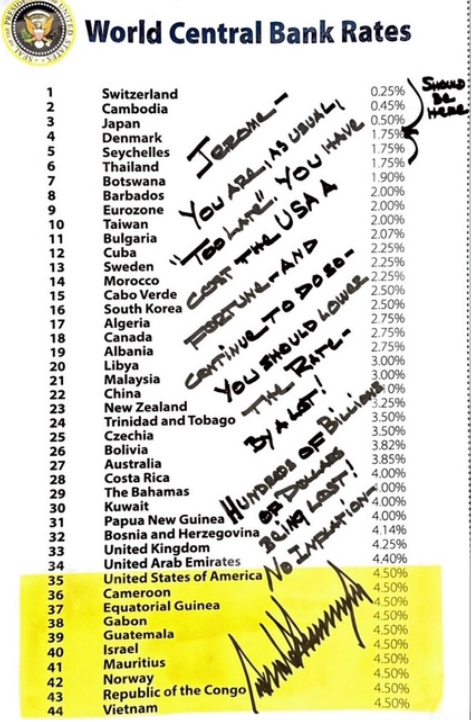

First off – what are we looking at? Well, it’s an actual note sent from POTUS to FCOTUS (pronounced how you think at least until a replacement is named) outlining how the rest of the world is chopping interest rates, while the U.S. is not and, needless to say, POTUS is not happy about it. Now, Powell’s term is up next May and while the guardrails have generally been off for Trump when it comes to most things, he has been hesitant to try to replace Powell before his term is up as: 1) it’s not clear if he has the authority to do so; and 2) investors may not like it as it would challenge the independence of the Fed.

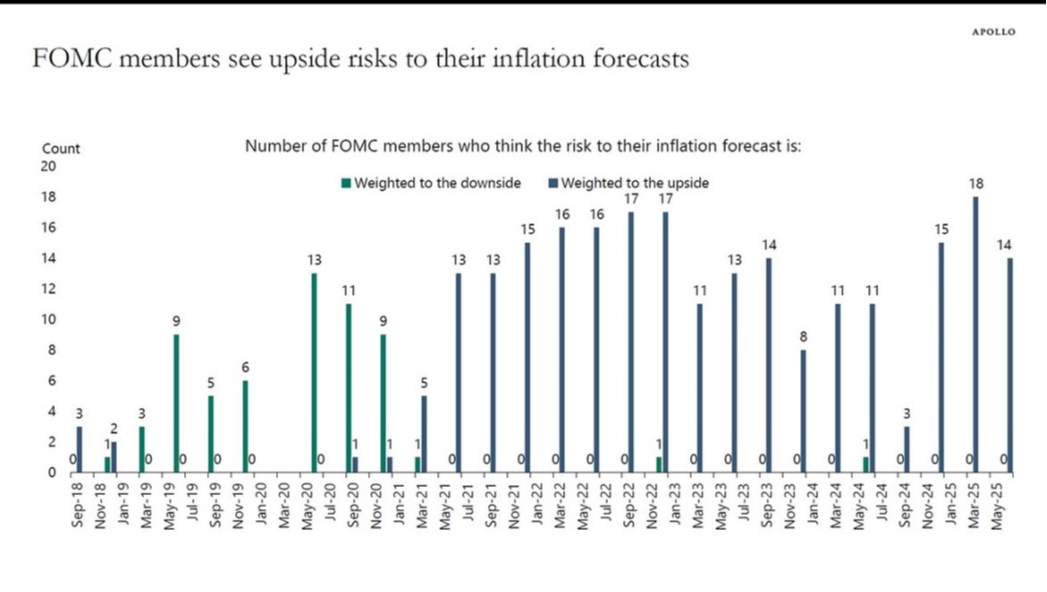

However, the next best thing to actually replacing Powell would be – naming his replacement now with the hope that Powell will feel the pressure to either resign or cut rates when he does not want to cut rates with this other guy/gal looking over his shoulder. It is worth noting that other Fed members would need to be on board with rate cuts and they currently seem worried about another inflation flare-up (see chart below), so “Project Shadow-FCOTUS” may not prove effective:

Anyway, at least he doesn’t wear a tan suit in August – shame on you, Barrack.

- Canadian economy stages a recovery: it has been a messy 12-months for Canada. As we have noted before, the only thing really holding up the Canadian economy from an absolute growth perspective were huge immigration flows and with the sharp curtailment of these flows, the economy has not surprisingly stagnated. Add to this all the trade stuff and a strengthening loonie and it’s not surprising that growth has turned negative, while the jobs market has seen ~55k job losses in manufacturing alone since the start of the year. But, we think there is reason to believe that the next 12-months are going to show a marked improvement for a few reasons:

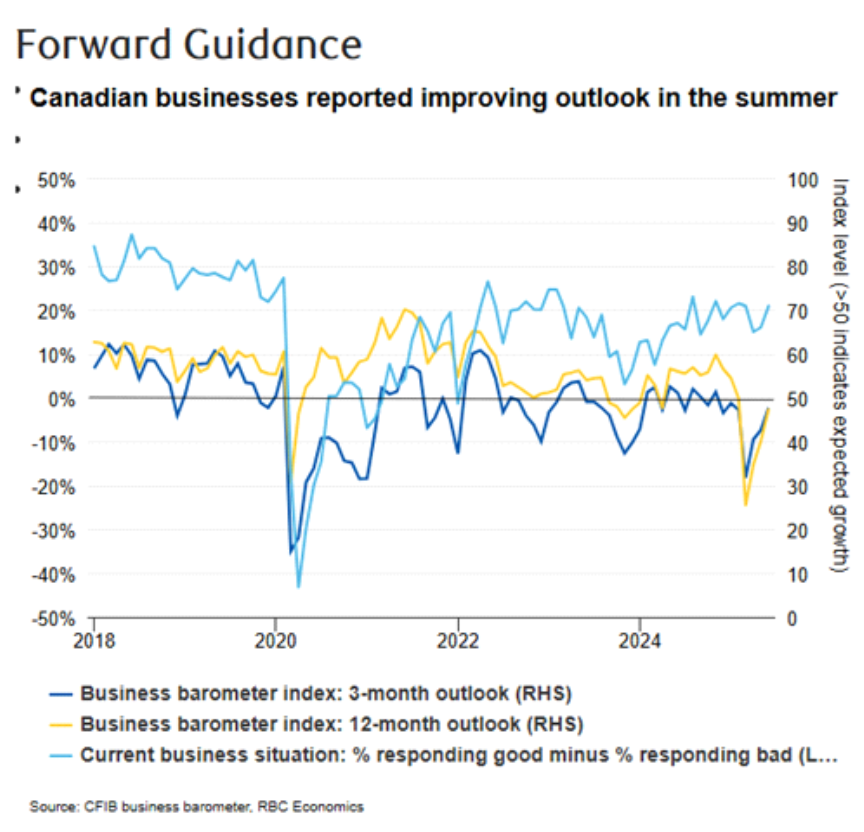

- Business confidence is up: Needless to say, all of the tariff noise had a pretty negative impact on business sentiment in Canada. But with the worst of Liberation Day behind us, sentiment has begun to recover:

While there is still much room for improvement in sentiment, things are generally moving in the right direction and based on some other factors (see below), we expect this to continue and to translate into better overall investment.

- Stimulus is coming: While it remains early days for the Carney government, it appears that we are going to get meaningful changes in the Canadian investment climate. Controversy aside, Bill C-5, which purports to reduce tape a fast-track major projects in Canada, should provide a boost to growth. Add to this the potential for a reduction or even elimination of intra-provincial trade barriers and for the first time in more than a decade, we are likely to see investment become a driver rather than a drag on the Canadian economy.

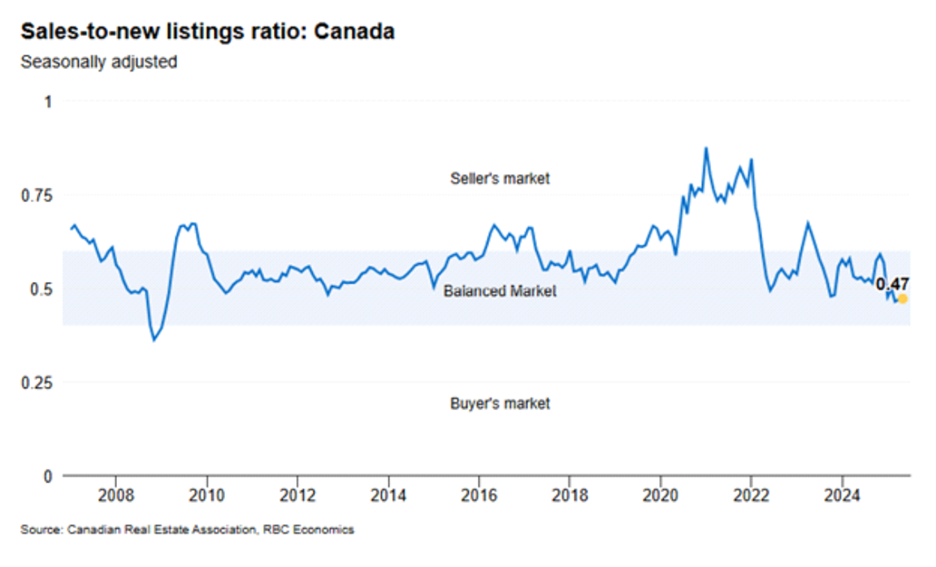

- Housing looking better: It has been a tough couple of years for the Canadian housing market, but this appears to be shifting. Resales were up in both April and May after six months of declines, while the overall market is as close to balance as it has been in nearly 20-years:

Add to this declining rent levels and housing, which has generally been a drag since rates spiked higher in 2022, should become a tailwind as we head into the back of 2025 and early 2026.

- BoC still has room to cut: Unlike the U.S., which very much still has an inflation problem, Canada looks to be better situated. While inflation up here has remained sticky, with slack in the labor market and lower long-term rates, the BoC likely has room to add to the 225 basis points of cuts it has already chopped since the fall of 2024.

Okay, we are going to stop there with the idea that we will feature three more predictions in our next installment. Until then, enjoy the summer and remember Alex.