Government by Alliteration

Using an alliteration to name a bill should be the norm going forward. The Democrats started this with the Build, Back, Better Plan, which was an artful way of making infrastructure spending sound sexy. But the Democrats were not completely committed to the bit as inflation reared its ugly head in 2022 when they were trying to get the bill passed. And so - “Build, Back, Better” became the “Inflation Reduction Act” and the dream of using alliterations to name bills seemed to die a quick death. But death did not last in this case and we instead have the Republicans channeling their own inner-Stan and Jan Berenstain with the One Big, Beautiful Bill.

If the One Big, Beautiful Bill were instead called “The Cutting Taxes for the Rich, while reducing Benefits for the Poor Bill” it might not get near universal support from the GOP as pulling an inverse-Robin of Locksley does not generally sit well with voters. But the One Triple-B? I mean it’s “big” and it’s “beautiful”, so what could possibly be wrong with it? And while both parties seemed to really embrace the letter “B”, we think the future of governing is ripe for using any letter of the alphabet to “alliterate” your bill.

Instead of – The Defense of Marriage Act – we propose – Making Moms Marry Misters Act – we wouldn’t vote for it, but we’d at least tip our caps to the catchiness. Rather than the – Affordable Care Act – why not – Keeping Costs of Care Contained for Carrie and Connie Act? Who in their right minds is going to vote against that? It would pass 100-0. Or, let’s get the carbon tax back, but through the “Carbon Causes Clouds of Cancer Act”. Again, we may not be proponents of this, but imagine on the campaign trail having to defend voting against the prevention of “clouds of cancer”. I mean – isn’t everyone against cancer clouds?

Anyway, on the subject of the One Big, Beautiful Bill – it has some stuff in its 1,100 pages that is bad for beavers, umm, Canadians, so let’s take some time to explore the implications. Let’s start with a chart and then comment:

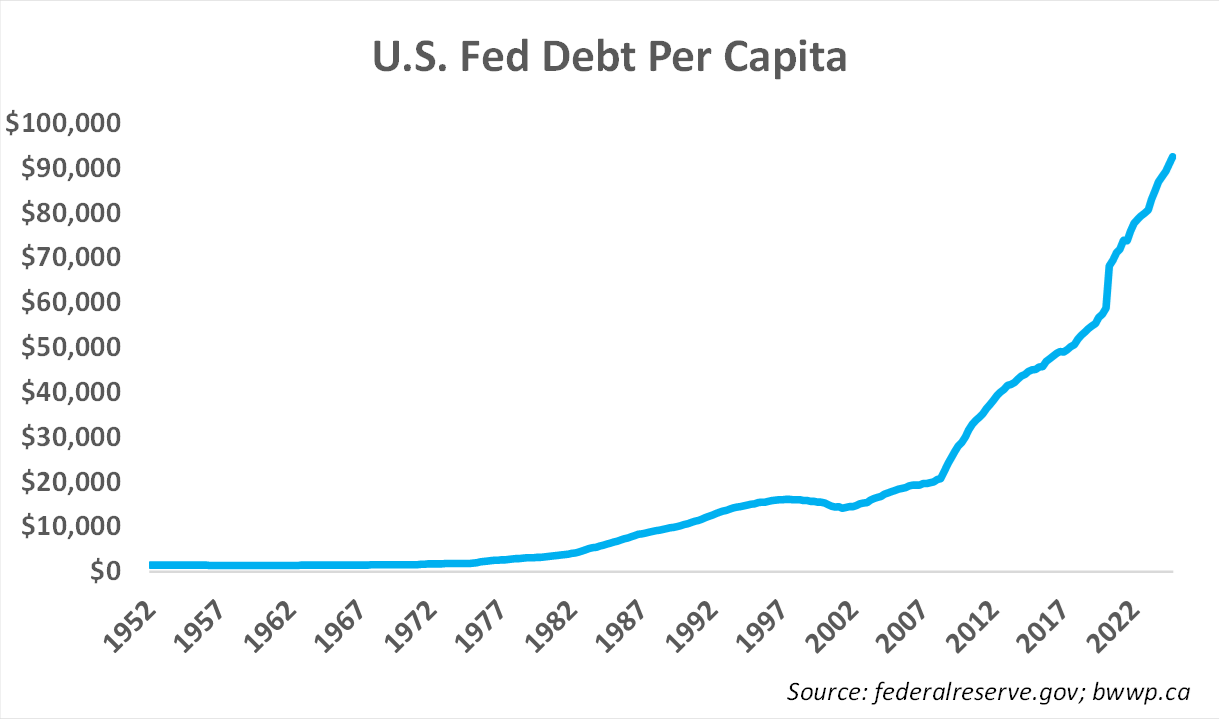

Federal debt per person in the U.S. is now approaching $100,000. This is more than a five-fold increase from the levels of two decades ago. The choice that the U.S. has made has been to essentially allow consumers and corporations to repair their balance sheets over the past two decades, while the Federal government has seen its balance sheet deteriorate. Let’s add a chart that captures this and then comment:

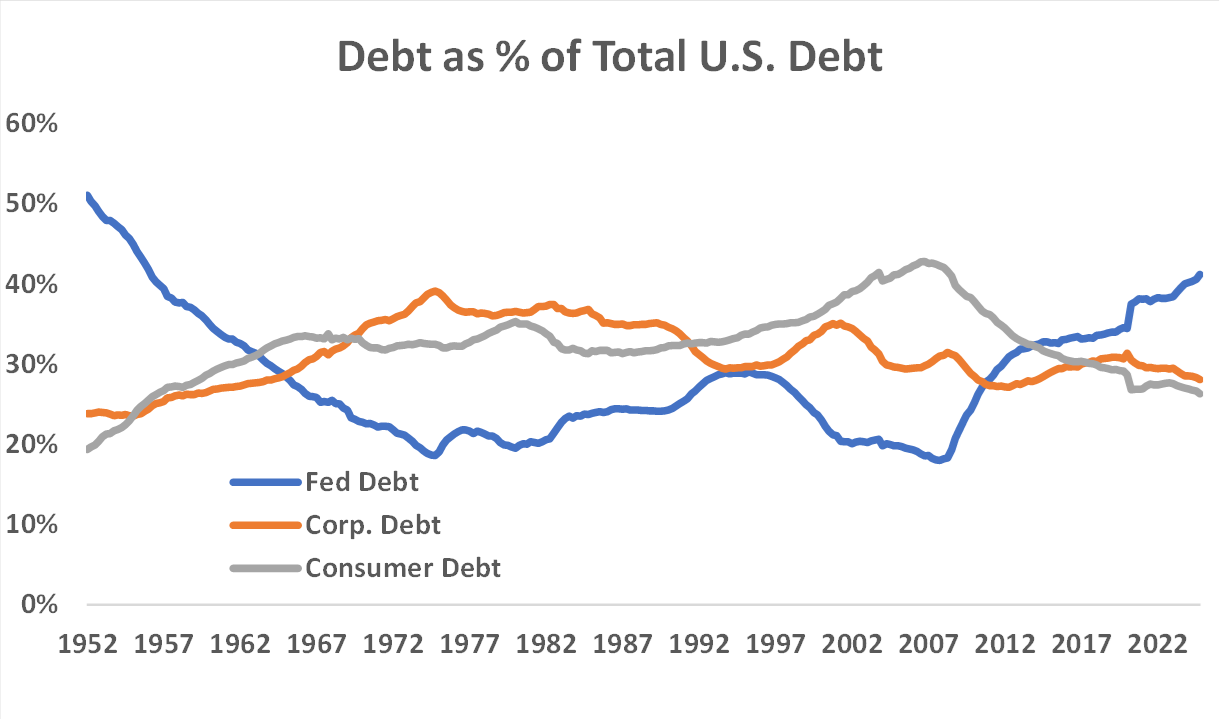

Just prior to the Global Financial Crisis, consumer debt made up ~42% of total U.S. debt. Today, that figure is ~25% and is likely to fall further in the coming years as the Federal share of debt continues to grow in size. This dynamic is in sharp contrast to Canada where consumer debt has continued to grow over the past two decades, while federal debt (despite large annual deficits) has maintained a relatively stable share. And the One Triple-B is very likely to make this Federal debt situation worse in the coming decade as rather than lowering annual deficits that are already too high, it seems poised to increase them:

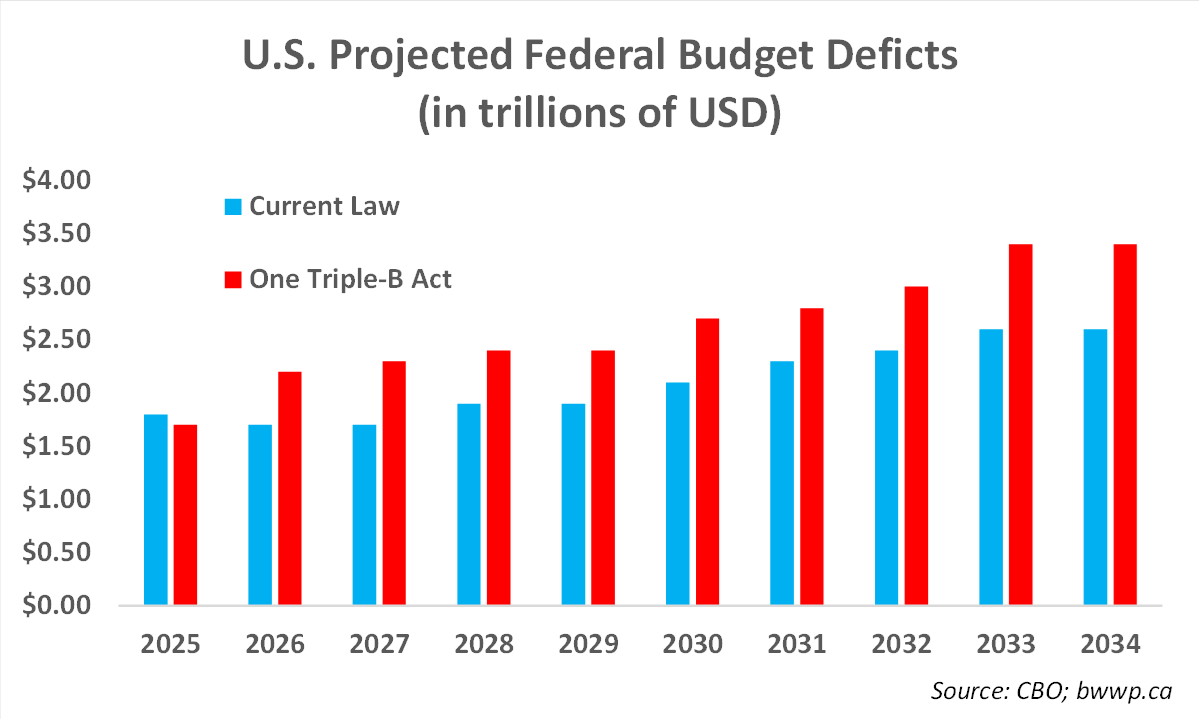

As you can see, annual deficits were already projected to be around $2 trillion, but other than 2025 where the One Triple-B lowers the deficit a bit, the remaining nine years of the projection show an aggregate increase of ~$26 trillion vs. ~$21 trillion under current law. Put another way, if we assumed the U.S. population grew at the same rate of the past 20-years (a big assumption considering population growth has been slowing), then the above Federal Debt per Capita figure would approach $150k by 2045. Now, we are going to point out that existing law was not much better - $21 trillion is still $21 trillion – but with all the talk of DOGE and controlling spending, the One Triple-B looks to fall short of the "Beautiful" part (although, we do acknowledge that it’s “Big” and a “Bill”).

Bad for Beavers

Aside from being bad for balance (no one alliterates like we do!), the One Triple-B also has something buried in Section 899 that is bad for beavers, umm, Canadians. Section 899 purports to go after the “Enforcement of remedies against unfair foreign taxes”. In the case of Canada, we added the Digital Services Tax in 2024, which was designed to tax foreign companies that sell products online to Canadians. While we will not debate the merits of this tax, it would tend to hit U.S.-based businesses disproportionately (think Amazon) and the current Administration is not happy about this, especially since the U.S. does not tax foreign companies operating in the U.S. in the same way.

Section 899 would do away with any treaty agreements on withholding taxes for individual investors and corporations, and instead would penalize investors until such time that these “unfair taxes” are rolled back. To put this in perspective for individual Canadian investors, the current withholding tax on U.S.-sourced dividends and interest payments is 30%, but by treaty, Canadians only pay 15%. This would immediately revert to 30% and then would rise by 5% per year until it reached 50% by 2030.

So, what’s going to happen to the One Triple-B and Section 899?

Okay, let’s start with – the One Triple-B is not actually law yet. While it has made it through the House of Representatives by a vote of 215-214, it now must go to the Senate where it will likely be altered before returning to the House. The major areas of debate in the Senate are likely to be:

- The so called “SALT” deduction, which is the state and local tax deduction that allowed those living in high tax states such as New York and California to deduct these taxes from their federal tax bill. Prior to Trump 1.0, the SALT deduction had no limit, so if you paid $40k of state and local taxes, you could deduct the full amount from your federal taxes. However, the 2017 tax bill capped SALT at $10k, which was a big tax hit to higher income earners in blue states. The House version of the One Triple-B raises the SALT deduction to $40k largely because, contrary to what you might think, there are a lot of Republican House members that hail from high-tax blue states. There are not, however, currently any Republican Senators that hail from high-tax blue states, so they do not have the same motivations to increase the SALT deduction.

- The projected deficits, which as we mentioned – are big. While we find most of the protests about deficits to be pure theater – they stomp their feet and say, “never again”, but then they somehow are convinced to vote in favor anyway – we acknowledge that this time could be different. Several Senators are already on the record saying, “no way”, and considering how hard it was to appease everyone in the House, there is a chance that deficits will ultimately throttle the One Triple-B.

That said- we would likely bet on the One Triple-B becoming law, albeit with some adjustments to its current form. We doubt that Section 899 will be a part of the debate, so we would assume that this is likely to become law when One Triple-B is passed.

What does this mean for Canadian investors?

While we would not bet against One Triple-B becoming law, we do think there is the potential for Canada and other governments to respond with a rollback of provisions such as the Digital Services Tax. While we are in favor of a good fight on pure principles, we wonder whether the small incremental revenue gains from something like the DST is worth “dying on that hill.”

But, if we assume 899 becomes law and the DST stays in place, then all Canadian-based investors will need to reassess their U.S. based investments. While we do not tend to derive much dividend or interest income from U.S.-based investments (the U.S. market tends to be more of a capital gains driven investment and those would not be impacted), we plan to reassess those that do and would look to make changes accordingly if and when One Triple-B becomes law and assuming no Canadian response.

What does the U.S. debt and deficit mean for investors?

The U.S. debt situation is worrisome to be sure. Recently, bond yields have begun to rise with the 10-year U.S. treasury crossing 4.5% and the 30-year crossing 5%. This is, in a sense, a signal that investors are unhappy with the fiscal situation and are going to demand higher yields in order to continue financing large deficits. This rise in rates also creates a sort of vicious cycle as larger deficits lead to higher rates and higher rates increase the interest costs for the U.S. Treasury, which has a further negative impact on the deficit.

That said – we would add two potential offsets to this narrative:

- While it is early days, tariffs are likely to provide a revenue offset that could make the fiscal situation better. Based on April’s numbers, tariffs are annualizing at ~$200 billion, which is a ~$120 billion increase over prior years. While this won’t put a big dent in the aforementioned $2 trillion+ annual deficits, it does provide somewhat of an offset.

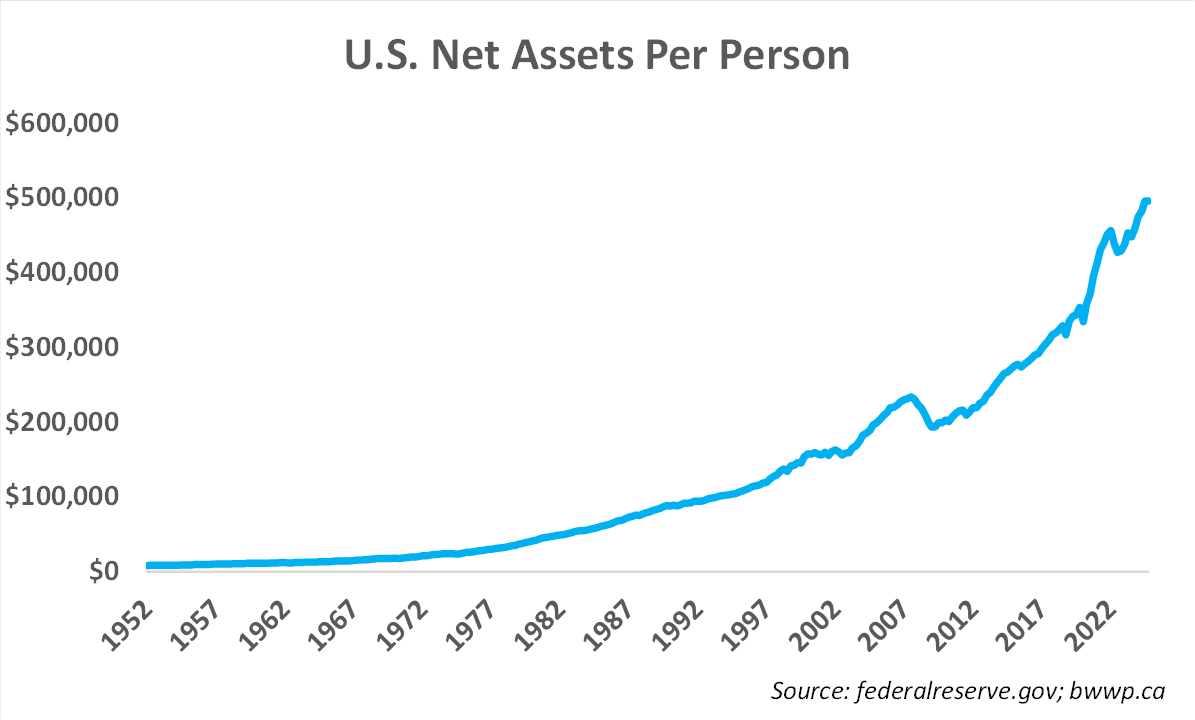

- While the Federal balance sheet and income statement are in bad shape, the consumer balance sheet has never been stronger:

The average U.S. person now has a net worth (assets minus liabilities) of ~$500k, which is roughly double the levels of 15-years ago. While this does not solve the fiscal problems the government faces, it does give a better picture of the overall wealth situation and speaks to the potential for the U.S consumer to continue as a driving force of the global economy.

Final Thoughts: While the One Triple-B has yet to be enacted, we think it is likely to become law by the end of 2025. This will have both profound implications for the U.S. fiscal situation, as well as the investment thesis for Canadian investors who own U.S. securities. That said – while the withholding tax issue is likely to have an impact on the relative attractiveness of some U.S. investments, considering the thesis for owning U.S. stocks has largely been their long-term capital appreciation potential (and this is not impacted by the One Triple-B), our investment approach is likely to be altered at the margin, but not necessarily profoundly changed. For now, we will “wait with wistful wondering”.