February 4th, 2025 – Minutes of the Meeting of Station WLRN 26, Miami Dade:

Station Manager: So, what are we going to air on the night of May 3rd in that coveted 9 pm slot?

Program Manager: Well, we have some choices here – we could go with The Ten Commandments – I mean, everybody loves Heston with a big shaggy beard …

Station Manager: Seriously? In this environment? Haven’t we pretty much just thrown the commandments out the window and you want to throw them in people’s faces? “Thou shall not …” what shouldn’t we do anymore?

Program Manager: Okay, [muttering to himself] no Commandments. How about The Truman Show? Everybody loves that one, it’s a delight.

Station Manager: Isn’t Jim Carrey Canadian?

Program Manager: Ummm, he’s from Newmarket. Is that in Canada?

Station Manager: Next?

Program Manager: So, I guess the Lightfoot biopic is out too?

Station Manager: [Glaring]

Program Manager: The French Connection? I mean, Hackman just died, we pay homage to a great AMERICAN actor and …

Station Manager: French? Come on – you know that Mar-a-Lago is in Florida, right?

Program Manager: [shuffling through notes] What about Eastwood?

Station Manager: Go on …

Program Manager: Not Dirty Harry - takes place in San Francisco - not the one with the orangutang because they’re from Africa – not The Good, the Bad and the Ugly because that sounds too much like the economy – oh, I got it – Escape from Alcatraz! Clint Eastwood – American – check; prison movie – check; prison is closed for good – check …

Station Manager: Hmmm. Let’s play this out – anyone still alive who might have stayed there?

Program Manager: Think they shut it down in 1962, which is [doing math], 63-years ago. I mean, maybe, but we would be talking about a few guys at most and what are the odds one of them is watching a UHF station in Florida on a Saturday night?

Station Manager: Okay, I’m liking this. Anything else we might not be able to think of that might come back to haunt us?

Program Manager: Like what? I mean, it’s not like someone is going to see this and think we should reopen the darn place.

Station Manager: [Laughing] – could you imagine? Okay – I love this plan – let’s do it!

Feeling Liberated

With Liberation Day now roughly one-month behind us, we thought it would be worthwhile to check in on where we are at in terms of the U.S. and Canadian economies. As we discussed in our Webex call on April 22nd, there are a lot of moving pieces to this, so we will do our best to boil this down to a few key points. Let’s start with the U.S. economy and then go from there.

U.S. Economy

Let’s paint the mosaic: Sentiment data, which reflects how consumers and businesses feel about the outlook for the economy, is generally in free-fall:

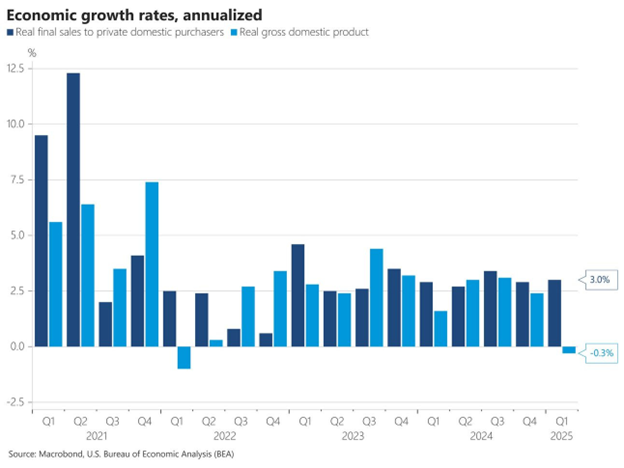

Basically, if you exclude COVID and the Global Financial Crisis, manufacturers have not felt more uncertain over the past 20-years than they do now. This generally feeds into employment – uncertainty breeds fewer hirings and bigger layoffs – although, this has not developed as of yet. We have seen consumer confidence take a similar nosedive. And yet if we look at first quarter GDP, it was bad, but not that bad:

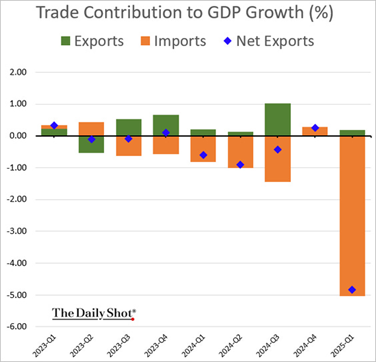

While Q1 growth was negative, declining 0.3%, final sales – which measures domestic spending, was a solid 3%. So why did GDP decline if spending was still strong? Quite simply – trade:

Not to get too wonkish, but GDP is essentially how much consumers spend plus how much companies invest plus how much the government spends plus net exports (exports – imports). The net exports’ part, which as the chart above shows, got really weird in the first quarter of 2025 with imports going ballistic (this made net exports a big negative). The obvious reason for this is that lots of U.S. companies bought a ton of stuff ahead of Liberation Day in anticipation of much higher tariffs. This will likely reverse in a big way in the second quarter (in other words, net exports will become less negative), so it’s hard to read too much into the headline negative GDP print. Of course, how much sentiment weighs on the other parts of GDP (consumption, investment) remains to be seen, so we would not rule out another negative print regardless of what happens with trade.

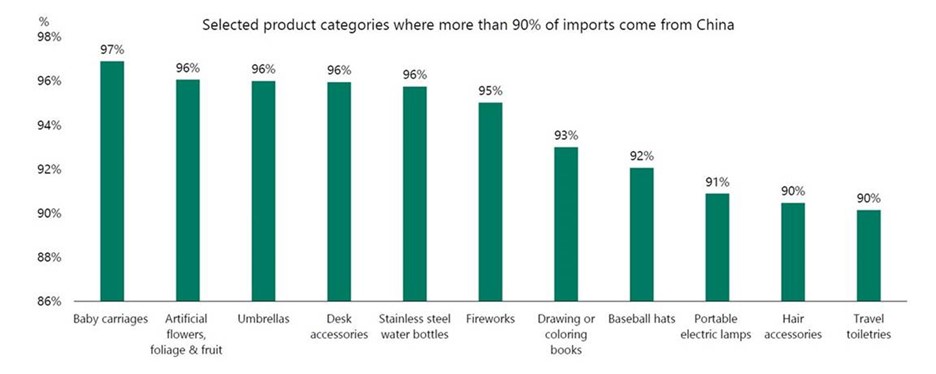

We would also add that we are on the cusp of reaching some uncharted territory as we are about to see how Liberation Day and especially the bazillion percent tariffs on China impact the supply of stuff on U.S. shelves. Consider this:

Look, Americans are a sturdy bunch, but if they can’t get their Yetis, there could be riots by August. Anyway, as we discussed in our Webex, there are three types of pain – Economic, Market and Political – and we are seeing how much of each the Trump team is willing to endure before providing some relief. In the case of market pain, we got a sense of that in mid-April when they backed off the tariffs rhetoric and gave a 90-day reprieve. However, in the case of economic pain, we might not get a sense of that until June/July as there is generally a ~2-month lag between Chinese containerships not leaving China and store shelves looking bare:

While some economic pain has already started to set in (used car prices, for example, have risen sharply in recent weeks), much of this has been offset by the drop in gasoline prices. But should we see the virtual embargo on Chinese goods, not to mention across the board tariffs on most other countries, start to impact product availability and prices this summer, we will likely get a better picture of how much of a hit the economy is actually taking.

Bottom Line on U.S.: The Trump Administration wavered on tariffs in mid-April in large part because markets were in a panic and “Market Pain” reached a point in which they had to act. We would expect something similar this summer as it relates to “Economic Pain” should we see things such as sharp price increases and stockouts. We remain of the view that recession risks are more elevated than normal and will remain cautious until we get more visibility on the economy.

Canadian Economy

Canada will be tougher to gauge in the near-term for a few reasons:

- With a new minority government, it is not clear what economic goodies will be forthcoming to kickstart what has been a generally moribund economy for the past decade. While Prime Minister Carney campaigned on a combination of tax cuts for the middle class and increased investment, until we have an actual blueprint, it is hard to gauge the overall impact.

- Businesses in Canada have been taking a wait and see approach in part because of the trade war and in part because of the election. Thus, much of the survey data that we have is stale dated as it comes pre-election.

- While trade with the U.S. has been called into question, the Canadian economy is still heavily reliant on the U.S. economy and thus one needs to gauge the health of the latter before deciding on the health of the former.

While we would hesitate to draw any definitive conclusions, we would note that prior to the election (but post the tariff dust-up), business confidence in Canada was plumbing the depths:

We would observe a couple of things from the above: 1) business confidence is at its lowest level in the 25-years of the survey; 2) confidence has been below 60% for virtually all of the post-Covid period. In other words, while it would be easy to blame Trump and the tariffs for the decline, confidence has generally been tepid for a long time, and this has been reflected in investment growth. Carney’s number one priority should be lighting a match under the business community in Canada not only because of the tariffs, but also because Canada has been in desperate need of it for some time.

Bottom Line on Canada: The economy is likely to be tepid over the next couple of quarters, with a two or three quarter recession a distinct possibility, as a combination of tariffs and the overhang of the election weigh on growth. That said – we would not be surprised to see “animal spirits” start to pick up should the Carney government follow through on pro-growth initiatives.

Final Thoughts: We often think of Rip Van Winkle in times like these. For those not familiar with RVW, he comes from a Washington Irving short story about a man who drank a strange Dutch liquor and falls asleep for 20-years, only to awaken to a starkly different world. In the case of the past 40 or so days, had RVW drank this elixir on the eve of Liberation Day and awoken this morning, he might have thought that nothing had occurred, at least as it related to the stock market as the S&P and TSX are at roughly the same levels they were prior to President Trump appearing with his spreadsheet. Of course, the world has potentially starkly changed since then; although, the next several months will undoubtedly tell us more on this front.