If you'd like to receive future Black & White notes, you can subscribe here

My focus in these notes is not on last week’s headlines or quarterly performance — there’s already plenty of commentary on that. Instead, I want to highlight the long-term forces that truly matter: the recurring patterns in credit and equity cycles, investor behaviour, structural market dynamics, and tax-efficient planning opportunities. My goal is to share how I’m positioning portfolios through an institutional, total-portfolio lens.

________________________________________

Within that backdrop, I’ve organized this month’s note around the areas where I believe risk is most mispriced – and where thoughtful portfolio construction, duration discipline and tax efficiency can add the most value today. We’re in a part of the cycle where investors are taking more risk being paid less to do so. Credit spreads are tight, refinancing pressure is rising, and the return to discipline – quality, liquidity, duration and tax efficiency – is starting to matter again.

How I’m thinking About the Portfolio This Month

1. Markets & Credit: Where Risk Is (and Isn't) Being Priced

• Credit spreads & duration

2. A Multi-Asset Theme That Matters Right Now

• Why I’m avoiding private credit & high yield

3. A Planning Opportunity Many Investors Miss

• Corporate-class fixed income

4. Charts & Ideas That Shaped My Thinking This Month

• Themes that caught my attention

1. Markets & Credit: Where Risk Is (and Isn't) Being Priced

Credit markets today look strikingly similar to past late-cycle environments. Investors are once again accepting less compensation for taking on credit risk, even as refinancing pressures, downgrade risks, and tighter lending conditions quietly build beneath the surface. The difference today is that, for the first time in many years, investors are meaningfully compensated for interest-rate risk, not for credit risk — a shift with major implications for portfolio construction.

What I’m Seeing

- High-yield and private-credit spreads remain exceptionally tight relative to history.

- Corporate refinancing needs are rising meaningfully into 2026–2028.

- Investor inflows into credit strategies are strong despite weaker compensation.

Portfolio Implications

- This is not the environment to stretch for incremental yield in speculative-grade or illiquid credit.

- It is an attractive time to add duration in high-quality fixed income, where compensation has improved significantly.

- Tight spreads mean even normal levels of credit losses can impair returns — no recession required.

How I’m Positioning

- Increasing overall quality; reducing lower-quality and speculative credit exposure.

- Favouring government bonds (Canada & U.S.) instead of corporates.

- Adding duration selectively, particularly in the 4–7-year part of the curve.

Portfolio Implications Summary

- Gradually adding duration

- Reducing credit risk

- Prioritizing quality and liquidity

- Maintaining multi-asset diversification

- Focusing on after-tax outcomes

2. A Multi-Asset Theme That Matters Right Now

Private credit and high yield have a real place in long-term portfolios. Over a full market cycle, taking credit risk is rewarded. Private credit has historically added roughly 1-2% per year over public markets because lenders earn an illiquidity premium, negotiate directly with borrowers, and can move faster than public markets.

Recent returns have also benefited from rising interest rates, because most private-credit loans are floating rate and reset higher with every central bank hike – a tailwind that has already played out.

The long-term case is solid – but cycles matter, and today’s entry point is unusually poor.

Credit spreads across almost every segment — are currently below their long-term averages. When spreads are tight, lenders are paid less for taking on credit risk- even though the risks themselves may be rising. The chart below shows this clearly.

Source: Bloomberg and RBC

This is exactly the setup that historically leads to disappointing forward returns.

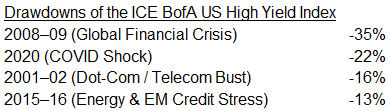

High yield performs well over time but its losses in downturns are large, sudden and tightly clustered:

Why Private Credit Can Be Even Worse

The table above shows what public high-yield bonds have experienced.

Private credit often suffers even more severe outcomes because:

- Higher Borrower & Fund-Level Leverage

- Private companies typically carry more leverage than public ones – and many private-credit funds add another layer of leverage at the fund level (often 1.2x-1.5x).

- Weaker Covenant Protection in Recent Vintages

- Massive inflows into private credit have created intense competition amongst lenders, in-turn pushing weaker covenant protections.

- Illiquidity + Delayed Marks

- Private credit losses are real, but reported NAVs tend to lag by quarters. The smoothing doesn’t reduce risk — it just delays its recognition.

These structural features don’t matter much when everything is stable, but they matter when the cycle turns.

Private credit and high yield add the most value when:

- spreads are wide,

- lenders have bargaining power,

- leverage is conservative, and

- underwriting discipline is strong.

Today, none of those favourable conditions exist. This is why I prefer quality, liquidity and duration today – and will revisit private credit and high yield when the next opportunity cycle emerges.

3. A Planning Opportunity Many Investors Overlook

Most people focus on what they invest in. Far fewer focus on how their investments are structured—despite structure meaningfully improving after tax returns in non-registered accounts.

Corporate-class mutual fund corporations are one of those rare tools. They can convert fully taxable interest into more tax efficient outcomes without changing the underlying investment.

But not all corporate-class structures are equal.

Corporate-Class Structures Built the Right Way

Strong structures pool multiple asset classes within a mutual fund corporation. This allows:

-

expenses in one class to offset gains in another,

-

losses in certain strategies to smooth income elsewhere, and

-

distributions to be paid as ROC or capital gains rather than interest.

This isn’t a loophole — it’s simply how a well-designed corporate entity operates. Pooling income, gains, losses, and expenses creates stability, and stability creates more predictable tax outcomes.

The Key Risk: “Trapped Income”

Inside the corporation, interest income still exists. If there aren’t enough losses or expenses to offset it, that income accumulates and must eventually be distributed—sometimes years after it was earned.

This creates the risk that an investor receives a taxable distribution tied to income generated before they owned the fund. There is no public ledger showing how much income is trapped. Investors must rely on:

- fund-company disclosure,

- ongoing tax governance, and

- the structure being managed conservatively.

Structures Affected by the 2016 CRA Rule Change

Before 2016, many corporate-class funds allowed investors to switch between classes without triggering capital gains. The CRA closed this loophole in Budget 2016.

Investors should also be careful with newer, more complex structures that attempt to replicate the pre-2016 switching benefit through layered entities or engineered share-class designs. These approaches may technically differ from the old rules, but they run counter to the spirit of the CRA changes and could attract scrutiny if they become large.

Structures That Rely on Large Tax-Loss Pools

Some entities launched with large internal loss carryforwards. These can shelter income—but only until used up. When the pools run out, distributions can shift quickly from ROC to capital gains or interest.

An Example

Below is a simple illustration showing how meaningful the difference can be over just five years.

Assumptions

- $100,000 investment

- 3.5% annual return

- 5-year horizon

- Top Ontario bracket (53.53%)

- Corporate-class fund distributes 100% ROC

Corporate class delivers roughly +1% more per year after tax—with the same underlying investment and no additional risk.

It is most compelling when:

- held in a non-registered account,

- the investor is in a higher tax bracket,

- the holding period is multi year, and

- predictable tax-efficient income matters.

4. Charts & Ideas That Shaped My Thinking This Month

These visuals and insights reflect interesting charts I wanted to share - not necessarily related to finance. I’ll let the charts speak for themselves.

Philanthropic Efforts Have Fallen (if you have a theory why I’d love to hear it)

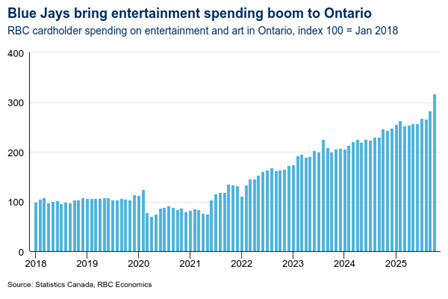

Blue Jays kickstarting the Ontario economy

Can housing prices continue to rise?

The real reason Mamdani/populists win?

Great Articles

-

This Year’s Thanksgiving Surprise: Half of the Guests Are Stoned

-

Can the Golden Age of Costco Last?

-

Why Gen Z Hates Work

Closing Thoughts

Successful investing is not about reacting to noise — it’s about understanding the environment, the compensation available, and the risks investors are being asked to take. Today’s conditions reward quality, liquidity, disciplined duration, and thoughtful tax planning. They penalize overstretching for yield, illiquidity, and relying on optimism in late-cycle credit conditions.

As always, I’m here to ensure your portfolio reflects these realities and remains aligned with your goals

If you got this far, thank you for reading!

Ari Black, CFA, HBA | Investment Advisor

Important Information

This commentary is provided for general informational purposes only and does not constitute investment, tax, legal or accounting advice. The views expressed are based on current market conditions and are subject to change without notice. Each investor's situation is unique and you should consult your accountant, tax advisor, or other professional advisors before implementing any strategy discussed herein.