- The past two years posed significant challenges to the classic “balanced” portfolio holding healthy weightings in both stocks and bonds.

- After many years of providing complementary exposures, the resurgence of inflation caused bond and stock returns to move nearly in lock step.

- While not problematic when prices were rising together, the lack of a countervailing force made the inevitable bouts of volatility more challenging.

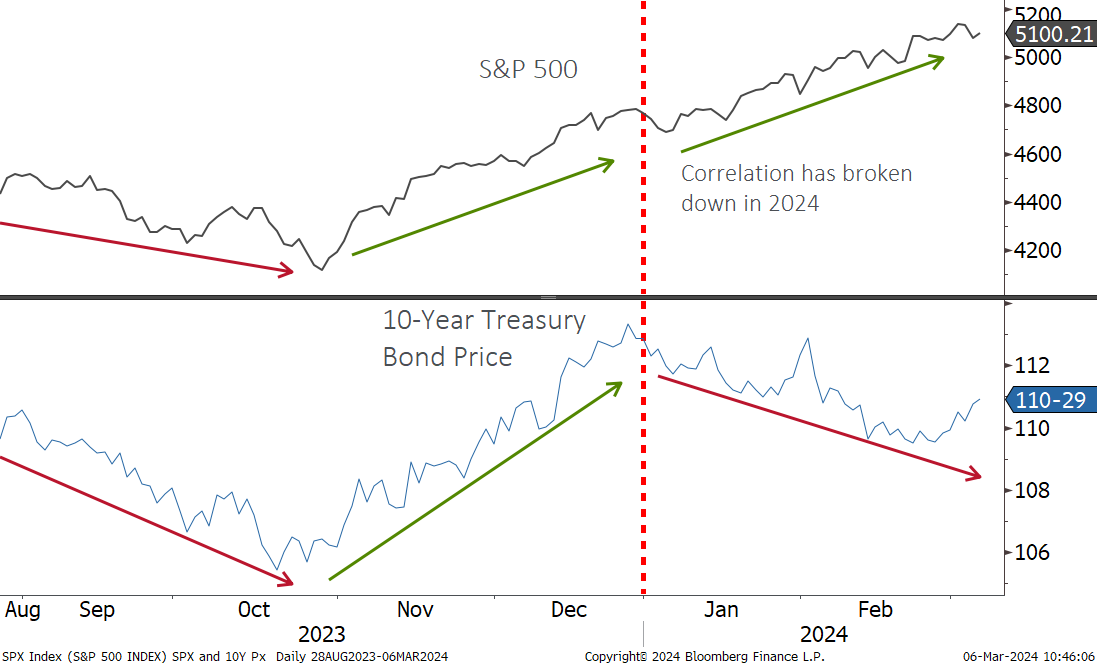

- As the calendar has turned to 2024, there are signs that we are going back to the old ways, as stocks have risen while bonds faltered.

- Markets have had a strong start to the year, yet we know an eventual return of volatility is a certainty; current trends suggest that when that happens, bonds are in a position to protect portfolios once again.

When is the last time you went to the circus? For us, it has been a long time, and for many of you, perhaps never. In this day and age, we would guess a lot more would put up their hand for Cirque de Soleil, providing all the entertainment of the circus and more without the animal rights issues. Aside from both events taking place under an extraordinarily large tent, the other thing they have in common is the death-defying stunts performed for a crowd. One way for the performers to mitigate their risk is to have a strong safety net below to catch them if they fall, leading to only a bruised ego instead of much worse in the event of a mishap. Of course, the most entertaining performances for the crowd are those without a net, as everyone involved knows the stakes are significantly higher.

For decades, a balanced portfolio of stocks and bonds served investors well…

For most of our investing careers, the balanced portfolio consisting of a healthy weighting of both stocks and bonds had been the investor’s equivalent to performing with a net. When stocks did well, bonds paid us our coupon income, but when stocks fell sharply we typically saw bond prices rise, buffering the volatility of the portfolio as a whole. It is not an exaggeration to say that this relationship was the foundation of investing for a whole host of investors, and it served us well for decades. That is, until it didn’t.

… but the resurgence of inflation upended the bedrock upon which portfolios were built

Since inflation returned to the fore in late 2021 and was the dominant force in 2022, we have been investing “without a net”, as stock and bond prices started to move in the same direction. Those bonds that had served us so well as portfolio ballast all of the sudden became additive to volatility. In other words, investors had nowhere to hide when markets went into a bad mood.

As inflation fades, 2024 has seen a return to the “old ways”

Since the calendar turned to 2024, stocks have maintained their momentum but bonds have faltered somewhat as markets push out their expectations for the timing and magnitude of interest rate cuts. In 2022 and 2023, such a move in bonds would have presented a strong headwind for stocks. That has not been the case in 2024, as seen below.

This would suggest to us that the market is now of the view that inflation is under control (or soon will be) and therefore moves in bond yields are more in response to changes in economic growth and Federal Reserve rate estimates than inflation. It is still early days, but current trends suggest that when the next bout of stock market volatility inevitably hits, we should be able to look forward to having the bond market on our side once again. Whether your preferred endeavor is acrobatics, trapeze or investing, all are safer when working with a net.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.