STRONG PERFORMANCE

Many people are wondering: With all the turmoil in the world, which only seems to be getting more intense by the day, how can the market continue to do well?

The answer is that the market keeps proving, over and over again, that it is resilient. And that what determines market performance is the long-term performance of businesses, not short-term political events.

That said, here at the start of the year is a good time to reiterate that our clients do not own the market at all. Instead, they own a portfolio that is professionally managed by our team and customized to each client’s specific goals as expressed in the investment policy statement and comprehensive financial plan we created for them, and that guides everything we do.

In 2025, our equity portfolio returns exceeded the S&P 500 *, and with our defensive strategies, we were able to do so with lowered risk; see Playing Defense, below.

This is consistent with our performance over the seven years since we moved to RBC.

* Source - RBC Wealth Management, FactSet; data through 12/31/25

A LOOK FORWARD

In the United States, we anticipate one or two rate cuts in 2026, of 0.25% each time. The market shares our view.

This projected drop is contributing to the US economy firing on all cylinders, as lower interest rates reduce the cost of shelter and support continued investment in artificial intelligence, defense, and industrial infrastructure. A drop in wage inflation has further given the Federal Reserve the green light to cut rates.

Although the market is not anticipating Canadian interest rates to go lower in 2026, we expect to see a cut of 0.25%, and potentially a second 0.25% cut.

In 2025, the Canadian dollar appreciated approximately 4% against the U.S. dollar, and we are projecting similar performance in 2026.

AN OLYMPIC ANALOGY

Our Olympic hockey teams in Milan-Cortina, scheduled to play their first games less than a month from now, cannot rely exclusively on attacking the net. They will also need solid defense to win what are sure to be chaotic tournaments.

The analogy for our work here at Marche Wealth Management is that for the past several months, our portfolios have been in a more defensive position than at any time since before the Covid pandemic took hold in March 2020, when we were in a carefully prepared defensive position before the market declined sharply. As a result of that preparation, our portfolios outperformed considerably, and were strongly positioned for the future, because we had ammunition to buy businesses trading below what we believed was their intrinsic value.

What does it mean to be conservative (a posture we are taking now because we view the market as potentially overpriced)? It means intensifying our focus on finding dividend-paying companies in regulated industries – those firms having strong management and business models we clearly understand. Those businesses trading, in our view, at prices below their intrinsic value.

OUR VIEW ON VENEZUELA

“The essence of strategy is choosing what not to do.”

Michael E. Porter

Much of the media believes that the Trump administration taking over the Venezuelan oil industry means that oil prices will go down substantially and that for this reason and others, this will be a bad thing for the Canadian oil industry and the Canadian economy overall.

We take a different view.

I will start by saying that we do not invest directly in oil producers, whether they are domiciled in Canada, the US, Venezuela or elsewhere. Oil companies have no control over the price of the product they sell: they are price-takers, not price-makers, which inserts a degree of uncertainty into their corporate performance that we are uncomfortable with.

Second, we do not see the US government takeover of the Venezuelan oil industry as a threat to any of the businesses we own.

Third, we do not envision a significant threat to the price of Canadian oil in the short- to medium-term, because it would take several years and many billions of dollars for the production of Venezuelan oil to increase to a level that will have a meaningful downward impact on prices. Even if there is an impact, we do not see it being a drop of more than one or two dollars per barrel.

Finally, a substantial increase in Venezuelan production is a considerable way off because their oil infrastructure is decrepit. It has long been neglected, and will require massive investments of time and money to upgrade, not to mention navigation of Venezuelan political, legal, commercial and bureaucratic systems. These realities are reflected in the fact that the CEOs of US oil companies have not been standing up to express optimism about pouring their financial resources into Venezuela.

Here is how the CEO of ExxonMobil, capitalized at over $500-billion and as such the largest oil company in the United States, put it:

“If we look at the commercial constructs and frameworks in place today in Venezuela, today it’s uninvestable.”

KEEP MORE OF YOUR MONEY

Tax planning is now more important than ever. Because of the power of tax-sheltered compound growth, your registered plans are one of the most important components of your financial plan. A strategy of careful planning, consistent management and making your maximum allowable contributions on a consistent basis is essential to maximize the value of these vehicles.

As we approach the RRSP deadline and tax season, we wanted to remind you of the details surrounding the use of tax-sheltered savings plans as an effective way to grow your savings.

RRSP Deadline and Contribution Limits

The 2025 RRSP contribution deadline is March 2, 2026 and the RRSP contribution limits are $32,490 for 2025 and $33,810 for 2026.

If you have the funds available, consider making your 2026 RRSP contribution early in 2026 rather than waiting until the deadline in 2027. The simple act of contributing early maximizes the tax-deferred growth of your investment portfolio.

TFSA

You are allowed to contribute $7000 to your TFSA in 2026. If you did not contribute to a TFSA in prior years, with the contribution room from 2009-2026, you will be able to contribute up to $109,000 to grow tax free.

FHSA

The First Home Savings Account is a new registered plan that gives eligible Canadians the ability to save up to $40,000 on a tax-free basis, for the purchase of their first home. It combines the features of a RRSP and TFSA where contributions are tax deductible (like RRSP) and withdrawals, including earned income are tax free (like TFSA) provided funds are used to purchase a qualifying home. The annual contribution limit is $8,000 with a maximum lifetime contribution limit of $40,000 (see attachment for more information).

Click here for more information on the FHSA.

Determining your available contribution room

Check your latest Notice of Assessment, RRSP Deduction Limit Statement (Form T1028), or log on to your Canada Revenue Agency account by clicking here.

Please give us a call if you would like to explore these strategies and we will help you develop a plan that makes the most sense for your situation. You can also make a contribution by transferring funds to your RBC Dominion Securities account directly from any RBC Royal Bank account through DS Online. For DS Online help or more information on transferring funds, contact Tanvir at 416-974-4811.

For our 2026 list of handy financial planning facts, click here.

MYRA UPDATE

I am very pleased to announce that effective January 1st, Myra Villaflor has taken on a larger role on our team, on an official basis, to ensure we continue to provide you with the highest level of service. Many of our clients have already had the pleasure of working with Myra, who has supported us in the past with the efficient flow of administrative work that is so important to delivering our brand promise: Your life, uncomplicated.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

www.tylermarche.com

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Steve Mogdan, CPA, CA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

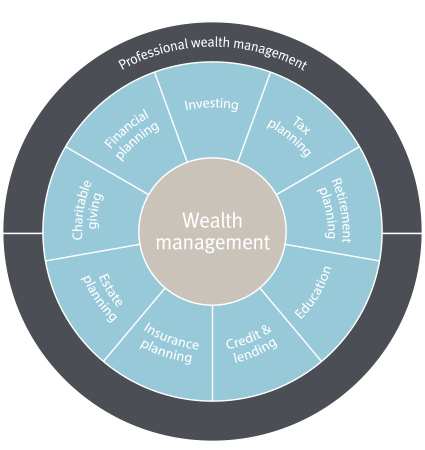

WHAT WE DO