Rewriting the Playbook:

Understanding the Logic Behind America’s Strategic Economic Pivot

In March, my family and I took a long-awaited trip to Mexico. Like most people, we only get one week a year for a true family holiday abroad—and we were determined to make the most of it. We had done our homework, picked a resort that looked stunning online, and arrived full of excitement.

But once we settled in, things weren’t quite what we expected. The hotel was new and polished, the photos matched the view, and the all-inclusive label promised effortless ease. But underneath the surface, it didn’t deliver. The pool was freezing. The restaurants they advertised were fully booked. Service was slow, and the crowds were overwhelming. It looked like luxury, but it lacked substance.

After a tough conversation—and weighing the cost of change—we switched hotels mid-trip. It wasn’t easy, but it was the right call. The second resort had warmth, space, attentive service, and a sense of calm. That decision made the holiday.

And it reminded me: sometimes, you have to let go of the appearance of what’s working and move toward something with real foundations—even if it means discomfort in the short term.

That’s the same dilemma policymakers, investors, and nations are facing today.

For decades, the global economic system has looked like a well-oiled machine: low inflation, abundant capital, frictionless trade, and rising asset prices. But beneath the surface, imbalances have quietly grown. The U.S. has run chronic trade deficits, outsourced key industries, and become increasingly reliant on foreign capital and imported goods. In return, it offered the world a stable currency and an open market.

The shine is still there, but the structure underneath is creaking.

Today, a new economic philosophy is emerging—one that’s questioning whether the existing playbook still works, and whether it’s time to move on to something more durable, even if the transition is messy.

- Real wages have stagnated.

- Industrial capacity has eroded.

- Supply chains are fragile and highly dependent on other nations

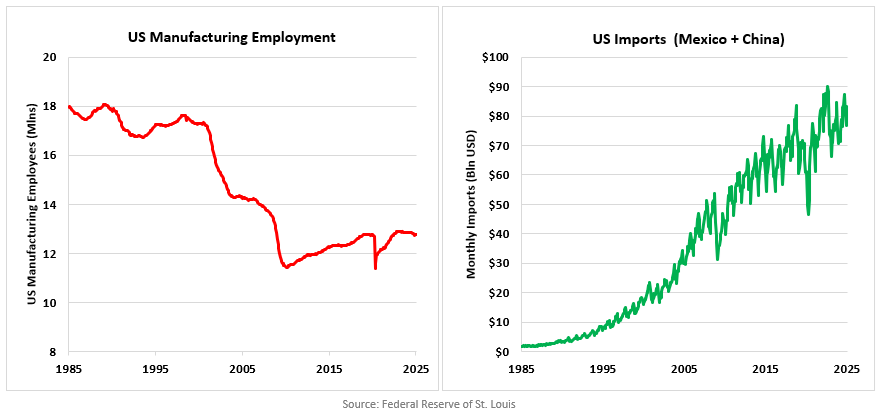

This chart underscores how the offshoring of industrial capacity – especially to lower cost regions has coincided with a steady decline in manufacturing employment in the US. It is this erosion of economic resilience that Trump and his team are working to reverse.

Moreover, America’s role as both global consumer and enforcer has become more burden than benefit.

This commentary explores the logic behind the Trump administration’s evolving economic vision by drawing on extensive interviews with Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, along with analysis of a white paper authored by Stephen Miran—recently nominated by President Trump to chair the White House Council of Economic Advisers. Together, their remarks and writings provide insight into a strategy that is still taking shape, but already challenging the assumptions that have governed global markets for decades.

A new strategy is taking shape—one that challenges many of the assumptions that have governed global markets since the end of World War II. This isn’t about short-term politics or next quarter’s GDP. It’s a rethinking of the rules of the game.

Sometimes the most valuable decisions come from recognizing when the old model no longer serves its purpose.

The Emerging American Agenda: Rebalance, Reclaim, Rebuild

At the heart of this shift is a clear set of interconnected goals:

1. Reduce the trade deficit, reviving U.S. manufacturing and discouraging overconsumption.

2. Weaken the U.S. dollar, to improve competitiveness while preserving reserve currency status.

3. Lower the cost of capital, through reduced dependence on foreign Treasury buyers and smarter fiscal policy.

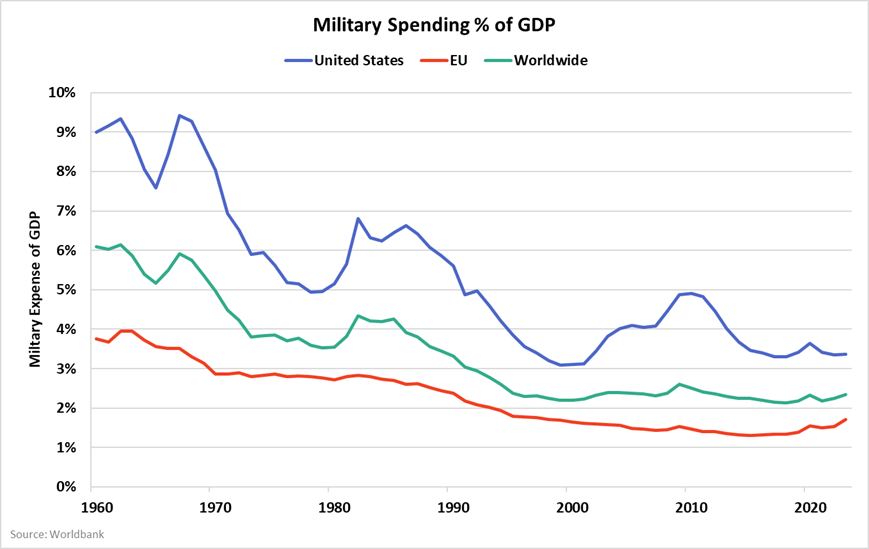

4. Realign global burden sharing, particularly in defense and trade relationships.

This framework reflects not just policy tweaks, but a broader philosophy of economic sovereignty. The idea is simple: the U.S. should produce more of what it consumes, depend less on rivals, and use its economic tools—tariffs, tax policy, deregulation—not just to grow, but to shape a more resilient and strategically sound future.

Echoes from History: The Post-War Blueprint

This isn’t the first time the U.S. has rewritten the rules of global commerce.

After World War II, the United States emerged as the world’s dominant economic power. Through the Marshall Plan, it provided more than $17 billion (over $200 billion in today’s dollars) to rebuild Europe—not only to prevent the spread of communism, but to create a healthy global economy that would ultimately benefit American exports.

Crucially, while the U.S. dropped its own tariffs to allow goods from recovering nations into its market, it tolerated high foreign tariffs in return. This asymmetric arrangement allowed allies to protect their industries while relying on access to American consumers.

This post-war generosity laid the groundwork for modern globalization—but it also sowed the seeds of imbalance. Over time, trade surpluses shifted abroad, and the U.S. transitioned from producer to consumer, from exporter to debtor.

The Nixon Shock: A System Recast

Another key turning point came in 1971, when President Nixon abandoned the gold standard, ending the Bretton Woods system. Known as the Nixon Shock3, this decision was made in response to dwindling U.S. gold reserves and a growing trade imbalance.

In short order:

• The U.S. dollar devalued sharply (over 30%),

• Exports surged,

• Manufacturing rebounded, and

• A new era of fiat currencies and floating exchange rates began.

While the move was controversial at the time, it ultimately allowed the U.S. to regain competitiveness and reassert monetary control.

Today, the comparisons are striking. Once again, the U.S. faces a dilemma: continue supporting a system that no longer serves its interests, or make a bold, disruptive move to recalibrate. And once again, the cost of doing nothing may be higher than the cost of change.

Hudson Bay Capital: Tariffs and Currency as Strategic Tools

Stephen Miran, senior strategist at Hudson Bay Capital and current chair of the Council of Economic Advisers to the White House, published in November 2024 a white paper called “User’s Guide to Restructuring the Global Trading System”, which lays out a potential roadmap for reshaping international trade. The paper argues that the U.S. is stuck in a modern Triffin Paradox: to maintain the dollar’s reserve status, it must run persistent trade deficits, but those same deficits hollow out the domestic economy. The Triffin Paradox end game culminates in a host of national security issues and sovereign credit risk due to the ballooning deficit.

To fix this, Miran proposes a deliberate, managed transition:

• Tariffs to generate government revenue and re-level global trade,

• A weaker dollar to support exports and reduce capital inflows,

• Reduced reliance on foreign Treasury buyers, enabling organic yield suppression.

This isn’t traditional protectionism. It’s a strategic response to a system where the U.S. shoulders the cost of global liquidity and open trade, while others benefit more from the rules.

The white paper suggests that tariffs can be non-inflationary, particularly if paired with currency adjustments or if exporters absorb the cost to preserve access to the U.S. market.

Scott Bessent: Capital Efficiency over Financial Engineering

Treasury Secretary Scott Bessent, a seasoned investor and former CIO of Soros Fund Management, shares a similar diagnosis. In his All-In podcast5 appearance, Bessent emphasized the need for structural deficit reduction, deregulation of regional banks, and income tax reform.

His vision includes:

• Deregulating small and mid-sized banks to encourage real economy lending,

• Cutting income taxes for earners under $150K to ease household burdens without raising employer costs,

• Reducing fiscal deficits to lower Treasury yields over time.

Bessent’s proposals reflect the influence of his former mentor, Stan Druckenmiller, who has long warned about America’s reliance on debt-fueled consumption and the erosion of productive investment. Druckenmiller’s philosophy—that the U.S. needs less liquidity and more structural reform—is embedded in Bessent’s approach.

This is not an austerity agenda. It’s about realigning capital toward businesses and industries that build long-term value.

Howard Lutnick: Tariffs as a New Tax Code

Commerce Secretary Howard Lutnick added a bold twist: the idea of abolishing the IRS and replacing income taxes with tariffs.

“The goal is to let the outsiders pay,” he said in an interview6. Under this framework, revenue would come from foreign imports rather than domestic earnings—flipping the traditional tax model on its head.

It’s a dramatic proposal, and not without risk. Critics warn it could raise prices, hurt lower-income households, and provoke retaliatory tariffs abroad. But the broader point is consistent: America’s fiscal model should reflect its strategic priorities, not simply legacy systems.

Whether or not this proposal gains traction, it reflects a core belief that economic tools—taxes, tariffs, spending—should all serve the goal of national resilience.

Where Canada Fits In

As Canada sits next to the world’s largest economy—and closest political and economic partner—this shift presents both risks and opportunities.

• Strategic alignment: Canada’s natural resources, stable financial system, and skilled workforce make it a logical partner in North American reindustrialization. Energy, minerals, agriculture, and manufacturing will be central to this story.

• Export exposure: If the U.S. weakens the dollar and reorients trade, Canadian exporters may face more competition—but also more demand from reshoring efforts.

• Policy harmonization: Canadian fiscal, trade, and regulatory policy will need to adapt quickly to avoid being sidelined.

For Canadian investors, this moment requires watching Washington as closely as Ottawa.

What It Means for Investors

A shift of this magnitude has implications across asset classes:

• Strategic commodities and energy infrastructure may see long-term support.

• Small and mid-cap businesses, especially domestic producers, could benefit from tax and lending reforms.

• The U.S. dollar may face downward pressure, boosting non-U.S. assets and inflation hedges.

• Fixed income markets may begin to reprice around fiscal policy, not just central bank action.

• Geopolitical strategy will increasingly shape risk and opportunity—economic alignment may matter more than cost efficiency.

This is not a moment for wholesale portfolio turnover, but for thoughtful repositioning around resilience, productivity, and strategic exposure.

A Note of Caution: Strategic Risk and Market Complexity

Still, for all its logic and long-term rationale, this strategy is a gamble—and there’s no guarantee it will work. A coordinated global response could easily overwhelm the intended effects, with retaliatory tariffs, financial tightening, or capital flight tipping the global economy closer to recession. The interconnectedness of markets today means shocks are rarely contained.

If the administration backs down too quickly—whether due to political pressure, market volatility, or diplomatic pushback—it risks undermining its credibility in future negotiations. Bluffing only works if you’re willing to play the hand through. Any perception of retreat could weaken the United States’ negotiating posture, both at home and abroad.

The Federal Reserve also faces a delicate balancing act. Should it respond too quickly to volatility stemming from this policy pivot, it risks creating moral hazard—reinforcing the idea that the central bank will always step in to buffer political or policy-driven disruptions. That blurs the line between independent monetary policy and reactionary support, potentially eroding the Fed’s credibility at a time when clarity and restraint are essential.

This is what makes the current market environment so challenging. It’s tempting to respond to every headline, but reaction without reflection is risky. There is no historical playbook for tariffs of this scale deployed as part of a broader economic restructuring. To make sense of this, we must think three-dimensionally—accounting not just for the direct impacts, but also the second- and third-order consequences across supply chains, geopolitics, and capital markets.

Frankly, it’s too soon to know what kind of landscape this strategy will ultimately produce. Making sweeping investment calls now might not be prudent. But we are watching closely. As policy hardens into action and the agenda begins to take shape, we’ll adjust accordingly—with purpose, discipline, and an eye on long-term resilience.

Stan Druckenmiller once said, “Good investors don’t just have better information. They have better frameworks”. That’s how we see this moment: not as a prediction, but as a framework.

One that says the era of passive globalization may be giving way to strategic engagement.

One that values resilience over leverage.

One that is still being written—but worth understanding, even now.

As always, we remain committed to helping you navigate this evolving landscape with perspective, clarity, and discipline.

References

- St Louis Federal Reserve

- Worldbank.org

- Nixon shock

- Hudson Bay Capital

- Scott Bessent All-in podcast

- Howard Lutnick All-in podcast

Disclaimer

This commentary is based on information that is believed to be accurate at the time of writing, and is subject to change. All opinions and estimates contained in this report constitute RBC Dominion Securities Inc.'s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Interest rates, market conditions and other investment factors are subject to change. Past performance may not be repeated. The information provided is intended only to illustrate certain historical returns and is not intended to reflect future values or returns. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license. © 2025 RBC Dominion Securities Inc. All rights reserved.