Market Commentary: The Tariff Game and Portfolio Strategy in 2025

There’s a saying that the market never sleeps, but on weekends, I try to carve out some time to recharge—whether it’s a quiet night with a great bottle of wine with my wife or a trip to the slopes in Whistler with the family. The first weekend of February, however, was anything but relaxing.

Using the 1977 International Emergency Economic Powers Act, U.S. President Trump announced sweeping tariffs: 25% on goods from Canada and Mexico, sparing Canadian oil with a lower 10% tariff. The market reaction was swift. By the time U.S. futures opened on Sunday night, the S&P 500 and Nasdaq had already dropped 2%. A partial rebound followed as Canada and Mexico secured a one-month reprieve, but volatility remained high throughout the week.

The market knew Trump’s ambitions for trade policy, yet his decisions still caused shockwaves. His approach to tariffs closely follows a negotiation framework heavily influenced by game theory—the study of strategic decision-making.

The Game Theory of Tariffs: Strategic Play in Action

-

Threat-as-Leverage (Strategic Commitment)

Trump frequently announced tariff hikes before enforcing them, using them as bargaining chips. This aligns with the concept of strategic commitment in game theory—where a player makes an irreversible move to influence an opponent’s response. By making threats that seemed credible, he aimed to extract concessions from trading partners before the tariffs even took effect. A historical example of this tactic was the 1980s U.S.-Japan trade negotiations, where the U.S. leveraged tariff threats to pressure Japan into voluntary export restraints on automobiles, ultimately reshaping global car production. -

Tit-for-Tat and Retaliation (Repeated Games)

Trade disputes resemble an iterated Prisoner’s Dilemma, where short-term self-interest can erode cooperation. Predictably, Canada, China, and the EU responded with their own tariffs. While this mirrored classic game theory models, the repeated nature of these interactions meant both sides had incentives to de-escalate rather than engage in prolonged economic warfare. A real-world example can be seen in the 1930s when escalating tariffs between the U.S. and its trading partners exacerbated the Great Depression, reinforcing why sustained retaliation is economically dangerous. -

The Commitment Problem (Dynamic Games and Credibility)

Game theory teaches that threats only work if they’re credible. Trump’s shifting positions—one day imposing tariffs, the next rolling them back—kept adversaries on edge but reduced his long-term credibility. In dynamic games, when a player reneges on commitments, opponents become less likely to take future threats seriously. A similar dynamic can be seen in OPEC’s historical struggles with production quotas. While OPEC members frequently agree to cut or limit oil production to stabilize prices, individual nations often overproduce to capture additional market share. This commitment problem weakens OPEC’s collective influence, leading to price volatility and periodic breakdowns in cooperation. Similarly, in trade policy, when a country frequently changes its stance—such as imposing tariffs and then reversing them—it reduces the credibility of its commitments, making trading partners more cautious and less likely to negotiate in good faith. -

Nash Equilibrium and the Stalemate Effect

A Nash Equilibrium occurs when no player can unilaterally improve their position1. The U.S.-China trade war reached this stage, where further escalation harmed both sides, forcing them into negotiated truces. This underscores a key game theory lesson: aggressive tactics may provide short-term leverage, but long-term retaliation often erases those gains. Businesses reliant on global supply chains, such as automobile and technology manufacturers, found themselves navigating a landscape fraught with uncertainty.

The Smoot-Hawley Effect: A Lesson from History

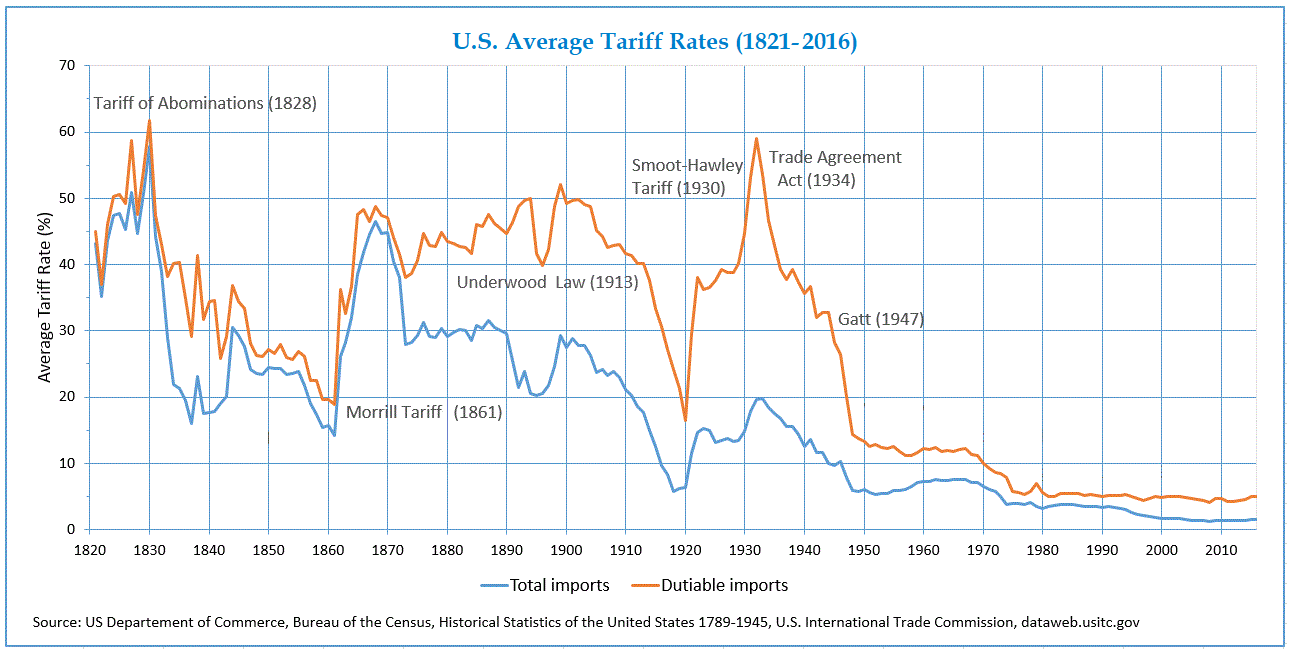

Tariffs aren’t new, and history provides key lessons. The Smoot-Hawley Tariff Act of 1930 was a prime example of aggressive protectionism gone wrong2. Initially, higher tariffs seemed to boost U.S. production, but retaliation from trading partners quickly followed. Canada imposed tariffs on 16 U.S. goods, affecting 30% of American exports. Global trade suffered, unemployment surged (30%3 in Canada, 25%4 in the U.S.), and the Great Depression deepened.

To illustrate, below is a historical chart depicting U.S. tariff rates before and after Smoot-Hawley:

The lesson here is that while tariffs may appear to be a powerful economic weapon, they often produce unintended consequences that harm both sides in the long run.

Looking ahead, the outlook for trade tariffs between Canada, Mexico, and the U.S. remains uncertain. Given the historical pattern of trade disputes and negotiations, it is expected that tariffs will be used as leverage rather than applied broadly.

From a game theory perspective, this scenario closely resembles a Repeated Game of Tit-for-Tat, where each country will strategically respond to actions taken by the others. If the U.S. aggressively enforces tariffs, Canada and Mexico may retaliate in specific industries rather than escalating across all sectors. This measured response minimizes economic damage while still maintaining negotiating leverage.

Additionally, elements of Nash Equilibrium may come into play, where each country ultimately reaches a point where further escalation is too costly, leading to a stabilizing agreement. However, if one country perceives an opportunity to gain a short-term advantage, disruptions could occur before the balance is restored. This dynamic underscores the need for investors and businesses to remain flexible and prepared for potential shifts in trade policies.

Canada's Long-Term Business Orientation Amid Trade Uncertainty

Given this prolonged uncertainty, Canada’s long-term business strategy will likely pivot toward greater economic diversification. Canadian businesses may deepen trade relationships with Europe and Asia, reducing reliance on U.S. markets. Agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Canada-European Union Comprehensive Economic and Trade Agreement (CETA) are expected to play an increasingly central role.

Additionally, businesses may accelerate investments in domestic supply chain resilience, encouraging greater self-sufficiency in key industries like manufacturing, technology, and energy. We also anticipate that Canadian companies will place greater emphasis on automation and innovation to maintain competitiveness in an environment where cross-border trade remains uncertain. While short-term disruptions may arise, long-term adaptation and economic repositioning should provide new opportunities for growth.

Tariffs and Portfolio Strategy for 2025

Turning to portfolio strategy given the current landscape, the key is distinguishing between economic reality and political noise. Some policies, like corporate tax cuts, had lasting benefits for markets, while others, such as fluctuating tariffs, created uncertainty. Tariffs should not be dismissed as mere rhetoric, but until specifics emerge, maintaining a balanced and prudent investment approach is essential.

A well-constructed portfolio should include companies with strong balance sheets, low debt, and resilient management teams that can adapt to changing trade policies. We are positioned in businesses that understand supply chain dynamics and can navigate tariff impacts effectively. Amphenol, for example, strategically distributes its manufacturing across multiple regions to mitigate geopolitical risks. Similarly, software and financial firms with borderless revenue models remain attractive holdings.

One sector particularly vulnerable to tariffs is the automotive industry. We have deliberately avoided direct exposure to automobile manufacturers, which remain a primary target of trade disputes. Instead, we have focused on industry stalwarts like Visa, Royal Bank, Microsoft, and BlackRock, paired with companies like Broadridge Financial Solutions and Cadence Design, which play critical roles in financial and technology infrastructure.

The Myth of Market Timing: Why Staying the Course Works

In times of uncertainty, there are always discussions about moving to cash and waiting out market volatility. While this instinct is understandable, history has shown that attempting to time the market is a poor long-term strategy. Markets are unpredictable, and missing just a handful of the best-performing days can have a drastic impact on overall returns.

For example, over the past 20 years, an investor who missed only the 10 best-performing days in the market would have seen their total return reduced by more than half compared to someone who stayed fully invested6. This highlights a key issue with market timing—recoveries often happen quickly, and being on the sidelines means missing out on significant gains.

Adjusting a portfolio for long-term risk management is different from trying to time short-term movements. If the goal is to reduce long-term portfolio risk and ensure alignment with financial objectives, this can be a prudent decision. On the contrary, emotionally attempting to time the market based on short-term forecasts is highly problematic. A more effective approach is to selectively increase risk allocation during major market selloffs when risk-reward dynamics become more favorable. This strategy works because markets have a long-term upward trajectory.

We advocate for a disciplined approach that prioritizes diversification, high-quality investments, and a long-term outlook. Ensuring that portfolios are positioned with a strategic framework designed to weather volatility remains the most effective way to achieve financial success.

Final Thoughts

Political events will always introduce uncertainty, but disciplined, long-term investing remains the best strategy. While no company is completely immune to geopolitical risk, our portfolio is structured to withstand volatility. We remain nimble yet focused, ensuring that we capitalize on opportunities while maintaining the integrity of our core investment principles.

As always, if you have any questions or would like to discuss your portfolio in detail, the Correia & Reynolds team is here for you.

References

This commentary is based on information that is believed to be accurate at the time of writing, and is subject to change. All opinions and estimates contained in this report constitute RBC Dominion Securities Inc.'s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Interest rates, market conditions and other investment factors are subject to change. Past performance may not be repeated. The information provided is intended only to illustrate certain historical returns and is not intended to reflect future values or returns. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license. © 2025 RBC Dominion Securities Inc. All rights reserved.