Key points

- In the wake of central banks winding up their bond buying programmes, (quantitative easing), bond yields for the first time in more than a decade have moved back to levels that make fixed income a fully useable and desirable adjunct to equities in a balanced portfolio.

- But much higher bond yields are also adding to costs for businesses, pressuring profit margins, while reducing the spendable income of consumers. Added to already restrictive credit conditions, these raise the probability of recession in the coming year, in our view. But the hard/soft landing debate won’t be over for a while—we believe both remain plausible outcomes.

- The prospect the Fed and other central banks have finished with rate hiking has raised investor hopes that rate cutting may be on the agenda sooner than expected. This has fueled a stock market rally that could set new highs for some of the large-cap indexes before it’s done.

Up and down …

… pretty much describes the last two years in major global equity markets. After what can only be described as dramatic advances off the pandemic lows of spring 2020 (see table), most indexes peaked some 21 months thereafter and have been doing not much more than digesting those hefty gains ever since.

A very large move higher for stock markets … followed by a rest

Index performance in local currency

| Index | March 2020 to December 2021 | December 2021 to November 2023 |

|---|---|---|

| S&P 500 (U.S.) | 120% | -6% |

| S&P/TSX Composite (Canada) | 99% | -9% |

| MSCI Europe | 82% | -9% |

| FTSE All-Share (UK) | 49% | 2% |

Source - FactSet; data through 11/20/23

The overwhelming predominance of equity index gains in 2023 has come from the so-called “Magnificent 7” tech and tech-related stocks in the S&P 500 (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla). Indexes which contain none of those stocks (Canada’s TSX, the MSCI Europe, and the UK’s FTSE All-Share) are trading at much lower valuations and have underperformed the S&P 500.

Where the action is

As much as stock indexes have stagnated and gone nowhere over the past couple of years, bond yields have surged higher to levels not seen since prior to the global financial crisis. For the first time in more than 15 years, an investor faced with a maturing bond security in a portfolio does not have to hold their nose and reinvest the proceeds at a much lower and unappealing rate, or hold it even tighter and perhaps shift to high-risk debt or high-yielding stocks to fill the gap in current income.

Today, a combination of government and investment-grade corporate bonds is yielding north of five percent. We believe that makes bonds once again a valuable adjunct to equities in a balanced portfolio, providing, as they have traditionally done, a combination of reduced volatility, more predictable returns, and the comfort of a maturity value.

This new, higher level for fixed income yields has arrived because central banks, led by the U.S. Federal Reserve, have abandoned the massive bond purchase programmes (aka quantitative easing) that were in operation throughout much of the past 15 years. These were designed to push bond yields much lower than market forces would have taken them as a support for the developed economies in the wake of the global financial crisis, the European sovereign debt crisis, and the pandemic.

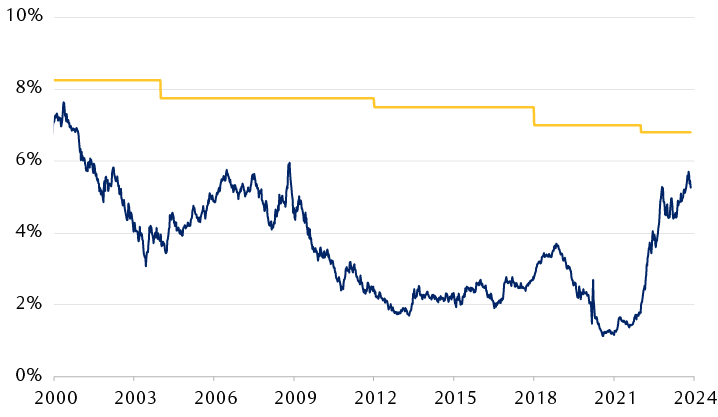

Expected returns from a bond portfolio balanced 50/50 between U.S. Treasury bonds and investment-grade corporates

The line chart shows what a balanced bond portfolio made up of 50% U.S. Treasuries and 50% investment grade corporates would earn on a starting annual yield basis if the funds were invested in those proportions, from 2000 through November 17, 2023. The line starts at around 7% in 2000 then sags progressively in three waves to a low of just 1% in 2021, before rebounding sharply to about 5.3% today. A second line plots the required annual return of the California Public Employees Retirement System (CalPERS), the largest pension fund in the U.S. That required pension return was slightly above 8% in 2000 and has drifted very slowly down to about 6.7% today. The bond portfolio’s expected return line is now closer to the required pension return line than at any time in 22 years.

Source - Bloomberg, California Public Employees Retirement System (CalPERS); data through 11/17/23

What does this new higher bond yield environment mean for equities?

First, it reduces the need to buy equities for income in order to make a long-term financial plan work.

At one point in the post-pandemic period, more than 60 percent of the stocks in the S&P 500 sported dividend yields in excess of the 10-year U.S. Treasury bond yield. Rather than make a multiyear commitment to a bond paying an artificially low rate, an investor was able to acquire the shares of a seasoned, probably well-known company with a higher-yielding dividend and offering the prospect that the dividend might be raised periodically.

As a consequence, fueled by the need to boost portfolio income, equity exposure in individual investors’ portfolios crept higher over that stretch when bond yields were deeply supressed by extreme central bank policies. The same trend toward higher equity exposure could be seen in some balanced funds and pension funds.

Today, no such obvious income pick-up advantage is widely available, in our view. Companies possessing dividend yields competitive with or better than bond yields often have other issues attending them.

If individual investors and pension funds find themselves able to achieve their long-term targeted returns and take less risk in the process, many may choose to do so. Lowering equity exposure by a few percentage points and redeploying the funds into fixed income is likely to be a feature of the coming months and quarters.

Second, the need for companies to refinance old loans and take on new ones in this higher-rate world means corporate interest costs are likely to rise, squeezing profit margins if those costs can’t be fully passed on to customers.

Only the largest, most seasoned businesses were able to use the pandemic interlude of ultralow interest rates to issue long-term bonds. Many others had to accept shorter maturities. Some 20 percent of high-yield bonds (i.e., bonds of low-quality issuers) will mature in the next 18 to 36 months and will have to be refinanced at higher rates, which for some will likely be difficult. Even more companies are already being squeezed by the fast-rising cost of floating-rate debt. This latter category includes many small-cap companies, which we think goes some way to explaining their persistent underperformance in the stock market over the past year.

And finally, sharply rising borrowing costs reduce the spendable income of customers—both individuals and businesses. U.S. consumers are contending with higher rates for mortgages, auto loans, and credit cards. At the same time, 44 million Americans are back making monthly payments on student loans.

Debate still on

Meanwhile, the hard versus soft landing debate about the likely course of the U.S. economy carries on. It won’t be settled definitively until the Business Cycle Dating Committee at the National Bureau of Economic Research decides on the official start date of any recession that arrives. That announcement usually comes about a year after the recession has begun—making the proclamation itself not very useful for investors.

For our part, we are persuaded that the combination of high rates and restrictive bank lending standards in place today is a recipe for recession, just as it has been in the past. Soft landings, on the other hand, have historically featured rising interest rates but no overt tightening of lending standards.

And the presence of similar conditions, i.e., high rates and restrictive lending, is already taking a toll in Canada, the UK, and the eurozone. GDP growth in all three has been no more than a shadow of U.S. growth over the first nine months of 2023.

Of course, our expectations for a U.S. recession could be misplaced. The pandemic abruptly ended what had been the longest uninterrupted economic expansion in U.S. history. And policy reactions to that public health crisis kick-started a new economic advance just as quickly. Big, decisive shifts in both fiscal and monetary policy over the past few years continue to have lingering effects on the course of the economy, which could persist in 2024. Instead of an outright multi-quarter decline in GDP, the headwinds alluded to above may do no more than keep growth on the slow side in 2024.

That could be enough to keep S&P 500 earnings growing, although probably not by as much as the current consensus estimate for 2024 ($245 per share, up 11.4 percent from 2023’s expected $220) would suggest. In our opinion, any growth in earnings would leave room for share prices to advance between now and the end of 2024, even if the path for getting there remains in debate.

Stock markets have been rallying recently, after inflation data improved further and the Fed paused its rate hikes, and presumably on the strength of Q3 GDP and earnings growth that was ahead of consensus expectations. It looks to us like the rally could have legs into the new year.

For now, we recommend remaining sufficiently committed to stocks to take advantage of the distinct possibility of some large-cap indexes led by the S&P 500 reaching new all-time highs in the coming few months. However, we believe investors should consider limiting individual stock selections to companies they would be content to own through a recession, which, in our view, is the most probable economic outcome in the coming quarters. For us, that means high-quality businesses with resilient balance sheets, sustainable dividends, and business models that are not intensely sensitive to the economic cycle.

Perhaps the most compelling reason for focusing on resilient, high-quality businesses is that the economic headwinds which have been gathering will, in our view, run their course and probably fully dissipate later in 2024. Equity markets typically have anticipated the start of a new economic expansion several months before it gets underway. In our opinion, portfolios that have held their value to a better-than-average degree will be best-equipped to take advantage of the opportunities that are bound to present themselves when a stronger pace of economic growth reasserts itself.

At some point if a more defensive structuring for a balanced portfolio is called for, having bonds back as a reasonable alternative for an investor looking to take some risk out is a welcome development.

View the full Global Insight 2024 Outlook here