A Word from Mike

Hello,

Financial markets continue to navigate competing forces from corporate earnings, investor sentiment and economic data. Below, I share my perspective on recent volatility in technology stocks, the Canadian labour market, and evolving political dynamics in Japan.

Tech Stress

Artificial intelligence (AI), a key driver of equity market trends, has recently been a source of volatility. Across the technology sector, concerns about AI-related disruption alongside rising expectations for tangible returns on AI spending have led to sharp share price swings in both U.S. and Canadian markets.

Within Big Tech, a small group of dominant firms has accounted for a disproportionate share of market gains in recent years. Capital spending on AI infrastructure among these companies has continued at an exceptional pace. As investment ramps up, however, investors are becoming more discerning, placing greater emphasis on how and when these investments will translate into profits. Despite near-term uncertainty, these firms generally remain financially strong, supported by cash-rich balance sheets, reliable cash flow generation and durable business models.

In software, the rapid rollout of more capable AI tools has heightened scrutiny around competitive disruption, leading to downward pressure on share prices—even for firms where earnings results were positive during the latest reporting season. Uncertainty about how AI could impact profit margins, barriers to entry, and intensify competition have weighed heavily on sentiment. While valuations now reflect some of this disruption risk, and recent tech selling pressure appears more sentiment-driven than fundamentals-based, it will likely take some time for software companies to restore investor confidence in the long-term resilience of their businesses.

I remain constructive on the AI theme over the long term but recognize that transformative technologies often bring periods of volatility and elevated uncertainty.

Canadian Labour Market

The Canadian economy lost 25,000 jobs in January, marking the first decline in five months following a strong run of employment gains last fall. Weakness was concentrated in Ontario manufacturing, an area particularly exposed to U.S. trade policy. Despite the job losses, the unemployment rate unexpectedly fell to 6.5% from 6.8%, largely because fewer people were actively seeking employment. Importantly, worker discouragement remained minimal, suggesting that fewer job seekers reflected demographic factors rather than worsening economic conditions. Furthermore, job losses in January were driven by part-time roles, while full-time positions and total hours worked both rose, indicating steady demand for labour.

Although job losses alongside falling unemployment may seem puzzling, this dynamic may become more common in 2026. Canada’s population growth has slowed sharply as the government has reduced immigration targets―January saw a record-low increase of just 5,000 people. Combined with ongoing retirements, fewer workers are entering the labour force, meaning fewer job gains are needed to keep the unemployment rate stable. The result may be a labour market that looks soft in headline numbers but remains fundamentally sound.

Japan’s election catalyst

Japan’s stock market rallied this week following Prime Minister Sanae Takaichi’s decisive victory in last weekend’s snap elections. The Liberal Democratic Party (LDP) secured a “supermajority” by capturing 316 of the 465 seats in the lower house of parliament. This electoral outcome is expected to deliver greater political stability and policy clarity, providing an additional tailwind for Japanese equities alongside solid corporate earnings growth and continued progress on shareholder-friendly reforms. Moreover, the result also carries positive implications for global market sentiment, given Japan’s position as the world’s second-largest developed equity market and fifth-largest economy.

Takeaway

Recent market volatility across tech-related sectors underscores investor uncertainty surrounding AI monetization and the potential for disruption to established business models. While near-term sentiment may remain fragile, I believe a disciplined investment approach―with an emphasis on quality and diversification―remains well suited to navigating this environment.

Highlights

Can Europe meet the moment?

The euro area defied expectations in 2025, delivering growth amid a challenging environment. Yet beneath this resilience, Europe has started to redraw its economic and strategic maps—reducing reliance on the U.S. while capitalizing on fresh fiscal momentum from Berlin and a focus on defense.

Regional developments: Canada’s unemployment rate unexpectedly falls; Energy leads the S&P 500 into 2026; European equities rotate into value while UK political risk abates (for now); Takaichi and LDP win big in Japan’s snap election.

Please take some time to review the Global Insight Weekly.

Global Insight Monthly

February 2026

I am pleased to share the latest investment strategy report from RBC Wealth Management—Global Insight, which provides our current thoughts on asset classes, the economy, and timely issues that impact investment strategy.

Full report: Global Insight

This month’s highlights:

Big Tech’s AI expansion: From investment to scalable returns

The AI investment cycle still has more runway ahead, but the prospect of a narrative shift toward monetization, return on investment, and enterprise applications strengthens the case for diversifying both within and beyond Big Tech to capture a broader set of opportunities.

Global equity: Earnings and the economy will tell the tale

While we expect the major equity indexes will post further new highs in 2026, it’s not all a bed of roses. We examine the competing catalysts facing stock markets, and why an invested but watchful approach remains relevant.

Global fixed income: The year of the ‘bond vigilante’?

The recent spike in Japanese bond yields has led to questions about the potential for large-scale sales of government bonds, with negative consequences for global markets. We do not believe the current episode portends a broader crisis, though investors should remain alert to potential impacts on both the Japanese market and the global economy.

Ottawa unveiled a new auto strategy

Tax incentives to help auto manufacturers invest and expand in Canada is a central piece of the federal strategy to stem job losses and attract investment in a sector hit by U.S. tariffs and policy uncertainty. The EV sales mandate was replaced with new emissions standards to boost the consumer market and strengthen the manufacturing base. Additionally, a new EV rebate program offers purchase or lease incentives of up to $5,000 for battery electric and fuel EVs, and up to $2,500 for plug-in hybrid models.

U.S. House voted to block tariffs on Canada

Six House Republicans joined Democrats in a 219-211 vote to repeal President Donald Trump’s tariffs on the U.S.’s northern trading partner. However, the House did not secure two-thirds of the votes necessary to override a veto from the President. The Senate had already passed a similar measure to cancel Trump’s tariffs on Canada. Democrats also unlocked a procedural move to force more votes, including on tariffs on Mexico and “liberation day” tariffs in the coming weeks. Markets are also waiting on a Supreme Court ruling on U.S. tariffs.

The U.S. labour market enjoyed a stellar January

The surprise 130,000-job gain was the strongest growth in more than a year, while the unemployment rate fell to 4.3%, suggesting that the market is shaking off its recent stagnation. Growth was led by the healthcare and social assistance sector, but also construction and manufacturing. However, transportation and warehousing, information, financial services and government sectors cut jobs. The data solidifies RBC Economics’ view that the U.S. Federal Reserve will go on a long pause in 2026.

U.S. businesses and consumers paid 90% of U.S. tariff costs

New research by the New York Fed concluded that Americans absorbed the bulk of the economic burden of the tariffs imposed in 2025, although exporters are starting to shoulder an increasing amount in the past few months. While inflation has been falling, some Fed officials believe the impact of Trump’s trade policies on U.S. shoppers will be greater in 2026 as inventories fall and companies raise their prices. U.S. tariff revenues have surged 192% to US$287 billion over the past year.

U.S. to launch a $12-billion stockpile of critical minerals

To counter China’s dominance in rare earths, the Trump administration is working on an initiative to procure and store minerals for American manufacturers, including automakers and tech companies. A dozen companies, including General Motors, Stellantis and Google, are said to have signed on to Project Vault, which includes US$1.67 billion in private capital and a US$10 billion loan from the U.S. Export-Import Bank. Currently, China controls about 90% of the processing capability for rare-earth minerals.

Charts of the Day

Supply surge keeps Canadian house prices on a downtrend

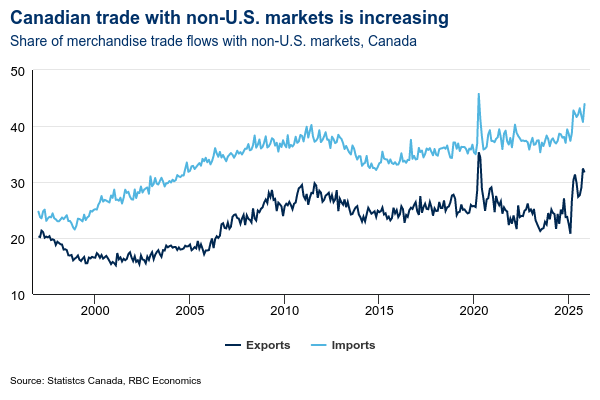

Gold and auto drag: Read RBC Economics latest report on Canadian trade flow

Interesting tidbits

- 3.9 million. The number of paper cheques sent by the Canadian government over the past four years that have gone uncashed. The value: $2.1 billion.

- 52%. The percentage of Canadians who turned to AI search results for health information, according to a Canadian Medical Association survey. However, only 27% said they trust AI tools to provide accurate information about their health.

Today's Funny

"We're seeing a lot of patients with these symptoms. Have you been normalizing copious amounts of insanity?"

REMINDER: Most of my new clients come to me via word of mouth as I don’t advertise or engage in marketing programs. Please keep my team in mind if you hear of anyone with over $1 million in investable assets who is in need of wealth management services.

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that any action is taken based upon the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein.