La valeur ajoutée du conseil

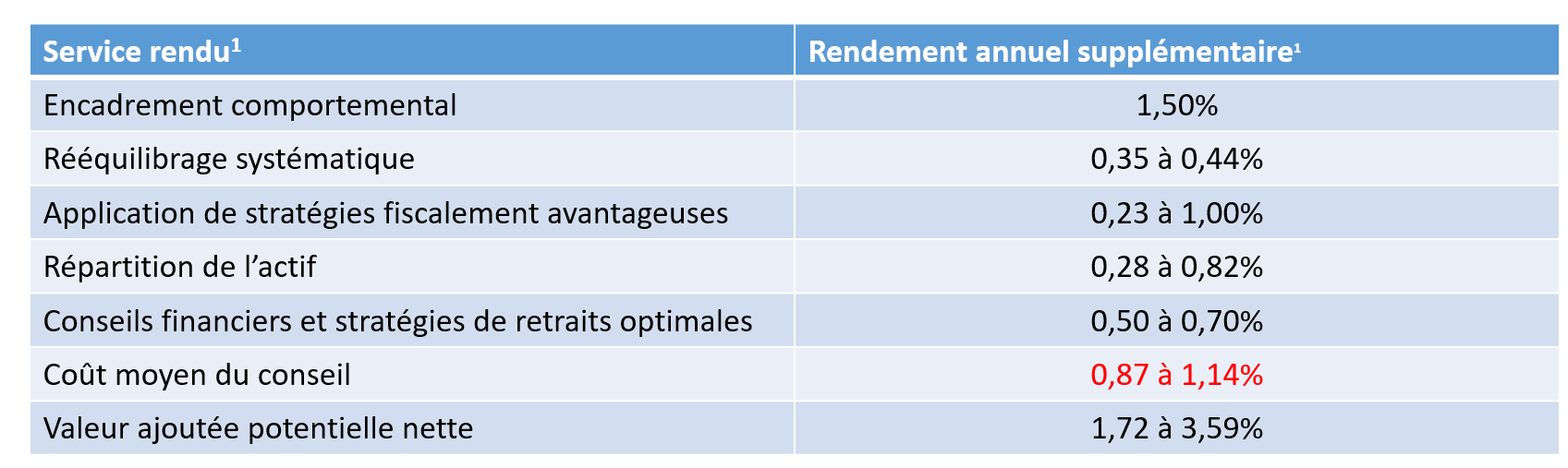

Bien se faire conseiller, avoir les bons outils et avoir accès à des bons gestionnaires font toute la différence à long terme. Travailler avec un conseiller en placement augmente le patrimoine2 de 1,7 fois après 4 à 6 ans, de 2,9 fois après 7 à 14 ans et de 3,9 fois après 15 ans ou plus.

Sources:

1-« Evaluating Financial Planning Strategies And Quantifying Their Economic Impact », The Kitces Report, Volume 3, 2015 référence : « Alpha, Beta, and Now…Gamma », Morningstar, 2013; « Putting a value on your value: Quantifying Vanguard Advisor’s Alpha », Vanguard, 2014;

2-Renseignements aux représentants, IFIC, mai 2017, références : « The Gamma Factor and the Value of Advice », Claude Montmarquette et Nathalie Viennot-Briot, 2016.