Open A First Home Savings Account (FHSA) at RBC

Work towards your goal of buying your first home with a First Home Savings Account (FHSA).

As the cost of owning a home continues to rise (especially here in Vancouver), many are finding it difficult to save the funds needed for a down-payment. The FHSA is a new registered plan that was launched in 2023, and it can help you save for your first home tax-free. If you’re at least 18 (and no less than the age of majority in your province), have a Social Insurance Number (SIN) and have not owned a home where you lived this year or at any time in the preceding four calendar years, you may be eligible to open an FHSA.

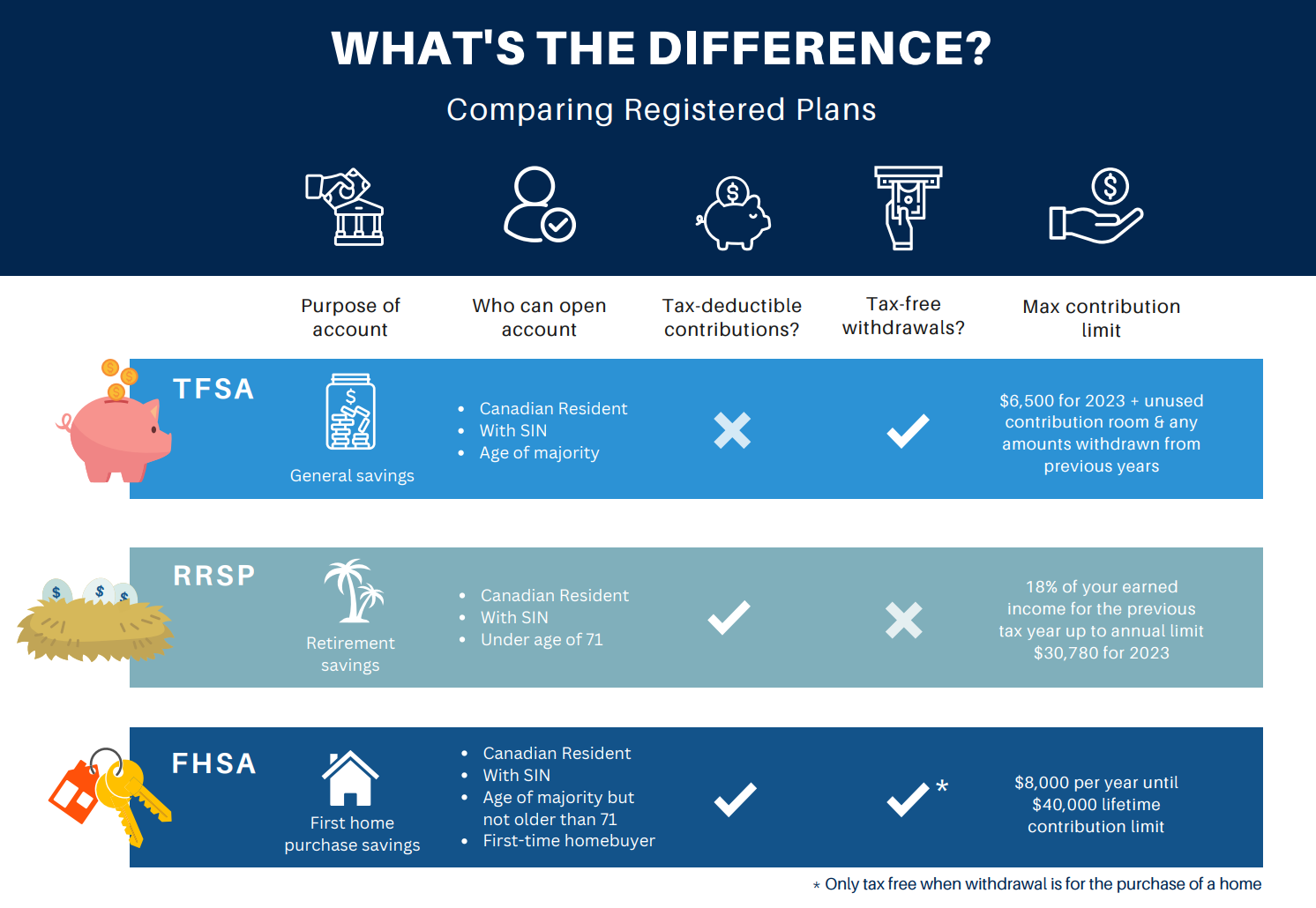

The first home savings account can help individuals save up to $40,000 on a tax-free basis to purchase their first home. The FHSA is a mix between a registered retirement savings plan (RRSP) and a tax-free savings account (TFSA). Like an RRSP, contributions you make to a FHSA are tax-deductible; like a TFSA, withdrawals you make to purchase a first home (including the investment income earned) will not be taxable.

Click here to download our FHSA brochure, or have a look at the infographic below to see how the FHSA compares with other registered accounts.