Buying a rental home with good cash flow, and financing it over a 25-year time period, should have your investment paid off somewhere near a 25-year time frame. Do not overlook maintenance costs, vacancies, legal liability, rent collection and a wide variety of owner responsibilities that come with being a landlord.

Now let’s compare that to an investment into a high quality stock with a 4% dividend yield, with the power of compound returns.

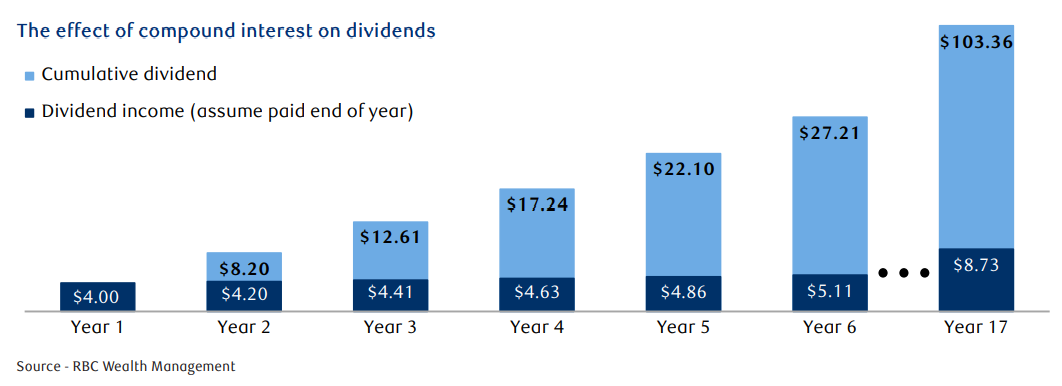

Compound interest is one of the most powerful concepts in finance and one that is highly desired in dividend-oriented wealth strategies. For instance, in the chart below, stock ABC trades at $100 per share and yields 4%. A shareholder can expect to receive $4 in dividends at the end of year one. It might not seem like much at first glance, but let’s assume stock ABC is capable of growing its dividend by 5% each year (for a $4.20 dividend yield in year 2). Fast forward to the end of year six, stock ABC is expected to produce an annualized dividend of $5.11 resulting in a 28% increase compared to the original $4 dividend. On a cumulative basis, an investor would have collected about $27 in dividends (recovering 27% of the initial cost base via distributions).

A shareholder could theoretically regain the entire cost for this stock after a 17-year holding period and continue to own the underlying stock. In the above example, I also assumed the share price of $100 remained unchanged. In reality, companies that can consistently grow their dividends are also likely to experience positive share price appreciation as well. In addition, Canadian dividends received in non-registered accounts come with the added benefit of lower taxes.

Now that the benefits of dividends and compound returns can be visualized, how do we go about constructing a dividend-based portfolio? It requires a combination of fundamental and macroeconomic analysis. Fundamental analysis includes the evaluation of a company’s financial statement strengths, the ability to support and grow existing dividends, and other company specific metrics. Macroeconomic analysis is an assessment of the overall strength of the economy, interest rate expectations, prices affecting the cost of living, and other global drivers. Using these two forms of analysis, we can make more informed decisions on a company’s future prospects and whether or not the portfolio should be positioned more defensively or offensively.

Dividend income and rental income both come with pros and cons… but it is difficult to overlook the ability to recoup your investment in 17 years by investing (with just your dividend income) in a high quality dividend paying company.

Thank you to Matt Altro, Dominick Hardy and Richard Tan, from RBC’s Portfolio Advisory Group, for sharing research and content with me for my blog.