Rogers claims to have “Canada’s Largest & Most Reliable 5G Network”, Bell claims to have “Canada’s Fastest 5G Network”, and Telus highlights a recent award claiming it has “the fastest network in the world” (note it does not specifically say “fastest 5G network in the world”). Marketing aside, I will do my best to determine who is actually leading the 5G race.

Backhaul Infrastructure

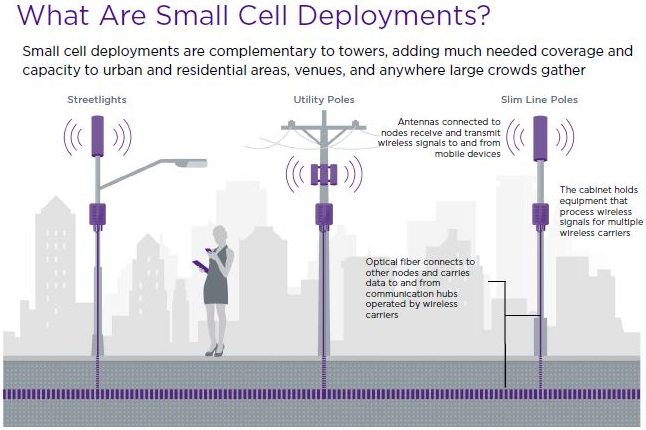

When you think about 5G, the word “wireline” isn’t usually the first thought that comes to mind. However, it is absolutely crucial in the build out of 5G. Why? Well, Canadian telecom operators expect to deploy both mobile 5G and fixed wireless 5G architecture. Thus, the deployment of small cells to meet the demand for high-capacity, ultrareliable and low latency connections over higher-frequency spectrum puts the focus on backhaul capabilities. Although there are multiple backhaul options, fibre represents the optimal long-term backhaul solution.

Exhibit 1: The role of fibre infrastructure in small cell deployment

Source: Crown Castle

BCE and TELUS operate under a national 4G LTE network sharing agreement and expect to use a similar agreement to deploy a national mobile 5G network. Both incumbents have aggressively built out their fibre-to-the-home (FTTH) networks to support their wireline business, but this infrastructure will also be used for mobile and fixed wireless 5G. Telus recently announced that it will be pulling forward $1.5 billion in capital expenditure in 2021/2022, with the majority of that spend going towards its FTTH expansion (substantial completion of the FTTH build by end of 2022) and copper-to-FTTH customer migration.

Rogers has indicated a preference to deploy its own national mobile 5G network without entering into network sharing arrangements with other regional operators. It appears that Rogers is largely on par with BCE and Telus with respect to the degree of 5G readiness within its cable footprint. However, it is less clear Rogers’ degree of 5G readiness outside of its cable footprint (i.e. Western Canada) where they would appear to have less wireline/fibre infrastructure to support extensive 5G backhaul requirements.

Cue Roger’s offer to purchase Shaw. If completed, the merger would instantly provide Rogers with the additional fibre/fixed telecom infrastructure in Western Canada required to develop a wholly-owned, national 5G network. If the deal is not completed, Rogers would have to build, partner or lease fixed infrastructure outside of its Central/Eastern Canada cable footprint. These could be lengthier and possibly more expensive options for Rogers.

Bottom Line: BCE and Telus appear to have the backhaul infrastructure edge at the moment, but if Rogers completes the merger with Shaw, all three incumbents should be on a level playing field sooner rather than later.

Spectrum

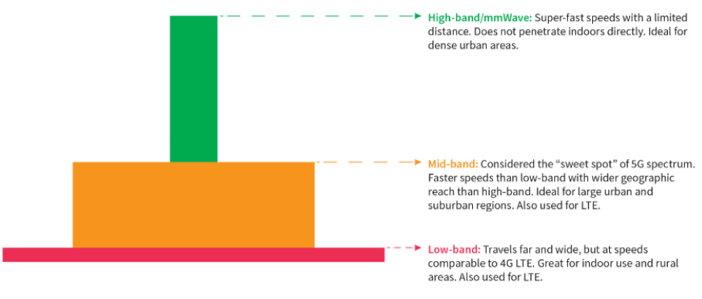

Without getting overly technical, the spectrum frequency bands for 5G networks are categorized into three groups, (i) low band <1GHz, (ii) mid band 1GHz-6GHz and (iii) high band >6GHz (aka mmWave).

Low band provides broad coverage across long distances with a single tower, which will allow operators to provide 5G access to those in rural areas, albeit at slower speeds than mid and high band spectrums. Mid band is generally viewed as the ideal spectrum range for 5G as it strikes a good balance between speed and range. High band provides the fastest speeds, but its range is quite limited.

Exhibit 2: The basic layering of approach to 5G spectrum deployment

Source: GSMA

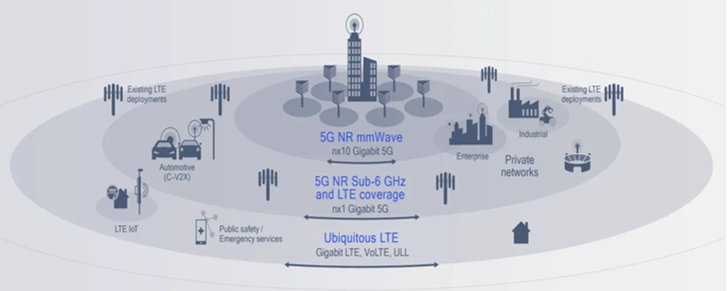

Exhibit 3: Greater deployment diversity with 5G

Source: www.5g-networks.net

The much awaited 3500 MHz Canadian spectrum auction is scheduled for this June, with Innovation, Science and Economic Development Canada (ISED) releasing the list of participants on April 7th. There are 24 applicants. However, a notable exclusion from the list is Shaw. A focus for investors going into the ISED applicant list release was whether or not Shaw would participate in the auction given its current affiliation with Rogers.

No single national wireless operator appears to have a significant spectrum advantage with incumbents generally on equal footing in terms of spectrum holdings in the mid-band range at 1700 MHz/2100 MHz and 2500 MHz. However, Rogers and BCE going into the auction will each have grandfathered 3500 MHz spectrum through their joint ownership of Inukshuk, which owns 50-175 MHz of 3500 MHz in most major population centres across Canada prior to the potential return of any spectrum in advance of the auction.

Given Rogers and BCE’s grandfathered spectrum ownership, it may appear that Telus is at a disadvantage and may have to spend the most on spectrum this time around. While that could very well be true, Rogers and BCE’s current ownership of some 3500 MHz spectrum may reduce the competitive intensity of the upcoming auction.

Bottom Line: While Rogers and BCE appear to have the 3500 Mhz spectrum edge going into the June auction, the 3500 MHz auction framework should allow Telus to obtain sufficient spectrum.

Conclusion

Overall, the 5G story is in its very early stages and positioning between the three incumbents is essentially a wash. Although Rogers has the early lead on 5G coverage across Canada, given BCE and Telus’ network sharing agreement and significant fibre backhaul, we expect them to be the pace cars in deploying mid-band and mmWave spectrum and densifying urban markets with small cells to support future 5G use cases. However, if Rogers completes the acquisition of Shaw, the three incumbents would be on a more even playing field.

In our view, rather than focusing on who is leading the race, we would rather look at 5G as a longer-term opportunity that could benefit all incumbents. More importantly, the development of 5G should provide the infrastructure for monumental technological advancements in the years to come.

Thank you to Sunny Singh, CFA, from RBC's Portfolio Advisory Group for sharing research and content with me for my blog.