The first quarter of the 21st century: 2000 to 2024

Key themes:

- China’s growth in the first quarter of this century was significant. China was admitted to the World Trade Organization in 2001. It has since enjoyed a rocket-fueled ride, taking over a large swath of global manufacturing and massively increasing its own standard of living along the way.

- The technology sector dominated, with the internet blossoming and smartphones revolutionizing our daily lives.

- The global population has grown every year since the year 2000, but at a declining rate. Between 2000 and 2005 the global population growth rate was at around 6.7% per year. Since then, it has slowed to around 4.5% per year between 2020 and 2025. A range of countries are now experiencing outright shrinking populations.

- The European Central Bank was just a year old in the year 2000 and the physical euro was not introduced until 2002. The European Union (EU) has expanded from 11 to 20 countries, issuing common debt, devising bailout mechanisms, centralizing banking supervision, and now coordinating energy and military decision-making.

- Households leveraged themselves significantly over the first part of the quarter century, at which point the public sector broadly took over, borrowing extensively through the latter part of the quarter century. The bottom line is that a significant amount of debt has accumulated for both individual households and governments alike.

- We saw a commodity supercycle (long-term trend of price increases across a broad range of commodities, lasting decades), largely because of China’s rapid growth and ravenous appetite for raw materials.

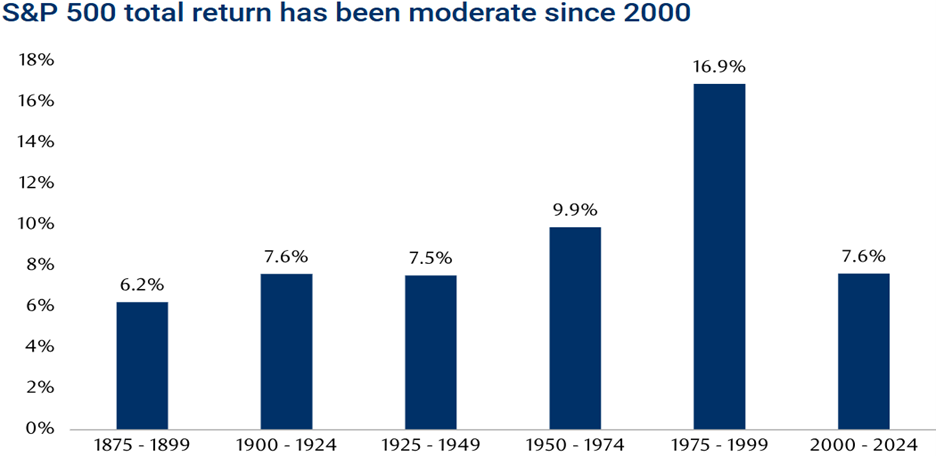

- The US stock market performance, over the quarter century, averaged 7.6% annualized growth per year. If that seems surprisingly low, recall that it was a tale of two time periods, with the “lost decade” of 2000 to 2009 seeing the S&P 500 lose ground, followed by pretty remarkable gains since then.

As of 08/18/2025. Total return estimated using price index levels from Bloomberg and Robert J. Shiller’s data and dividend yield data from Bloomberg and Multpl.com. Sources: Robert J. Shiller, Bloomberg, Multpl.com, RBC GAM

The next quarter century: 2025 to 2049

It is a matter of great speculation what the next quarter century may bring. I would like to flag a few potential themes, broken down into three categories below.

Continuation of existing themes:

- China may no longer be growing at 10% per year, but appears capable of generating remarkable economic growth with an increasing central role in the world.

- As China becomes wealthier, and other emerging market economies nip at its heels, the rise of the global middle class should continue, creating greater consumption and stronger demand for discretionary goods and services.

- Demographic challenges are set to intensify, with fertility rates falling and longevity continuing to rise. The global population could peak around 2066 – out of the timeframe of the next quarter century, but not radically so.

- The technology sector looks capable of remaining at the centre of economic growth and innovation, though artificial intelligence (AI) applications could broaden productivity gains to a larger portion of the economy.

Relatively new themes that may persist:

- The pivot from a single country being the global economic powerhouse to a world where multiple countries hold a more equal share of the power, is likely to continue, with China being a fierce and formidable competitor for the US.

- A recent move toward deglobalization (countries trying to be more independent) should persist, but at a less aggressive pace than the US tariff talk has created within the last six months. Cliques of countries will form, and nationalization will be preferred over multilateralism.

- Strong countries are less likely to heed international norms, and more likely to push smaller countries around. Conflict is likely to increase, and military spending is certain to rise. Geopolitical stability declines.

- AI has been a central theme for a few years, and shows every ability to remain a central theme – and likely to become the main economic theme for years and perhaps decades to come.

- Canada is facing a massive small business succession crisis: over 75% of small business owners plan to exit this decade, but only 9% have a plan, leaving $1.8 trillion in Canadian businesses up for grabs.

New themes:

- US exceptionalism is likely to diminish somewhat. While the US economy will probably still continue to grow faster than most of its developed-world peers, the growth advantage may not be as great as it has been in recent years. US immigration is down, and public policy decisions could undermine a fraction of the country’s long-term growth. Conversely, other countries have been startled awake by recent events, and are re-prioritizing economic growth. Given American political polarization, debt levels, and changing posture toward the rest of the world, the clout of the US dollar and the Treasury market may decline somewhat over time.

- We budget for faster global productivity growth in the decades ahead, given a confluence of exciting and potentially revolutionary technologies, including AI applications in natural language processing, robotics and sensing (combined to great effect in self-driving cars), health care innovations, and beyond. It remains to be seen whether the demand for human labour will decline at the economy-wide level, but if so, there would be far-reaching consequences.

- Oil demand is expected to peak around 2029-2034. Oil drilling will not grind to a halt, and it also doesn’t guarantee that oil prices will fall. It does mark a significant change, and one of substantial relevance to a number of industries.

- India and a number of Southeast Asian nations appear to be on the cusp of really making waves in the global economy, over the coming decades, given their large populations and rapid growth. Africa should also start to become more relevant, though its biggest impact may be saved for the second half of the century.

In financial markets, one might imagine the stock market generating more modest equity returns than over the past few decades as we question if the pace of profit margins growth can continue on the same trajectory. Rapid productivity growth should remain an important support.

Thank you to Eric Lascelles, RBC Global Asset Management Inc.’s Chief Economist, for sharing his research and content with me for my blog.

- Brad Weatherill