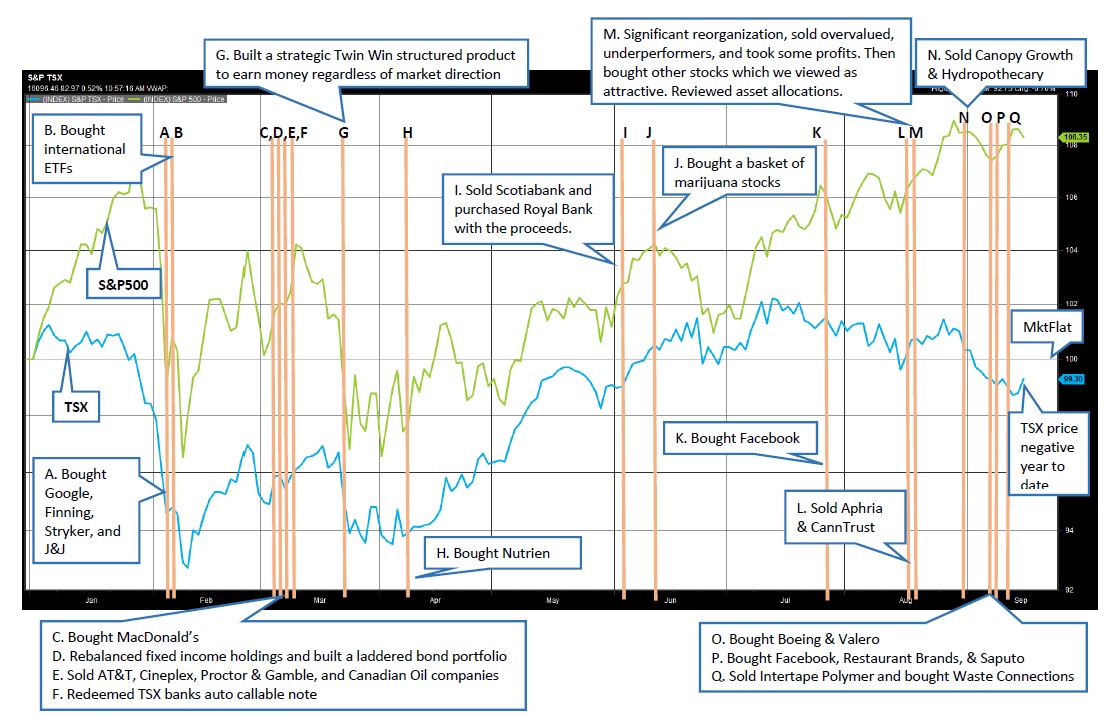

What a volatile year we’ve had within the equity markets, with significant drops in February and March, which took the US almost three quarters of the year to recover, and Canadian markets were bouncing back much earlier but having since been trending downward for a negative return. The US economy still remains strong as we expect favorable corporate earnings to push markets higher throughout the year and are hopeful for a fall seasonal rally in the markets. But markets could face headwinds with the trade negotiations between the US and China. And while we want these negotiations to wrap up as soon as possible, realistically they may continue on for months and result in a negative impact on the markets. Having said that, we are happy to report that we are currently positive in all asset mix mandates and are looking forward to a positive finish towards year end.

U.S. and Canada Trade Agreement in Place

After months of negotiations and after negative headwinds to the Canadian markets, the U.S. and Canada have finally come to a trade agreement. We believe this will help boost Canadian markets into what we hope will be a positive year-end rally. We have already seen positive jumps in Saputo and Magna but we also expect to see positive impacts for other companies that generate revenue from the U.S. such as Waste Connections.

Housekeeping - Multiple Statements and Currency Benefits

As you may have noticed, your registered accounts now come with two statements which separate out your CAD and USD investments. This is a significant benefit to you as this allows your US securities to settle in USD. Some firms have forced trades in registered accounts to settle in CAD, even when switching between US securities, which resulted in other firms taking a small spread on your US trades and having a negative impact on your overall performance. This problem has been resolved by RBC by providing a USD side to your registered accounts. Some U.S. securities that transferred to RBC settled on the Canadian side of your accounts and it has taken my team several months to correct the issue. Now that it’s fixed and your holdings are on the correct side of your accounts, you will be receiving both a CAD and USD statement every month. To help you clearly understand how you are doing, you will continue to receive a quarterly consolidated portfolio report. This additional report outlines performance, recent transactions and holdings in Canadian dollars only.

Maneuvering Through Market Volatility within the Portfolio

This has been a very busy year for us and the portfolio and we have remained attentive throughout the changes in the financial markets. We have worked hard to actively manage your accounts throughout the year while keeping in line with your investment policy statement and taking advantage of opportunities in the market. Please find on the next page a summary of trades we have completed throughout the year. We worked very hard to keep valuations in line with a close eye on corporate debt, share buy backs, and earnings growth. We have you well positioned to navigate the financial markets with a plan for the next two years and we are here to help with any financial concerns that you may have.

I’m always available to talk and I look forward to seeing you again soon.

You can download the MFMT newsletter here