What Is a Bond?

A bond is a fixed income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental). A bond could be thought of as an I.O.U. between the lender and borrower that includes the details of the loan and its payments. Bonds are used by companies, municipalities, states, and sovereign governments to finance projects and operations. Owners of bonds are debtholders, or creditors, of the issuer. Bond details include the end date when the principal of the loan is due to be paid to the bond owner and usually includes the terms for variable or fixed interest payments made by the borrower. I could prepare a 27 page newsletter on bonds and their intricacies but I will spare you. For all the headlines that revolve around the equity markets, the bond market is actually significantly larger. Call me anytime if you want to chat bonds.

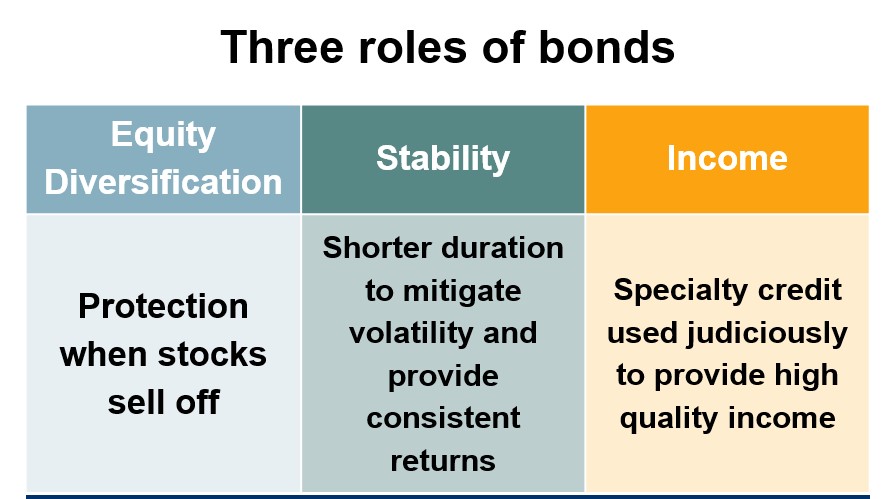

Why Do We Hold Bonds in a Portfolio?

What is the Current Problem with Bonds?

Out of the three roles identified above, the first two still hold. Income – or yield and return – is the lag now and will be for a while. Rates are so low that a high quality domestic bond portfolio is not helping out with the overall target return of the portfolio. If rates are low for a while, this problem isn’t going away. And if rates go up, current bold holdings become less attractive because of their low relative yields and can actually decline in value in short term. We are fine with the bonds that we own for you now but the challenge is what to do with bonds that are coming due this year and next (or matured recently).

So…what are the options if we want (or need) to maintain a certain rate of return to achieve all of your goals?

- Reduce fixed income exposure and increase equity. Problem – this increases risk metrics of the overall portfolio. This is not appealing to most people when the inevitable sell offs occur.

- Deal with it and accept a lower rate of return. This sounds OK in theory but investors still want to maintain their purchasing power and / or grow their nest egg. A lower rate of return over the next decade will impact your overall plan.

- Expand your horizon to areas of the bond market that still check off all three of the boxes identified above.

I Like Option 3

Bonds are in your portfolio for a reason. We still need to keep an eye on risk and want to maintain your income needs. A couple years ago, we could buy a bond or a GIC and get a yield above 3%. The reality is that we cannot do this today with the bonds we are comfortable buying. This is based on the risk characteristics of the bonds we look at. Investors need to expand their universe and the best and most efficient way to do this is with a bond fund. A mutual fund or an ETF (exchange traded fund) would be our preferred method. We have identified a handful of third party managers will actively manage a portfolio of global bonds, currencies, mortgages, etc. Our team would prefer do manage the individual bonds ourselves if we could but, let’s face it, we are not able to get the access we need to a global high yield or emerging market bond inventory. We will put our egos aside and engage a fixed income team to assist as the risk is too high given the limited number of names we could hold for you. And we have access to the biggest bond desk in Canada – RBC’s.

You may see us making use of these tools as bonds come due and the reinvestment options are not at all compelling. This is our team dealing with the current environment and being receptive to using the best tools at our disposal. If we have chatted recently, we may have brought this up. If we are due to chat soon, it will probably come up during that meeting.

I hope you are staying well. Brighter days are ahead.