Equity market volatility has picked up noticeably in recent weeks, with rather large swings higher and lower. To make matters more painful for portfolios, bond prices have moved lower, suggesting they have not offered the kind of diversification benefits investors have come to expect. Below, I offer some perspective on the recent market turbulence, address the issue of inflation expectations, and discuss how we are managing your portfolio in the face of these challenges.

Inflation - The primary driver of volatility

Global equity markets have had a poor year thus far. There is certainly no shortage of concerns: the war in Ukraine and the knock-on effects via commodities, and China’s various lockdowns that threaten its growth outlook and exacerbate the problems facing global supply chains. But, the primary culprit behind the weakness seen in markets is inflation, which has been elevated and rising.

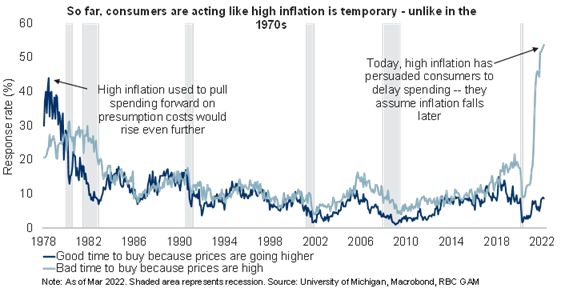

Inflation expectations have indeed been creeping higher. This explains the relatively aggressive actions undertaken by central banks who have been raising interest rates rather forcefully. The bigger risk is that inflation becomes embedded in the expectations of consumers and businesses and becomes self-fulfilling. The good news is that we are not seeing a change in consumer attitude towards inflation, in other words the consumer is acting as if believes this will be temporary.

The below chart looks at consumer behavior in the 1970’s in contrast to today. In the 1970s, high inflation was viewed as a reason to pull spending forward, on the presumption that the cost of products would continue to rise rapidly, rendering them even less affordable in the future.

In contrast, today, the dominant thinking by consumers is that it is now a bad time to buy things given that their cost has recently risen so substantially.

As mentioned, to combat the inflation backdrop central banks have engaged in fairly aggressive actions, rising interest rates. The good news is that monetary policy historically has been a very effective tool at curbing inflation. The challenge we are faced with however is that when Central Banks tighten (or rise interest rates) to his magnitude their actions have historically it pushed the economy into recession. With that said there could be some relief on the horizon. Recent inflation readings in the U.S. have hinted that growth in core prices, excluding food and energy, may be on the verge of starting to slow. In other words, inflation may remain elevated but close to peaking, marking an important change in trend as we move into the second half of the year.

Periods of market weakness are not uncommon. In fact, the U.S. equity market, which is the most widely followed, has averaged at least one sizeable decline (i.e. 10% or more) every year since 1975, with the average fall being nearly 20%. Yet, the U.S. equity market still managed to generate a positive annual return in 35 of the past 46 years. In other words, dealing with market volatility is part of the investing experience.

It is not just stocks experiencing volatility

Equity markets have been under pressure, but so too have bonds. In fact, bond markets have had one of their worst starts to a year. Given the sell-off in global bond prices, the yields offered by government and corporate bonds have risen meaningfully. While it’s easy to focus on the poor returns of late, there is a silver lining. As a result, there is now an opportunity to lock in future returns in fixed income that are significantly higher than levels seen over the past decade.

Taking a longer-term perspective, it is very rare to see both bonds and stocks both deliver negative returns in a given year. If we look at the performance of Canadian stocks and bonds going back to 1980, there has never been a three year period where both asset classes have been simultaneously negative.

Managing your portfolio in the face of today’s volatility

Periods of market turbulence, such as the current one we are experiencing, can understandably cause some angst. Yet, it’s a relatively normal phenomenon that occurs from one year to the next. The key risk remains whether inflation becomes entrenched in the expectations of businesses and consumers. We’ll be watching this closely, in addition to the odds of a U.S. recession which remain low for the time being, yet as mentioned above we believe the market is starting to price in that reality.

We have made a number of adjustments to portfolios throughout the year. First for clients that draw a regular income stream from their portfolios we raised cash in January to make provisions for these needs. This means we are not forced sellers of stocks at today’s depressed levels. Secondly we added to energy in Canada early in the year. Finally, we have taken advantage of the recent price declines in bonds, adding a new position that invests in discounted bonds and holds them to maturity.

We have always stated that we do not play the market timing game, other investors can do that at their own peril.

As no one can predict the future, it is important to have a reasonably diversified portfolio of good quality assets, and resist the urge to abandon your plan in time of stress or times of uncheck optimism for that matter. We believe that constructing a portfolio that is biased to high-quality businesses is the way to weather periods of market volatility. The reason this works well is that high-quality companies typically possess strong competitive position within their industry, they also deliver a high-degree of visibility on cash flows, earnings, and dividends, which is important to us as owners of these businesses. It is for these reasons that quality companies on the whole tend to hold up better in times of market stress.

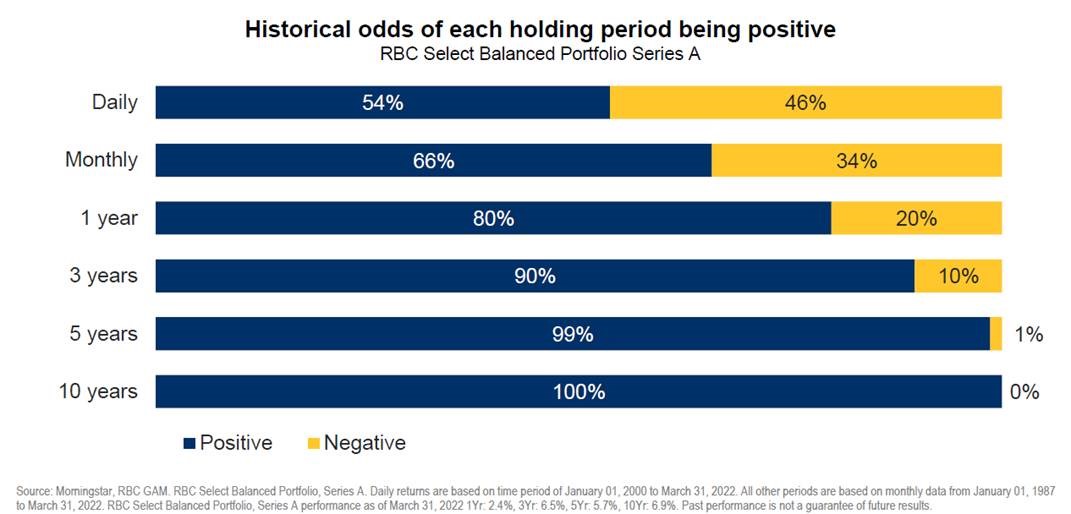

I want to close this email by sharing a chart that I shared with you back in early April of 2020. I have long said that the one advantage every investor holds equally is that of time.

The chart below from RBC Global Asset Management looks at the odds of a balanced portfolio generating a positive or negative return over various time frames. The key takeaway here is that as one’s investment horizon increases so does the likelihood of positive returns, and substantially so at that. The daily volatility that we are experiencing in markets today can be difficult at times, history gives us some comfort that we can get through this, as long as we are invested in a well-diversified portfolio and we stick to our long-term investment plans.