Geopolitical tensions between the Ukraine and Russia have been bubbling to the surface for some time, but they took a meaningful turn over the past few days with Russia embarking on an invasion of its neighbor that is broader in scope than expected. First and foremost, our thoughts and prayers are with any of our clients, family, and friends, who may be impacted one way or another by developments in the region. While we have a responsibility to focus on the investment implications of such a crisis, it’s important to recognize the human toll these conflicts can have.

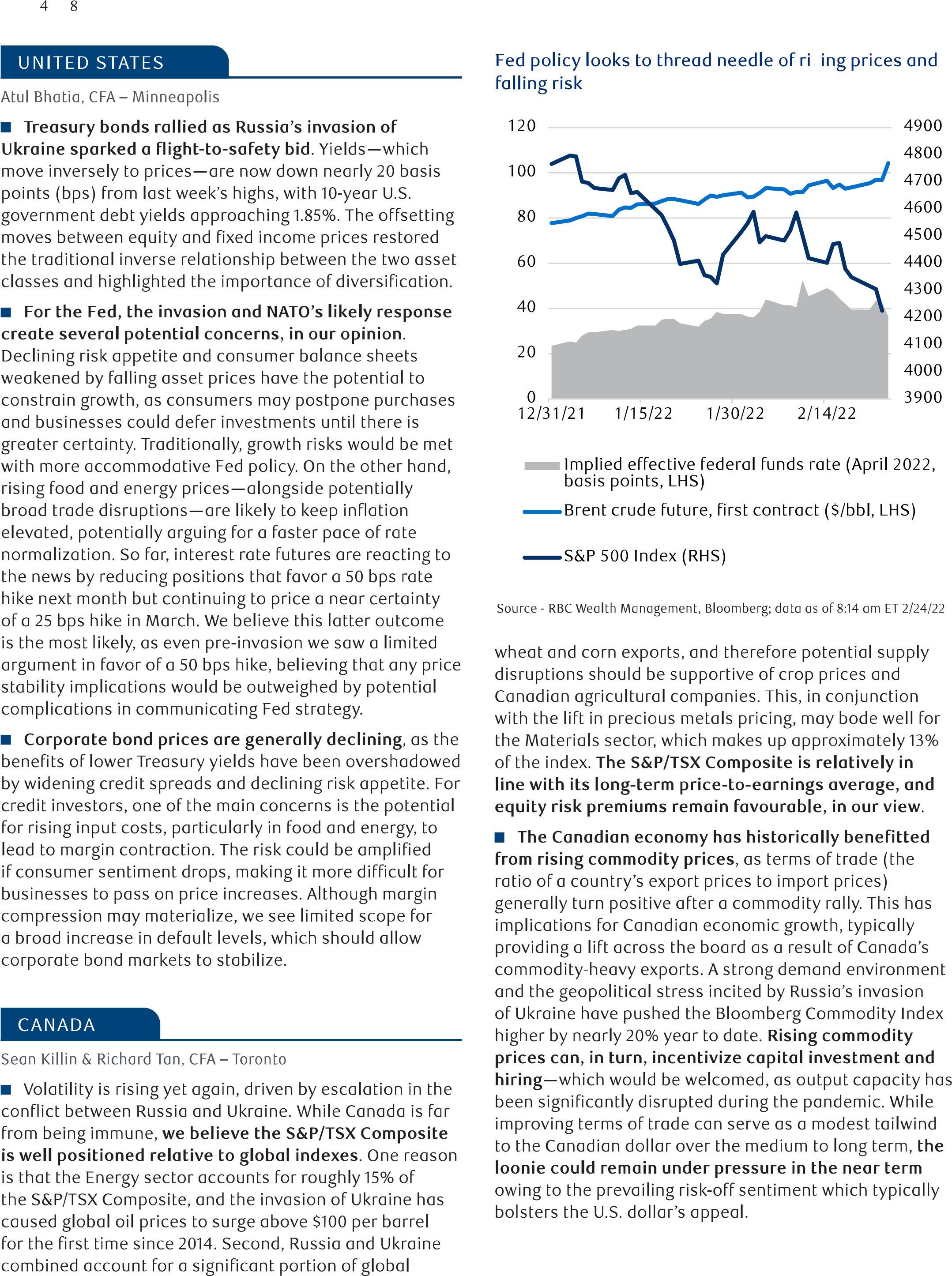

Global financial markets have responded in a somewhat expected and orderly fashion in recent days. Volatility has increased and global equities have sold off. Government bonds have modestly risen, while the U.S. dollar and commodities like gold have benefitted from a general flight to safety.

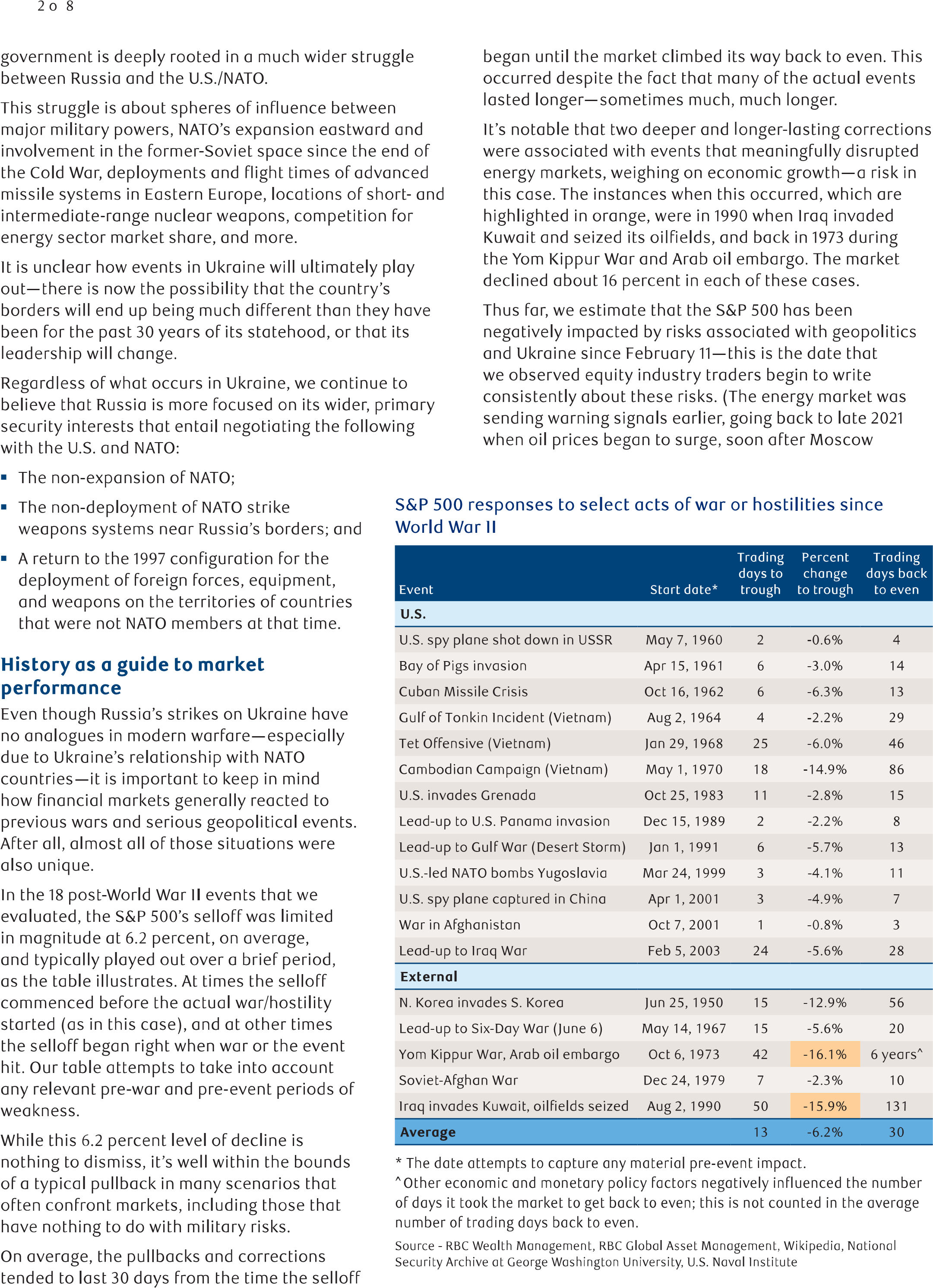

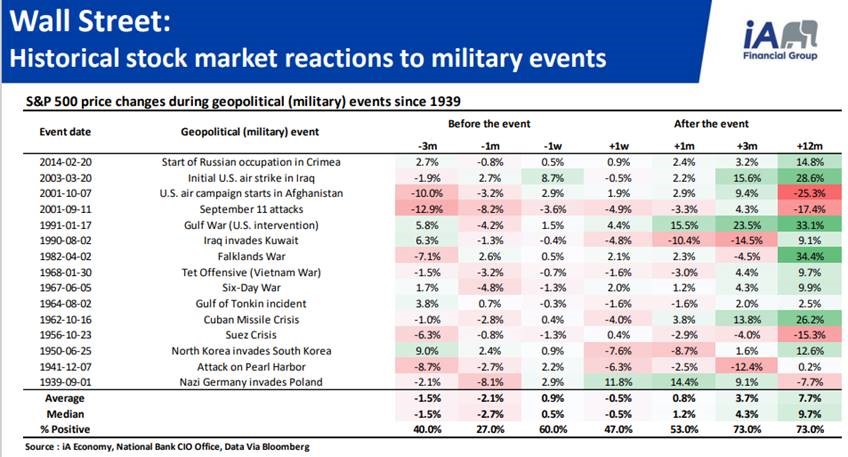

We are likely to remain in a period of elevated volatility and markets may remain vulnerable in the near-term as developments in Europe unfold. But, history has taught us that military conflicts tend to have a market impact that is limited in magnitude and time. Below is chart that illustrates the stock market reaction to previous military events. Typically the bulk of the selling pressure happens in the period leading up to the event itself, and immediately after. Taking a longer-term perspective, the markets have typically discounted these events rather quickly. Equity returns 3 month, and 12 months post have historically been higher on average. As a result, we are unlikely to shift around portfolio allocations in a meaningful way. However, we remain vigilant, flexible, and willing to take action should the need arise.

For anyone that wishes to dig deeper into the topic of the Russian/Ukraine conflict, and the implications for the markets, I have included a special report written by our head office.

Keeping a long-term perspective amid the correction

In our view 2022 has be a story of two key issues that have driven markets lower thus far. In January bond and equity markets moved lower on the expectation that policy shifts by central banks, in the form of higher interest rates, were coming sooner and in greater magnitude than was expected. The market began to stabilize in early February as the prospect of interest rate hikes became reflected in stock and bond prices. Strong 4Q corporate earnings in the U.S. refocused investor attention back to fundamentals. That was short-lived however as the market had to deal with the issue of the escalating tensions between Russia and the Ukraine.

Global equity benchmarks are now find themselves in correction territory with year-to-date declines of 10-14% across various geographic regions. The one relative bright spot has been the Canadian equity market which is down less than 1%. Canada has been arguably more resilient than others due to its sizeable exposure to commodities, and in particular energy, precious metals, industrial metals, and agriculture. These areas were already benefitting to some extent from tight global supply and an inflationary backdrop.

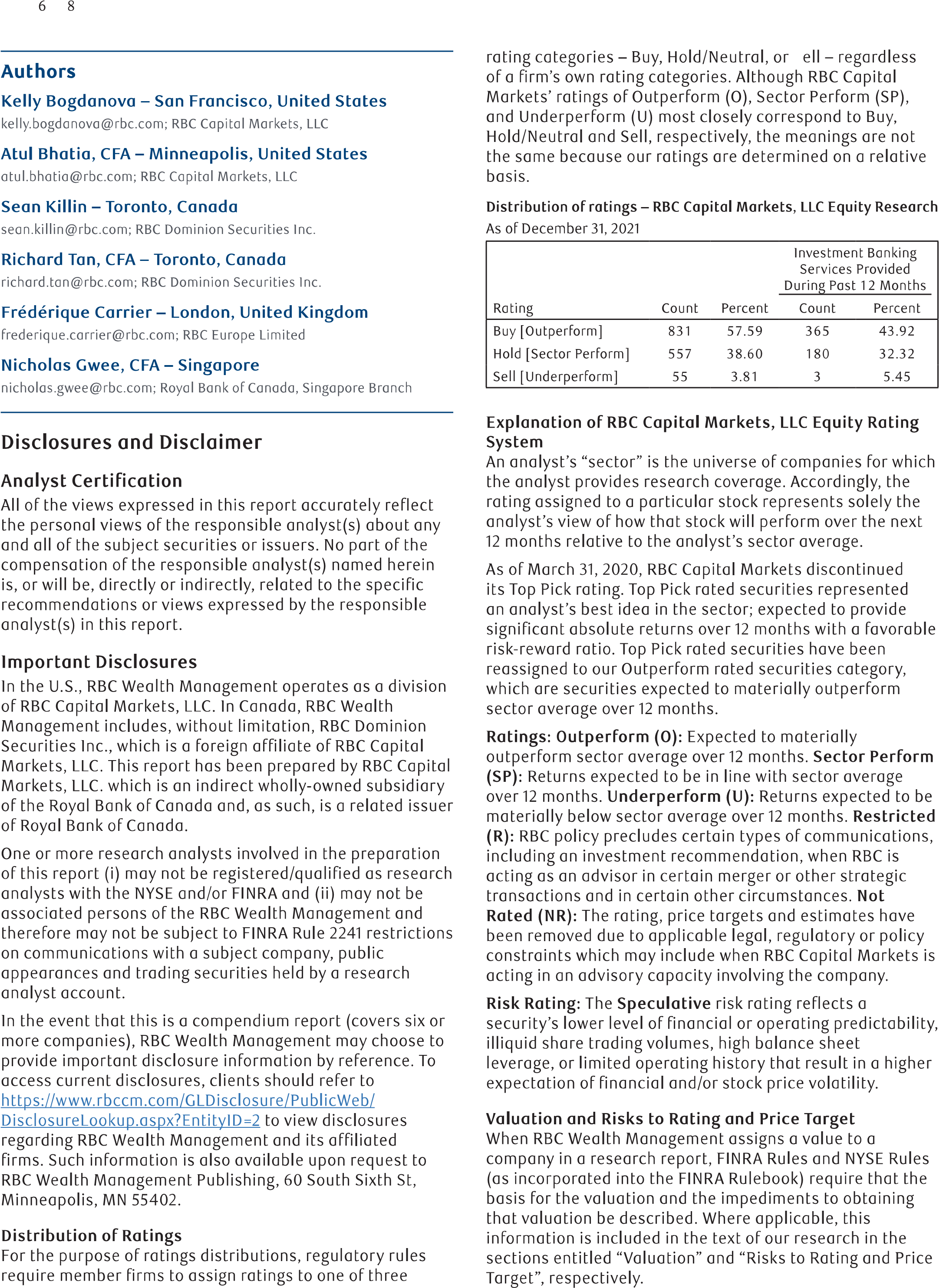

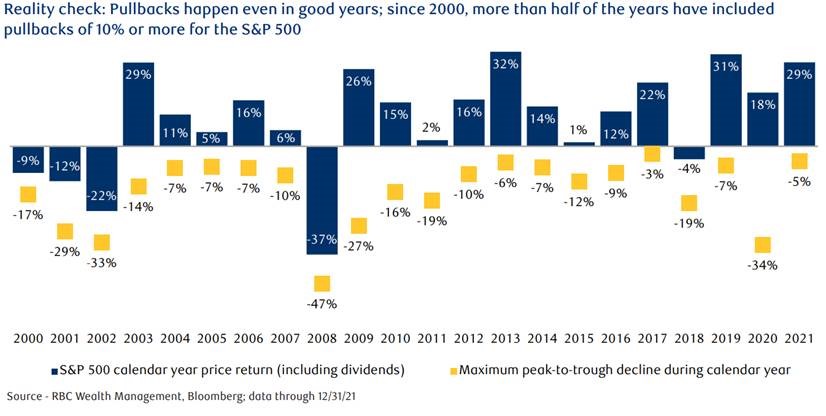

Late last year I wrote on the topic of market timing, and why it is an endeavor we do not pursue. It is not lost on me that in times of heightened volatility some investors may fall victim to the thinking that any action in their portfolio is better than no action. As investors that are focused on long-term results it is important to consider that market corrections of 10% or more are actually not all that uncommon, and further they occur even in good years. The below chart illustrates the calendar year returns of the S&P 500 (blue bars) and the peak-to-trough decline that occurred during each year (yellow bars). Note that more than half of the past 21 years have included periods where the market corrected 10% or more.

For anyone who feeling concerned or worried about the current state of the markets, please reach out and I will be happy to discuss our outlook and approach in greater detail. Similarly, if you have friends, or family members that would benefit from such a conversation, I would happily make myself available.