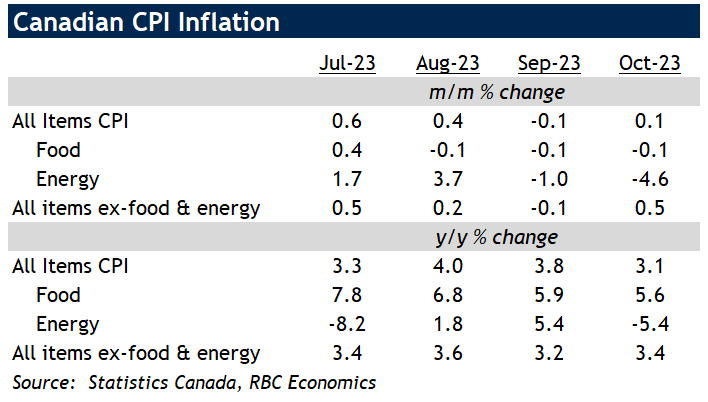

- Most of the drop in Canadian headline CPI growth to 3.1% year over year in October (just a touch above Bank of Canada’s 1% - 3% inflation target range) came from a 4.5% month over month decline in gasoline prices. That decline also pushed year-over-year energy price growth back below zero again (-5.4%).

- Food inflation was still higher but continued its down trend, moderating to 5.4% above last year’s levels in October from the recent peak growth rate of 10.4% this past January. Inflation at fast-food and take-out restaurants was higher at 6.4% in October, comparing to price growth for groceries (5.4%) and table-service restaurants (5.2%).

- Excluding food and energy products, year-over-year price growth ticked up to 3.4% in October. Shelter costs accelerated slightly, with increases in rent costs (+8.2%) and property taxes (+4.9% from annual adjustment) partially offset by lower inflation for home heating expenses.

- Still, most other measures pointed to further easing in price pressures. The Bank of Canada’s preferred CPI trim and median that are designed as a better gauge of broader inflation pressures both showed further improvements - averaging 0.2% month-over-month in October.

- The three-month average rate of month-over-month increases (a measure watched closely by the BoC) slowed to an annualized 2.7% for the CPI-median and 3.1% for the trim measure. The BoC’s ‘CPIX’ (which excluding mortgage interest costs and 7 other volatile components and indirect taxes) grew at just a very low 2.1% over the last three months on that same basis.

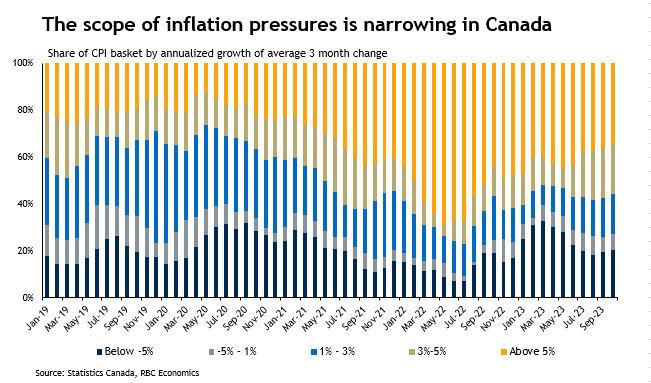

- Bottom line: Details in today’s inflation report showed further moderation in domestic price pressures in Canada, extending a downside surprise in price growth in September. Not only were the readings themselves lower among many components, the scope of inflation has also continued to narrow. The share of consumer basket (excluding shelter) that was seeing near-term inflation at above 5% annualized rate fell below 35% in October, still higher than the ~20% share in pre-pandemic 2019 and was just half of the peak share of 70% over early summer of 2022. Ongoing signs of deterioration in consumer spending and labour market conditions support our outlook for inflation to keep moderating in the quarters ahead. We continue to expect the BoC is done with rate hikes, and for them to cautiously pivot to cuts over the latter half of 2024.

RBC Inflation Watch: a tracker of key indicators on price trends in Canada.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.