In 2005, then-Fed Chair Alan Greenspan identified what he termed a “conundrum”: despite the Fed having hiked overnight rates by 1.5 percent, the yield on 10-year government bonds remained essentially unchanged.

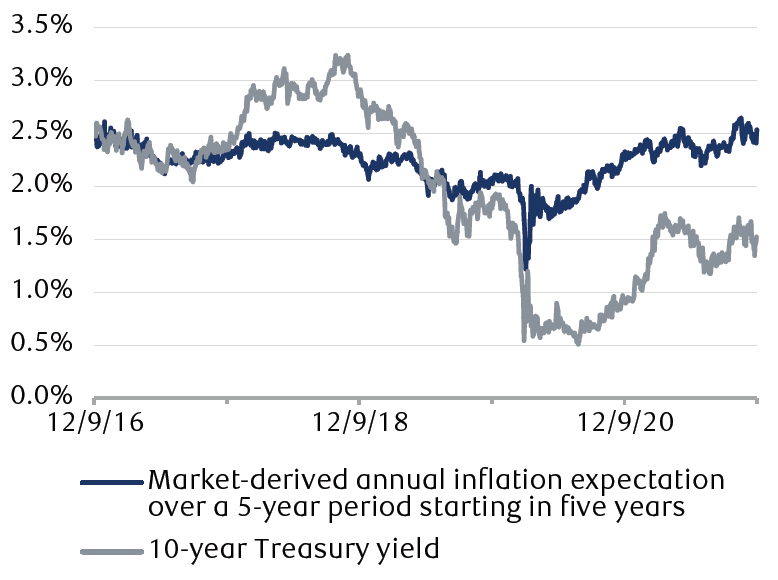

Since then, the conundrum has, if anything, amplified. Yields on 10-year government bonds are almost five percent below the last observed inflation reading, nearly one percent below market expectations for medium-term inflation, and they are essentially flat since Fed Chair Jerome Powell indicated a likely shift to tighter monetary policy, even as markets price nearly 0.75 percent in Fed rate hikes in 2022. Clearly, the conundrum continues.

Yield on 10-year Treasury not keeping pace with market’s inflation trading

Source - RBC Wealth Management, Bloomberg; daily data through 12/8/21

Traditional theory and valuation seem incomplete

Longer-term bond rates are frequently broken down into three components: real growth in the economy; compensation for inflation; and a catch-all “term premium” to describe uncertainty about the other two variables.

Traditional theory would look to growth or inflation expectations to explain current low rates: specifically, that the potential for the fed funds rate to reach 0.75 percent next year, and possibly 1.5 percent in the next three years, will engineer an economic contraction that will drop the sum of real growth and inflation over a decade below 1.5 percent. While it’s possible to make the math work out using those levers, we believe the argument is largely unsatisfying in logical terms and inconsistent with other markets.

The government’s contribution to growth is poised to flip negative next year, but the large stock of household savings—and consumers’ demonstrated willingness to spend—should more than offset that headwind. We believe inflation likewise appears poised to drop, both on fundamentals and on base rate effects, but it would likely require a decline into deflationary territory to justify 10-year yields below 1.5 percent, given reasonable economic growth forecasts.

Arguments that growth and inflation will justify 10-year yields are also inconsistent with other market signals. Medium-term inflation is now trading at roughly a 2.5 percent level, while investment-grade borrowers—on average—can borrow funds for nearly a decade at or below that level. Is it possible for growth and inflation to stay low when companies are essentially paid to borrow money? Of course. Is it likely? Probably not, and at best, it is a highly debatable contention.

It’s also difficult to square the extremely low growth environment bond markets are ostensibly predicting with corporate earnings and equity valuations. Major U.S. equity indexes are at or near record highs, large-cap valuations are stretched, and the consensus forecast implies S&P 500 earnings growth of 8.5 percent in 2022.

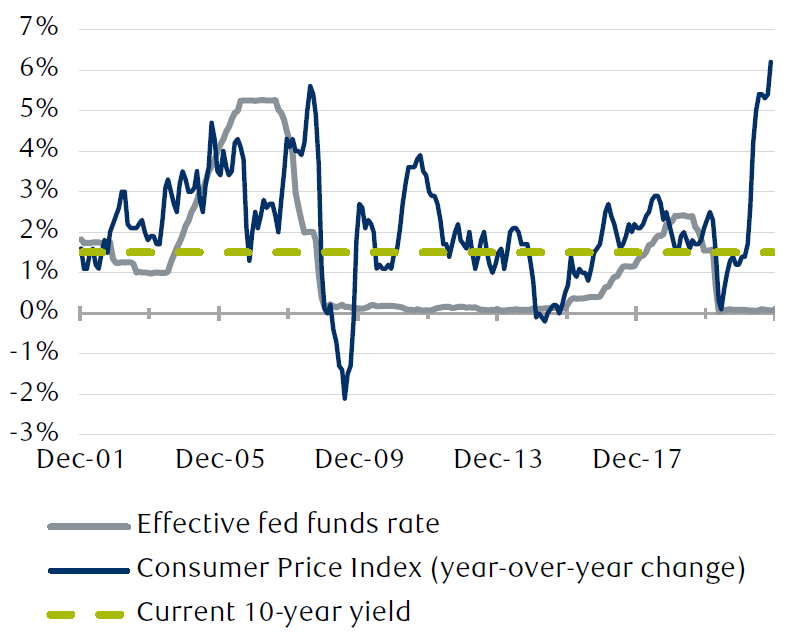

Will Fed policy justify low rates? Inflation may pose a challenge

Source - RBC Wealth Management, Bloomberg; monthly data through 11/30/21 for 10-year yield and fed funds, CPI data through 10/31/21

Faster hike, lower end

Another explanation for ongoing low 10-year rates is that initiating the rate hike cycle earlier will likely lead the Fed to stop hiking at lower levels. If the Fed were to stop hiking at 1.25 percent and hold it there for the next decade, then an investor could likely profitably hold 10-year Treasuries at current levels.

One problem with this argument is that it’s unclear how the Fed will keep overnight rates below inflation for years without triggering a rising price cycle that prompts a more aggressive response. It’s possible that longstanding disinflationary factors will help the Fed out, but it would likely require a shift in consumer behavior. And as the reaction to Powell’s recent comments indicates, the Fed is capable of surprising pivots; current levels of 10-year yields seem to offer little cushion for any unexpected Fed reaction.

Why buy at these levels?

We can think of several reasons why investors continue to buy Treasuries at these levels and why they may continue to do so:

- Price-insensitive asset allocators. Both institutional and private investors have asset allocation plans that drive investment decisions. Following strong equity outperformance in 2021, there is greater demand for fixed income across the board. Put differently, with equities at or near record highs, investors look to fixed income—and particularly longer-maturity fixed income—to help protect against possible growth disappointments.

- Uncertainty reigns. The omicron variant serves as a reminder that COVID-19 risks remain, and geopolitics are an additional source of potential uncertainty. For many investors, Treasuries’ high probability for return of capital outweighs any return on capital considerations.

- Rate hikes may be more consequential. Fiscal policy is due to be contractionary next year and we expect most of the growth impulse to come from private consumption. With retirement account and home equity valuations high for many individuals, the feeling of prosperity can tend to boost spending, even if those funds are not immediately available. If the Fed tightening had a significant impact on home or equity markets, then even moderate tightening could prompt a rally in longer-maturity bonds.

- Don’t fight the Fed. Even if the Fed is hiking near-term rates, policymakers have not indicated any significant discomfort with the shape of the yield curve and they continue to reinvest maturing Treasury holdings in newly issued bonds. Low 10-year yields can provide many benefits, not least of which is helping the government fund itself. With the Fed apparently content with low 10-year maturities, investors have few incentives to aggressively position for higher yields.

Lower for longer (maturities)

We believe there may be upward pressure on longer-term bond yields during 2022, but we think it will be difficult for 10-year yields to sustainably exceed two percent next year, even though this is well below even the Fed’s own projected nominal GDP growth. In our view, the difference is best explained by the likelihood of persistently low policy rates, with assistance from economic uncertainty and price-insensitive buyers. Although this blend of factors may be unsatisfying from a theoretical perspective, we believe it helps explain the apparently illogical price-setting behavior of U.S. Treasury markets.