Note: In order to provide the most accurate and robust insights, the methodology for the COVID Consumer Spending Tracker was recently updated to reflect delays between when transactions occur and when they are recorded in our database. To ensure archived versions of the Tracker are comparable with future versions, we have updated the data below. The key conclusions remain unchanged, though some estimates reflect new data.

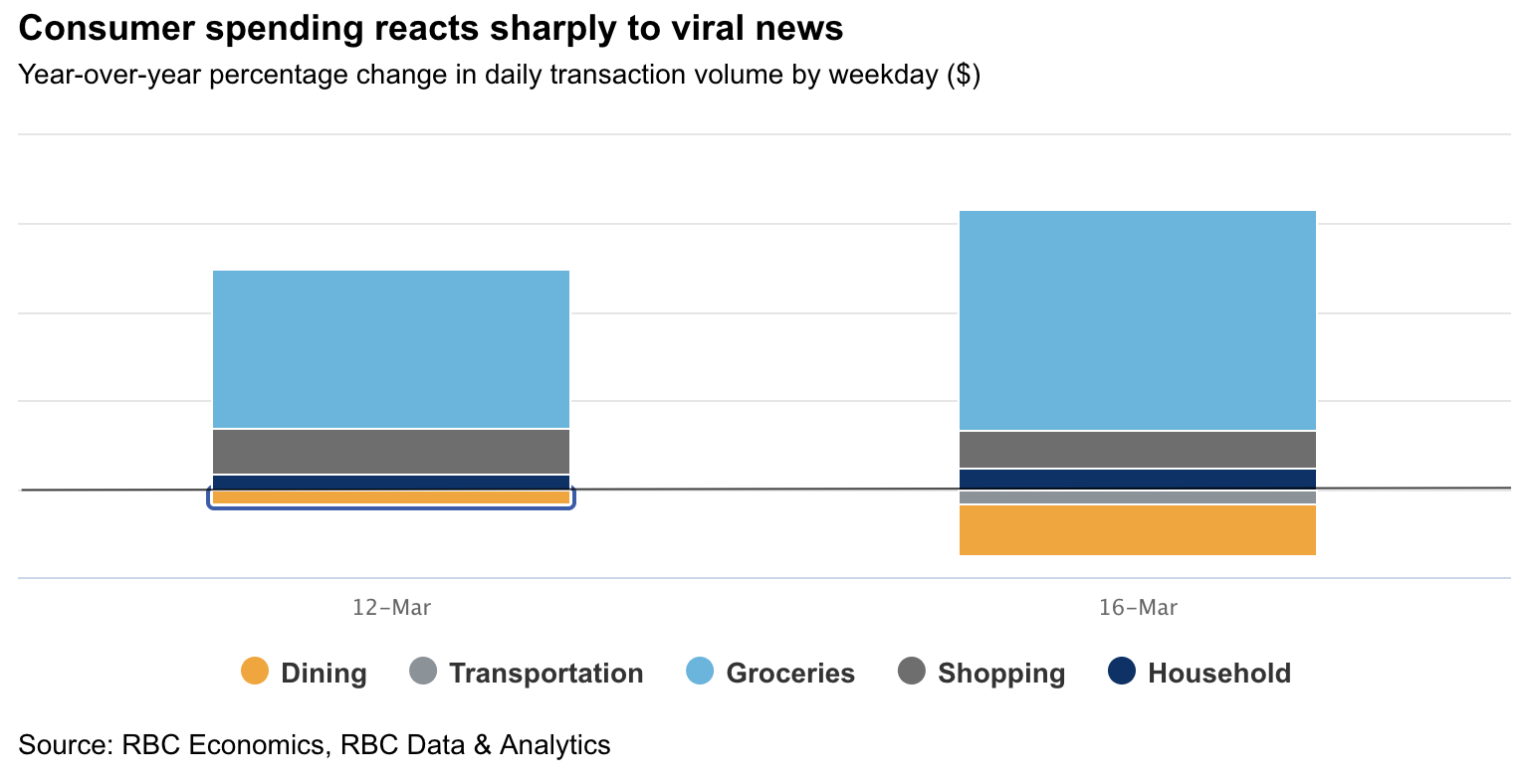

It’s not often a Canadian prime minister abruptly upends consumption patterns. Justin Trudeau appears to have inadvertently done that when he went into self-isolation on March 12 after his spouse was diagnosed with COVID-19. That news, along with a 2,350-point plunge in the Dow Jones Industrial Average, served as a one-two gut punch to Canadian consumers struggling to absorb a spike in pandemic-related developments.

Given the lag in the release of official Canadian retail sales figures, we’ve used RBC’s proprietary spending data1 to provide a snapshot of how the COVID-19 pandemic has altered Canadian consumption. We believe RBC’s broad Canadian client base serves as a proxy for national consumption. This is the first report in our series examining spending data up to March 31.

Highlights:

-

March 12 will go down in the record books as a pivotal day for Canadian retail spending

-

Canadians spent 13% more on March 12 than the same day a year earlier, mainly on groceries

-

Ottawa’s March 16 announcement that it would to close borders to most non-citizens dealt big blows to dining and transportation spending

-

Ontarians and Quebecers increased their shopping by close to half on the day business closures were announced

-

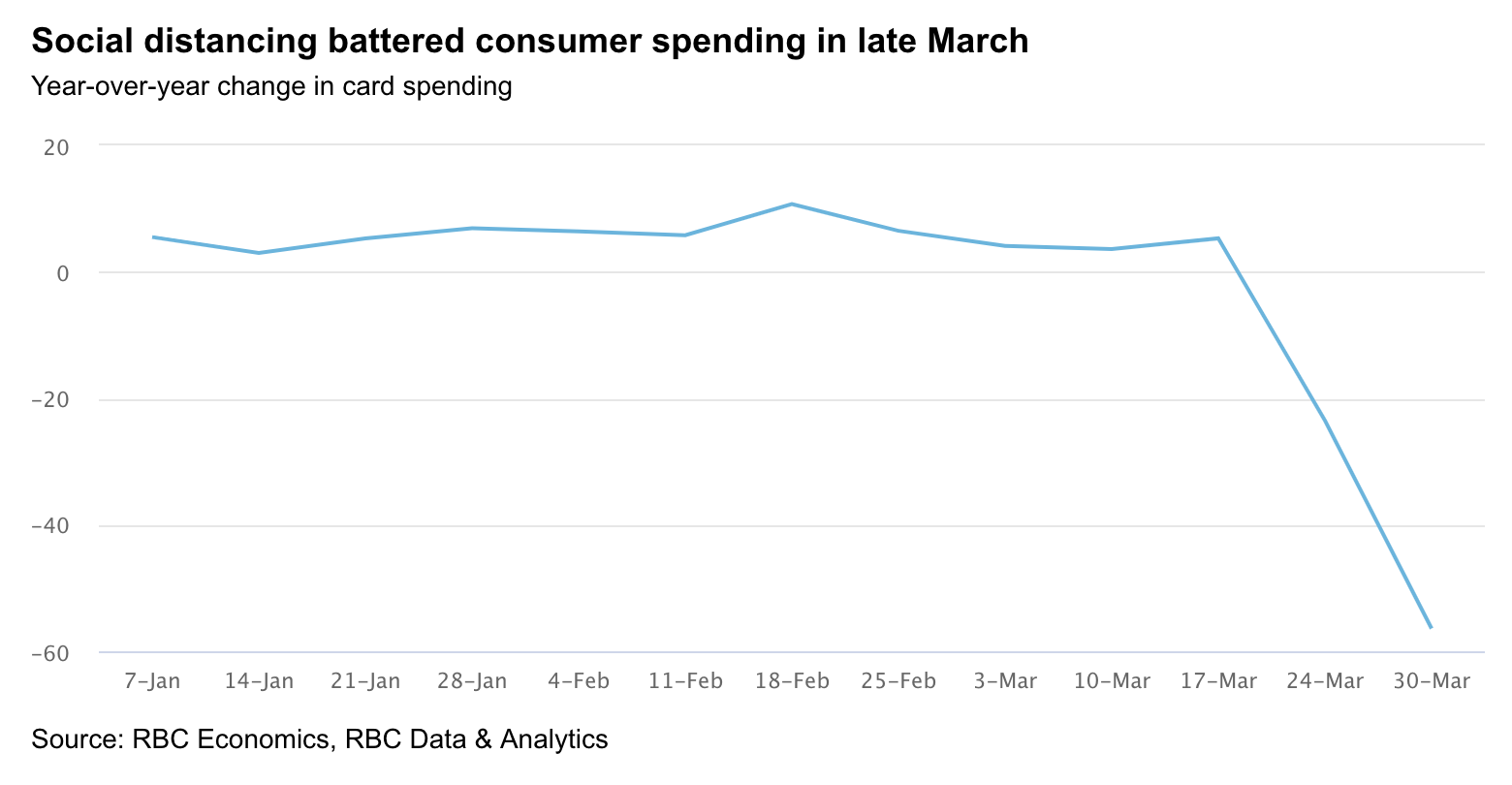

Card spending fell ~40% in week ended March 31 versus the same period last year

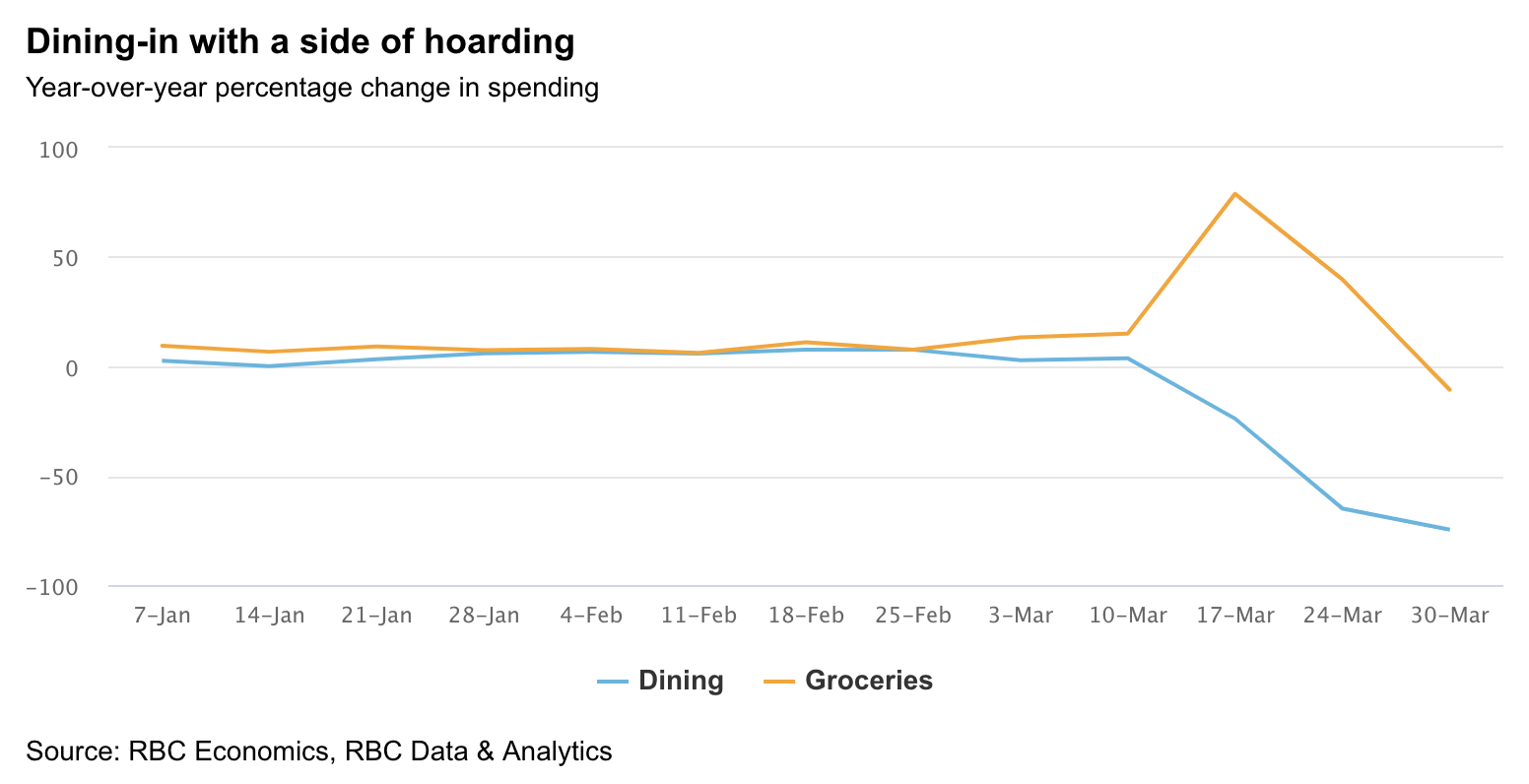

Baking, not bistros

- Grocery spending increased 80% in the week ending March 17th as Trudeau began self-isolating, and stayed notably elevated for two weeks

- While grocery shopping patterns subsequently normalized, the slowdown in restaurant spending persisted despite takeout/home delivery options

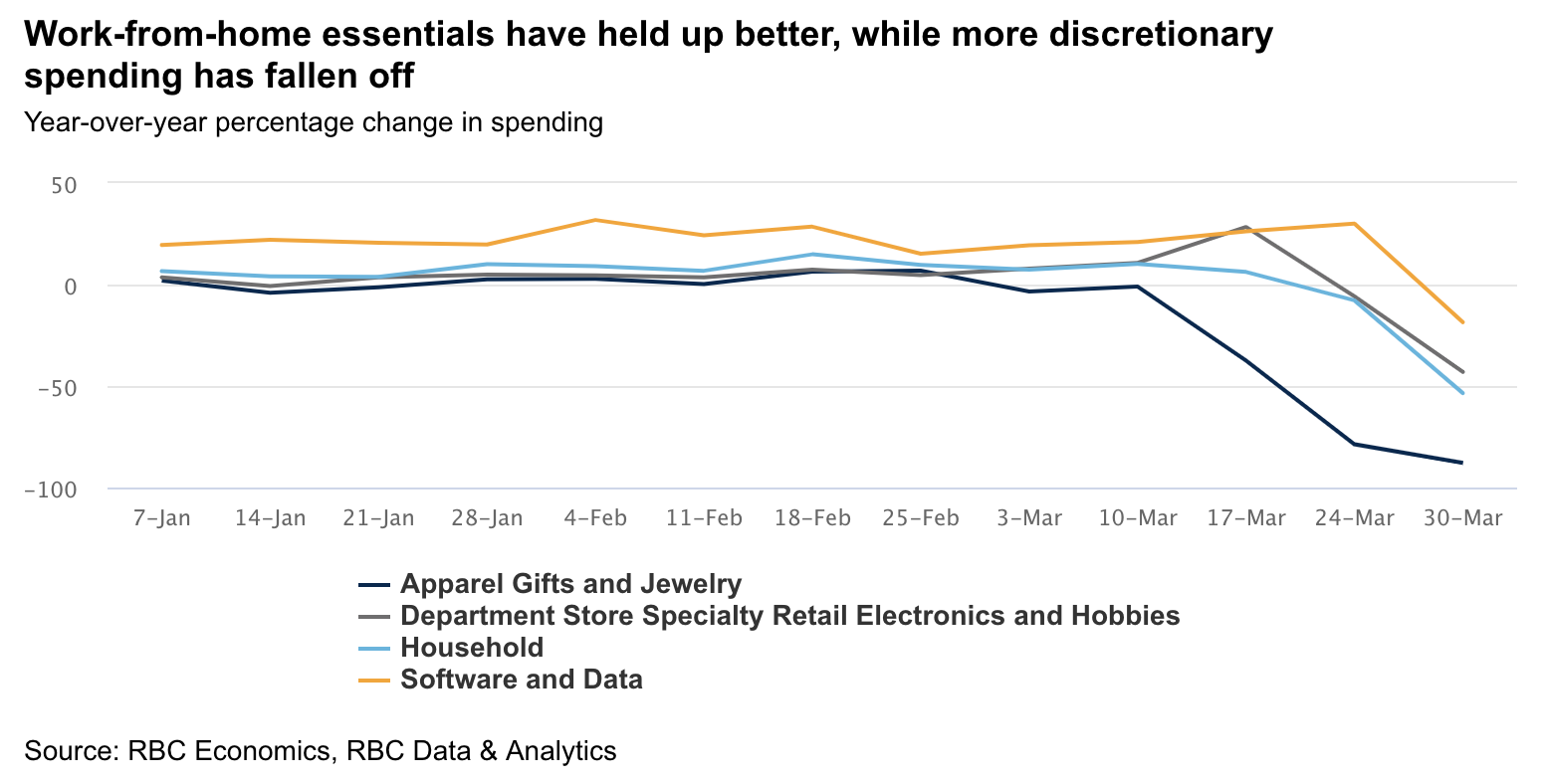

Software, not streetwear

- Software and data services spending held up better than other discretionary categories, as Canadians equipped themselves to work from home

- Canadians spent 81% less on apparel, gifts, and jewelry in the week ended March 31

- After a brief spike in shopping at big box stores, department store sales were down 21% versus a year earlier

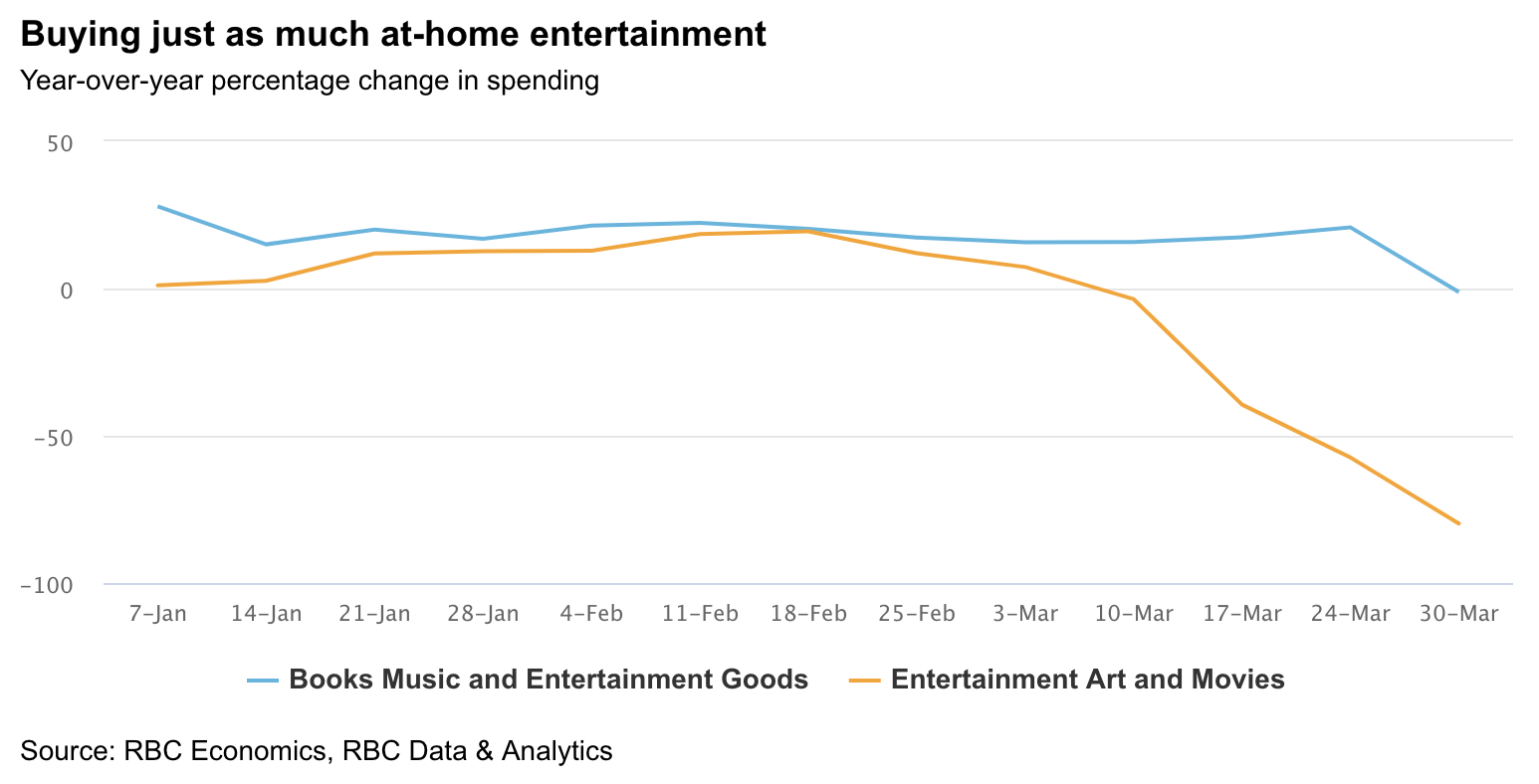

Streaming, not screenings

- Spending at movie theatres and art galleries had already slowed ahead of social-distancing measures

- Spending on books and music (including streaming and online services) has increased slightly

Methodology

RBC’s consumer spending tracking report uses RBC Data & Analytics’ proprietary database of anonymized card transactions by Canadian clients. The data are an accounting of merchant transactions that are divided into various spending categories covering tens of millions of weekly card transactions worth billions of dollars each week. Transactions, both in person and online, are classified into 11 broad spending groups: Dining, Education, Finances, Groceries, Health, Household, Shopping, Transport, Travel, Utilities, and Other. Within each group, the data are further classified: for example, shopping covers merchants classified as clothing stores, hobby shops, electronics stores, and jewellers, among others.

We examined changes in the value of all transactions in these areas for 7-day periods starting January 1st, comparing spending to the amount recorded over the same seven days in 2019. We excluded purely financial items (e.g., cash advances, insurance premiums, currency exchanges, fines). To examine the impact of important events, we looked at how spending changed on specific days, both on a daily basis and on an annualized basis relative to that same weekday a year ago.

Protecting your privacy and safeguarding your personal information is a cornerstone of our organizational ethics and values and will always be one of our highest priorities. The underlying data for this analysis was aggregated based on transaction date, region and merchant category, and cannot be used to identify any individual client or merchant. For additional information please visit www.rbc.com/privacy.

This report was authored by Economist, Colin Guldimann, and Economist, Carrie Freestone.

RBC Economics provides RBC and its clients with timely economic forecasts and analysis.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.