Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q4 2025 edition covers Market Review up to Q3 of 2025, the Artificial Intelligence (AI) boom and gold’s surge. Shiuman’s Corner is a about my cycling adventures for fund raising.

Markets

Market scorecard as of close on Friday November 14, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 30,326 | 1.6% | 22.6% |

| U.S. | S&P 500 | 6,734 | 0.2% | 14.5% |

| U.S. | NASDAQ | 22,901 | -0.3% | 18.6% |

| Europe/Asia | MSCI EAFE | 2,852 | 2.4% | 26.1% |

Source: FactSet

- TSX finished higher on Friday after recovering from a sharp morning drop. Sectors mixed. Canadian equities end the week up 1.4% after finishing lower the past two weeks.

- US equities were mixed in Friday trading after a big selloff in prior session. The S&P 500 eked out a slight gain for the week though Nasdaq and Russell 2000 added to last week's declines.

- While the broad indexes recovered from the closing low of the previous week, they surrendered their initial gains as investor enthusiasm for the end of the government shutdown gave way to concerns over a slowing economy.

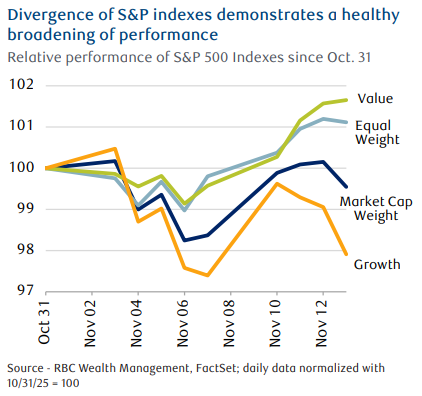

- Value investors were encouraged by a return to favor for this investment style during the week. Most of the gains in the equity market this year have been driven by the megacap, high-growth technology stocks exposed to the AI theme. But as more investors questioned the historically high valuations of these stocks, funds have started to flow into areas of the market that haven’t participated in the bull market to the same extent. This has resulted in the S&P 500 Value Index outperforming the S&P 500 Growth Index, and the S&P 500 Equal Weight Index outperforming the conventional market capitalization-weighted index so far this month (see chart below). We view this broadening of equity market participation to be a positive sign of the market’s health.

- The STOXX 600 Europe ex UK Index and the FTSE All-Share Index reached new all-time highs during the week, benefitting from news of the end of the U.S. government shutdown, progress on the French budget, and a generally improving earnings backdrop in Europe.

Economy

Canada

- The federal government announced a 43% reduction in the number of new temporary residents to 385,000 in 2026 from 674,000 in 2025. Additionally, the timeline to reduce the number of temporary residents to less than 5% of the total population was extended to the end of 2027. International student admissions will face the heaviest burden of these cuts, remaining at the 150,000 level for the next three years.

- The strength of the consumer has been a headline topic throughout 2025 as low- and high-income households have been spending, despite broader macro uncertainty. This spending has acted as a tailwind for the S&P/TSX Composite as companies that have value offerings and those that have premium offerings have both seen strength in their equity prices.

U.S.

- The U.S. House of Representatives voted to end the longest-ever government shutdown (at 43 days) on Wednesday. The market appeared to have shrugged off shutdown concerns with the S&P 500 up 2.4% over that period.

- RBC Global Asset Management estimates Q4 2025 GDP growth will be 1 to 1.25 percentage points lower due to the shutdown, but that Q1 2026 could add an extra 1 percentage point resulting in only a slight overall loss.

- Further Afield

- In its Q3 monetary policy report released this week, the People’s Bank of China (PBOC) pledged to maintain accommodative financing conditions, as the foundation for the domestic economic recovery “still needs to be consolidated through stronger policy efforts.” We think the PBOC’s latest statement suggests policymakers are willing to look beyond short-term volatility in economic growth and focus on long-term targets.

- In Japan, the yen looks set to retest the psychological level of 155 against the U.S. dollar. The new Japanese finance minister, Satsuki Katayama, issued a warning regarding currency movements: “We’re seeing one-sided, rapid currency moves of late…The government is watching for any excessive and disorderly moves with a high sense of urgency.” We think her comments increase the risk of intervention if the one-sided moves continue.

Notes About Companies in Model Portfolio

- Q3 earnings season finally wound down during the week. With 95% of the S&P 500 on track to have reported by the end of this week, earnings growth for the quarter is tracking at 13% y/y, with revenue growth up 8%. This compares to consensus estimates of 8% and 6%, respectively, at the start of earnings season. The sectors that drove most of this growth include Information Technology, Financials, and Utilities, while Communication Services, Energy, and Consumer Staples posted negative earnings growth.

- Element Fleet Management Corp. (TSX:EFN) the automotive fleet manager announced financial and operating results for the three months ended September 30, 2025. Net revenues increased by 10% year-over-year, reflecting strong performance across all components. Q3 2025 adjusted diluted EPS increased 14% to $0.33 year-over-year.

Feel free to contact me with any questions and/or to discuss investment ideas.

Regards,

Shiuman

PS: To unsubscribe, simply reply with “Unsubscribe” in the subject line.