How to Weather The Storm after the Calm

A Brave New World of Global Trade Disruption

Market Review: to April 2025

Stock markets in Canada and the U.S. experienced a volatile start to the year. The S&P/TSX Composite Index (TSX) was virtually flat at +0.5% (see red line in chart below) as of April 30. The S&P 500 Index in the U.S. was down 5.3%.

Source: FactSet April 30, 2025

If you extend the period to the previous 12 months, the performance of the TSX was +14% and the S&P 500 was +12%, as the chart above shows.

Historic Market Moves

The above stock market numbers appear benign, or even positive because of the double-digit gains in the past year. However, during April we saw some of the most dramatic swings in the stock market, responding to the latest news about tariffs the U.S. imposed on all countries, including trading partners with whom it has trade agreements.

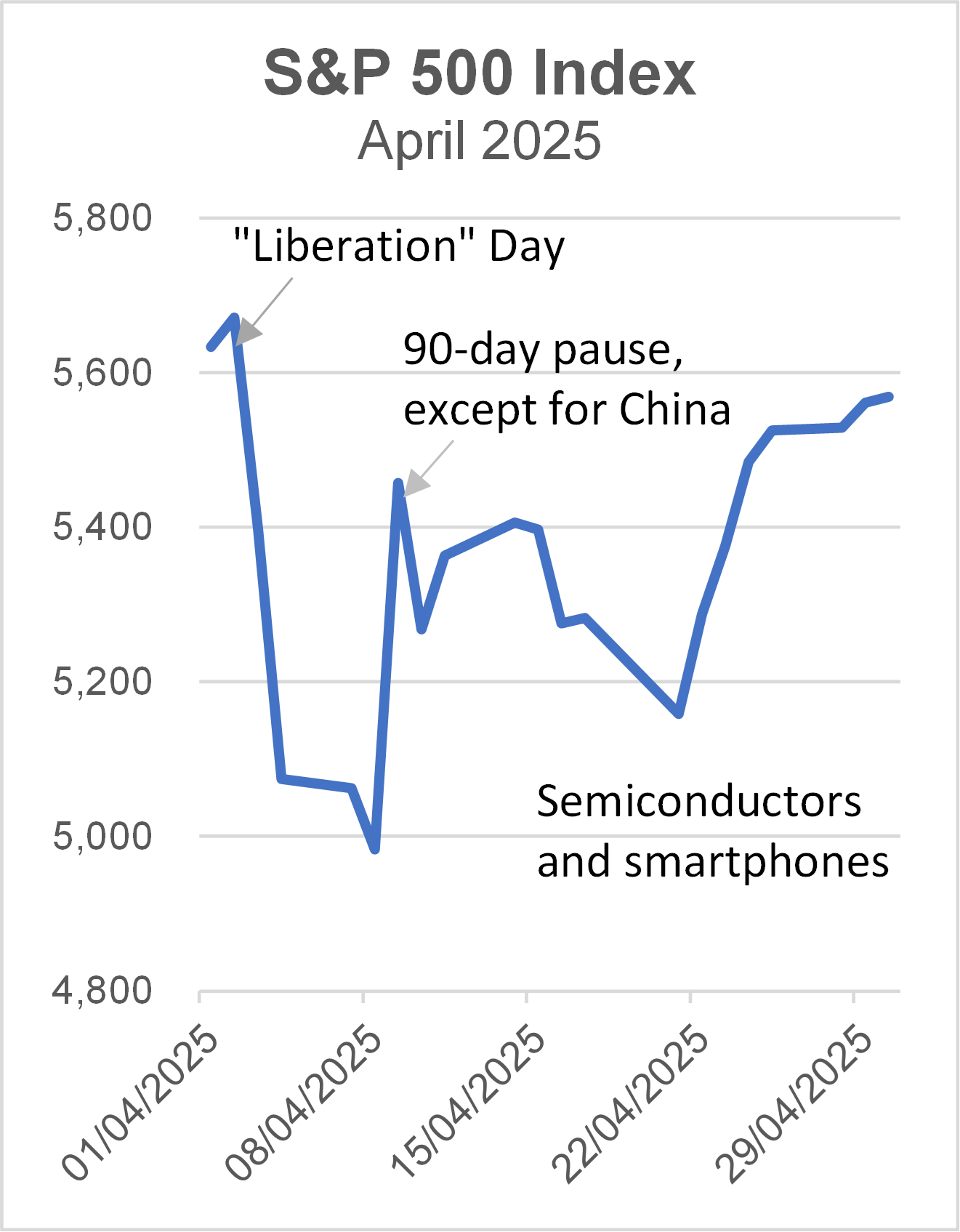

The U.S. president declared April 2nd as “Liberation” day, the day he imposed tariffs on every country on earth. The U.S. stock market reacted by falling 10.5%, its worst two-day loss in history on April 3-4. See chart below.

Source: FactSet April 30, 2025

However, by the end of April, S&P 500 recovered almost all its losses after various relief on tariffs including a 90-day pause, and concessions for semiconductors and smartphones.

Lesson: Focus on the Long Term

There has not been a better example of a time that demonstrated the benefits of staying calm and staying put during a period of volatility. The famous investor Warren Buffett is often quoted as having said, “be fearful when others are greedy, and be greedy when others are fearful.” More on how to put this into action later.

What Tariffs Have Done

Before the storm

Up until the first announcement of tariffs after the presidential inauguration, the U.S. economy was the envy of the developed world, with robust growth and low unemployment. Inflation was under control and interest rates were on a downward trend. To boot, stock markets were setting new all-time highs.

Uncertainty of tariffs

Since the first announcement there have been reprieves, increases, delays and other changes. We last saw tariffs this high almost 100 years ago. Certain sectors were targeted (steel and aluminum) while some had concessions (semi-conductors and smartphones). Not to mention retaliations from other nations. During those early weeks many reports were published including by RBC which became out of date before the ink was dry.

Impact of tariffs

Tariffs translate to higher costs for businesses that import material or finished products, which will reduce their margins and/or increase the price to consumers. The reason stock prices fell in response was to reflect lower profits from companies, and the reduced spending power of consumers. Some businesses stocked up on inventory to try to beat the tariff deadline, and individuals may delay or cancel their purchases altogether. The University of Michigan consumer sentiment survey fell from an average of 72.5 in 2024 to 52.2 in April of 2025. If tariffs persist, they may affect growth in the economy, jobs and inflation.

How to Weather the Tariffs

Understand the context

The recent market turmoil was caused by a man-made event (tariff on imports). According to RBC Capital Markets Head of US Equity Strategy Lori Calvasina, even at its worst point on April 7, the S&P 500 was not pricing in a recession. If trade deals are struck that reduce most tariffs substantially, that could be the catalyst that sparks a rally. Although we cannot predict the future, we know from history that corrections are followed by recoveries, leading to new highs. As the stock market action in April demonstrates, it is impossible to time the market.

Stay with quality

My investment philosophy is to invest in companies that have growing cash flows, low debt and competent leaders. It also helps to have positive long term trends that provide tailwinds for that industry. The growth of artificial intelligence is one such tailwind. Government and investment grade bonds now offer yields not seen for over a decade. Their default risk is much lower and they may appreciate in price when interest rates fall in the future.

Be truly diversified

The most important factor in a portfolio that determines the volatility of returns is choosing how much is invested in the three main categories – cash, bonds and stocks. In the recent stock market correction, cash and bonds provided a cushion to offset downturns. When the price of two assets move independent of each other, it’s known as having low correlation. There’s a category of assets called Alternatives that include commodities, real assets and investment strategies that employ tools such as derivatives and shorting. Alternative funds are designed to have positive performance no matter what happens in the stock or bond markets. They are sometimes called absolute return strategies.

Keep some cash

My advice to clients who need retirement income is to set aside enough cash for six to 12 months. This avoids having to sell investments when markets are down. Not withstanding my statement about not timing the market, investor who have spare cash can take advantage of temporary corrections to buy at a lower price. That would be a good time to be “greedy while others are fearful.” There is now record level of cash ($2 trillion) in retail money market funds that will need to be invested at some point.

Shiuman’s Corner

The art of retail

Luxury you can taste [photo: S. Ho]

E-commerce has taken a bite off bricks-and-mortar stores in Canada, especially from large department stores. I do not remember the last time I bought anything from one such store. The venerable Hudson Bay may soon join the scrapyard of Canadian retail that includes Sears, Zellers and Eaton, to name a few. On two recent trips to Japan I visited a few department stores and it was an eye-opening experience. The basement would house its food sections that include items intended as gifts such as strawberries that cost more than $5 each. The top floor would have multiple restaurants that had line-ups. The premises are impeccably maintained with floor after floor of attractively displayed goods. There were ample staff to greet and serve customers. Eye contact and a subtle nod was enough to signal to them to help you. One time the service was so good I could not help myself but to buy something (not the strawberries though). I understand this level of service and hospitality stems from the concept of omotenashi of anticipating the customers’ needs and then wholeheartedly looking after them. It sounds so simple a concept, but it is rarely seen in the rest of the world. Lastly, there would be bowing and arigato gozaimasu (thank you very much). That is the type of service I am happy to pay for!

|

â / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. (2025). All rights reserved. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. â / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. (2025). All rights reserved.

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that any action is taken based upon the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein.

|