Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q1 2025 edition covers Market Review for 2024, a discussion about the main themes for 2025, and some long-term multi-decade trends. In Shiuman’s Corner find out what my favourite books were from last year.

Markets

Market scorecard as of close on Friday April 4th, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 23,193 | -6.3% | -6.2% |

| U.S. | S&P 500 | 5,074 | -9.1% | -13.7% |

| U.S. | NASDAQ | 15,588 | -10.0% | -19.3% |

| Europe/Asia | MSCI EAFE | 2,281 | -6.9% | 0.9% |

Source: FactSet

-

Global equity markets fell more sharply this week following the revelation from the U.S. administration that its reciprocal tariffs will be much broader and larger than most investors expected. The “Liberation Day” announcement raised the spectre of a more global trade war between the U.S. and many, if not all, of its trading partners.

-

TSX closed sharply lower on Friday, near worst levels. Most sectors lower. Energy and materials the worst performers, down >8%, while communication services had minimal losses. Canadian equities posted their worst weekly performance since June-2022.

-

US equities were sharply down in Friday trading, ending not far from worst levels. Nasdaq Composite today ended in bear-market territory; S&P logged its worst two-day period since March 2020 and is now 17.4% below its February all-time high. Treasuries rallied again though came off best levels; 10-year yield ended back near 4% but earlier hit lowest point since October.

-

The U.S. stock market bore the brunt of the weakness, continuing a trend that’s been in place this year. Technology and industrial sectors were particularly weak as investors are increasingly questioning the resilience of the U.S. economy and the growth expectations embedded in its stock market. The Canadian market fared a bit better, with bank stocks demonstrating some resilience, helping to offset some of the weakness from the Energy sector. Overseas equity markets were also lower, albeit to a lesser degree.

-

Not surprisingly, government bond yields moved lower (and prices higher) as investors have grown concerned about global growth and have sought safe-haven assets. And while a recession is by no means a foregone conclusion, the risk of one occurring has risen.

-

Financial plans for our clients assume that market drawdowns, such as the one we are living through, may occur from time to time and to varying degrees. Sticking to a plan ensures that we remain disciplined in our approach which is particularly important during periods of market duress where emotions can often get in the way.

-

For more commentary on the stock market, you can read the Global Insight Weekly here.

Economy

Canada

-

In a somewhat positive surprise, Canada and Mexico were spared, as neither country will face additional levies. This removes, for now, some of the worst-case scenarios that investors were anticipating for both countries. As a reminder, Canada is already facing a 25% tariff on goods, including autos and parts made in Canada, not covered under the USMCA trade agreement signed in 2018, a reduced 10% duty on energy and potash not covered under USMCA, and a 25% tariff on steel and aluminium.

-

There are also uncertainties for the Canadian economy. Canadian GDP grew by 0.4 percent m/m in January, slightly ahead of Bloomberg consensus expectations and faster than the upwardly revised rate of 0.3 percent m/m from December. On a year-over-year basis, Canada’s economy grew at a 2.2 percent pace in each of the past two months, indicating to us that seven rounds of interest rate cuts over the past 10 months have helped boost consumer spending and investment.

U.S.

-

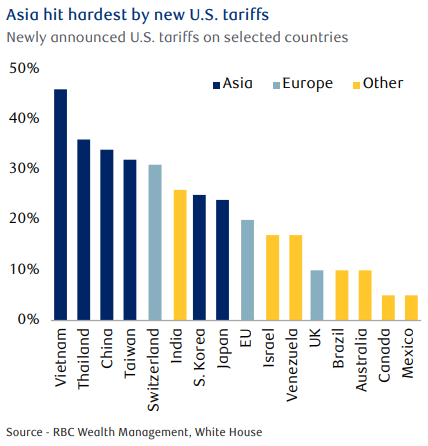

The final announcement delivered sweeping increases across 60 countries with many facing rates above 30 percent. Asian exporters were particularly hard hit. Wall Street economists calculated the weighted average tariff levied by the U.S. would increase tenfold to 24 percent to 26 percent compared to the 2.5 percent rate levied in 2024.

-

Initial estimates from our research correspondents suggest they will reduce U.S. economic growth by between 1.5 percent and 2.0 percent over a two-year period, and push inflation toward 5.0 percent from the current range of 2.5 percent to 3.0 percent, although much will depend on the longevity of the tariffs.

Further Afield

-

RBC Capital Markets expects the EU to reserve the right to retaliate while continuing negotiations and offering some concessions, with the April 9 implementation date providing a window for further talks. We continue to believe that eventually a deal will be struck, and lower, partial tariffs will end up being imposed, much like during the first Trump presidency, though this could take many months.

-

After the imposition of a 34 percent reciprocal tariff, China now faces a total effective U.S. tariff of around 65 percent. While the tariffs are higher than many investors expected, the market reaction in China was relatively modest, in our view. The onshore CSI 300 Index declined by 0.6 percent, and the offshore Hang Seng Index fell by 1.5 percent.

Notes About Companies in Model Portfolio

-

Dollarama Inc. (DOL) reported on Thursday its financial results for the fourth quarter and fiscal year ended February 2, 2025. Q4 Sales increased by 14.8% to $1,881.3 million, compared to same period last year. Comparable store sales increased by 4.9%. For the full year, diluted net earnings per common share increased by 16.9% to $4.16, compared to $3.56. There were 65 net new stores opened, same as prior year, bringing total store count to 1,616.

Feel free to contact me with any questions and/or to discuss investment ideas.

Please note that my Weekly Update will be taking a two week break, returning on Monday April 28th.

Regards,

Shiuman

PS: To unsubscribe, simply reply with “Unsubscribe” in the subject line.