Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q1 2025 edition covers Market Review for 2024, a discussion about the main themes for 2025, and some long-term multi-decade trends. In Shiuman’s Corner find out what my favourite books were from last year.

Markets

Market scorecard as of close on Friday March 28, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 24,759 | -0.8% | 0.1% |

| U.S. | S&P 500 | 5,581 | -1.5% | -5.1% |

| U.S. | NASDAQ | 17,323 | -2.6% | -10.3% |

| Europe/Asia | MSCI EAFE | 2,451 | -1.4% | 8.4% |

Source: FactSet

- TSX closed sharply lower in Friday afternoon trading, near worst levels. Most sectors down. Utilities and staples the modest gainers. Canadian equities recorded a 0.8% weekly loss.

- US equities were sharply lower in Friday trading as stocks finished near worst levels. S&P 500 posted second-worst day of the year, Nasdaq fourth-worst. Friday’s weakness put the major averages solidly lower, and down for fifth week in past six.

-

U.S. stock indexes posted lackluster returns for the last full week of Q1, with tariff uncertainty and dismal consumer confidence limiting gains. The strong start to the week, on headlines of tariff flexibility from the U.S. administration, was reversed by the announcement late on Wednesday, March 26 of blanket 25% tariffs on foreign-made automobiles and parts.

- U.S.-based auto companies were not immune to the turmoil with share prices of Detroit’s Big Three (General Motors, Ford, and Stellantis) down between 4% to 9% at the open on Thursday. Industry analysts suggested the tariffs could push up new car prices by $5,000 to $10,000 and used car prices by 10%.

- The latest Global Insight Weekly features an article that explains a technical view of the current U.S. stock market. You can read it here.

Economy

Canada

- The Conference Board’s Index of Consumer Confidence fell to its lowest level on record in the month of March, with labour market expectations the largest contributor to the decline.

- The BoC released its Summary of Deliberations for the March 12 policy meeting this week, outlining the Governing Council’s discussions. Faced with deteriorating consumer and business sentiment weighing on the outlook for growth, the central bank opted to cut the rate to 2.75%, which should “provide some help to Canadians to manage the uncertainty related to tariffs.

U.S.

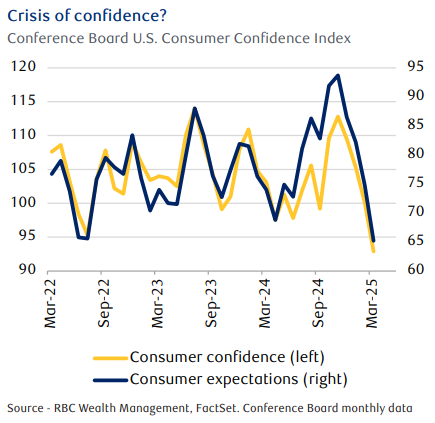

- It was a light week for economic data. Durable goods orders for February beat expectations, with buyers rushing to fill orders ahead of tariff hikes. Sentiment data was more downbeat, with consumer confidence readings for March continuing the downward trajectory they have followed since the November highs (see chart).

Further Afield

-

Recent UK economic activity and inflation data are supportive of more interest rate cuts from the BoE. The March preliminary indicators of overall economic activity show the economy shifting further into expansionary territory from February.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman