Strong Returns in Equities in 2024

What We Can Expect This Year

Market Review: 2024

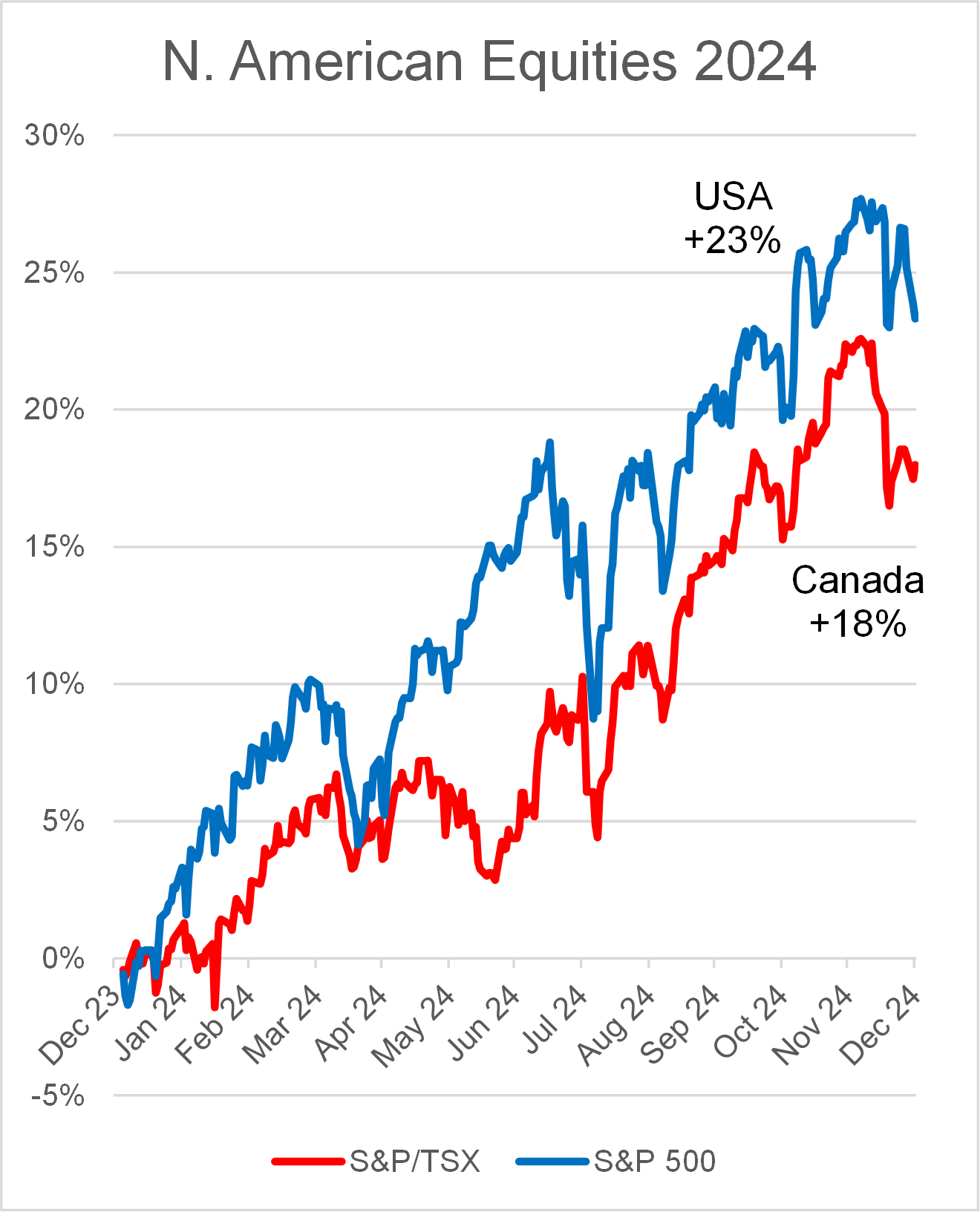

Stock markets in Canada and the U.S. closed out a strong year, even after a small pullback towards year end. The S&P/TSX Composite Index (TSX) was up 18% (see red line in chart below).

Source: FactSet Dec. 31, 2024

The S&P 500 Index in the U.S. was up 23%, the second straight year with 20 percent or better returns. The S&P 500 is up a cumulative 70% since the latest bull market began in October 2022.

Key Market Drivers

The strength of the U.S. economy was a main driver of markets, as was the lowering of interest rates. Once again, companies involved in artificial intelligence (AI) including Alphabet, Microsoft and Nvidia led the way. Nvidia, which designs and produces the most powerful and sought after AI chips in the world surged 171 percent for the year, representing more than one-fifth of the gains in the S&P 500.

Lower central bank policy rates did not translate into lower bond yields (or higher bond prices). The Canadian Universe bond index returned 4.2% whereas the U.S. aggregate bond index returned 1.3%.

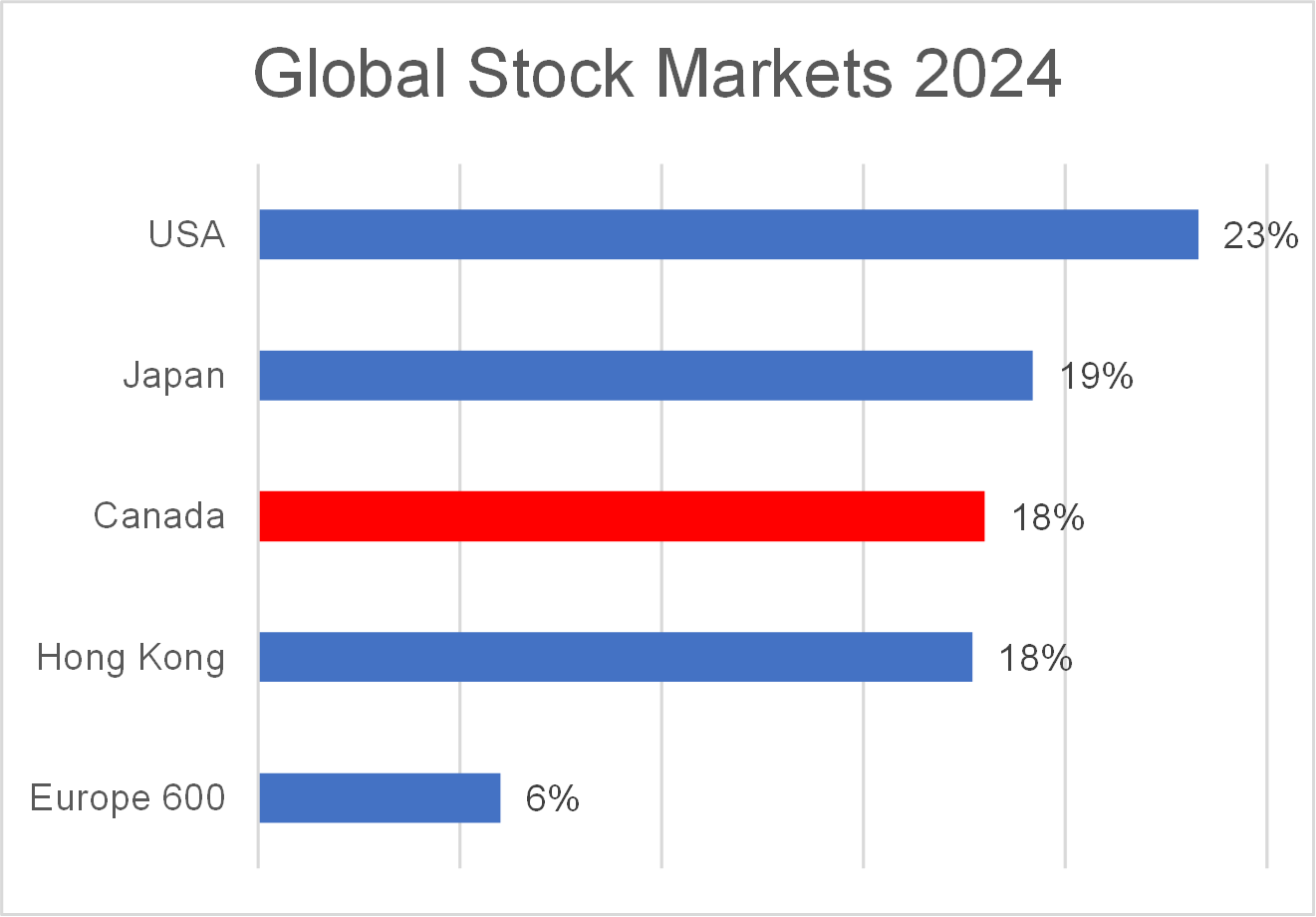

U.S. tops World Markets

Last year U.S. led the rest of the world in equities market return, as shown in the chart below. European equities struggled due to their lacklustre economic growth, and relatively high interest rates.

Source: FactSet Dec. 31, 2024

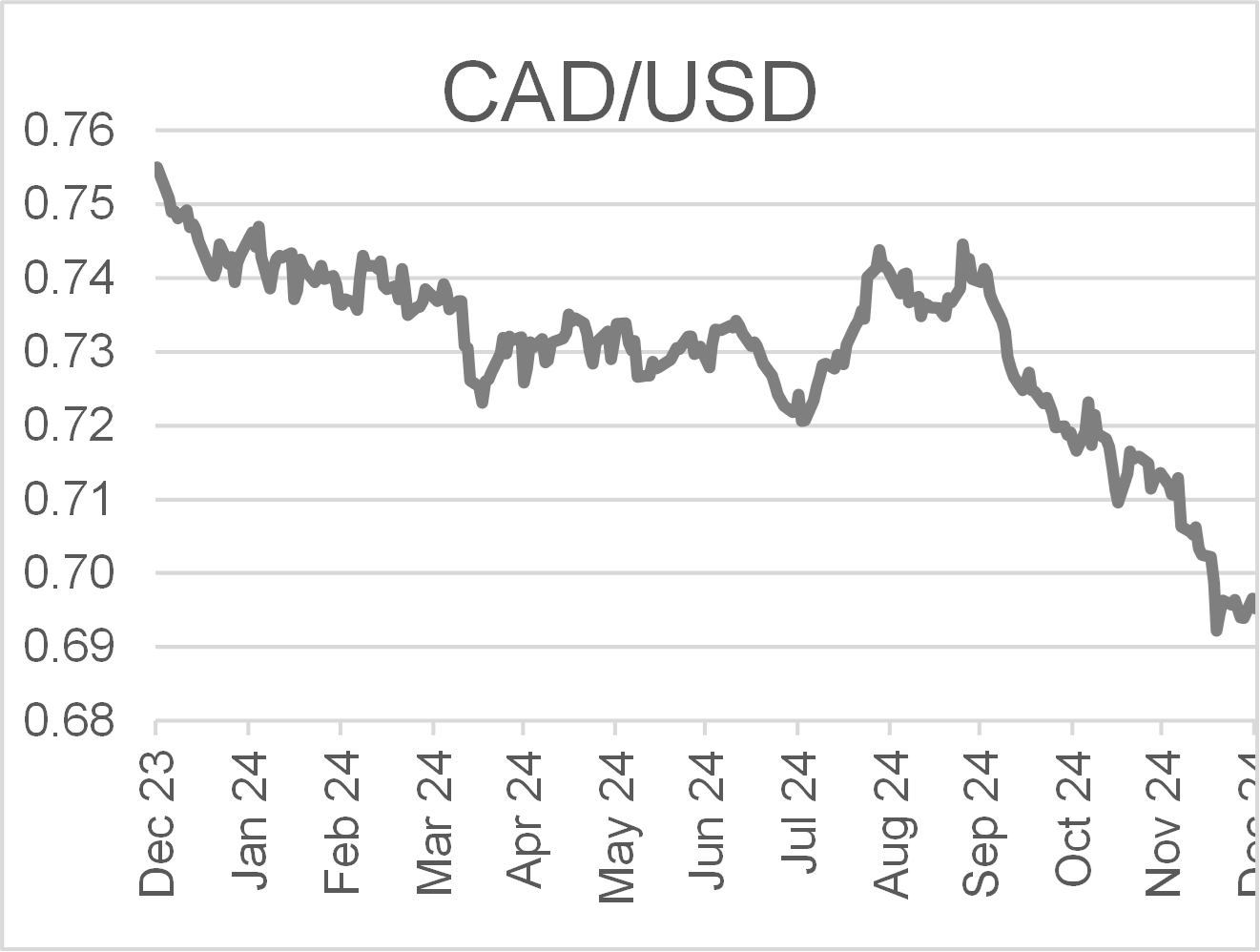

Lower Rates, Weaker Loonie

The Bank of Canada overnight rate started the year at 5%. In June 2024 it started the first of five cuts, and ended the year at 3.25%, a significant drop. The Federal Reserve in the U.S. made three cuts to its overnight rate to 4.3%, down 1.0% compared with a decline of 1.75% in Canada. The reason the U.S. rate did not come down as much is due to the resilience of its economy and low unemployment. This interest rate differential was also reflected in the government bond markets. The U.S. 10-year Treasury yield was 4.6% compared with the Government of Canada 10-year bond at 3.2% as of year-end. This contributed to the weakness in the Canadian dollar in the fourth quarter, as illustrated in the chart below. The Canadian dollar finished just below $0.70 U.S. by the end of 2024.

Source: FactSet Dec. 31, 2024

Main Themes in 2025

Rates continue to fall

For the past two years, we have spent a lot of time discussing (high) inflation and direction of interest rates. With any luck, inflation will not be a factor going forward. Rates are likely to continue to go lower although the pace of future cuts is likely to slow in the U.S. as well as in Canada.

Tariffs and global trade

While I don’t normally believe geopolitics have a direct effect on financial markets, some policies may exert an influence. With an incoming U.S. president who has floated the idea of punishing import tariffs, its potential impact must be accounted for. Economists are predicting a cut in global growth that will impact China, Europe, Japan and, of course, Canada. Tariffs may also be inflationary for the U.S. as all imports will be more expensive.

Canada remains lacklustre

The governing Liberal party will elect a new leader in March. A general election will be held before October 2025, maybe sooner. It will face immediate pressure to respond credibly and effectively to tariffs, if imposed by the U.S. The majority of Canadian exports head south to our neighbour. A lower Loonie, which makes exports cheaper, may offset the impact.

The U.S. continues to lead

In the near term the U.S. is likely to continue to lead the world due to its economic strength and the unstoppable advance in AI development. My client models will continue to have a healthy weighting in the U.S. market.

Long-Term Trends

In RBC’s Global Insight 2025 Outlook the focus article describes four powerful trends that are set to play out in the coming decades. Full report here.

Artificial Intelligence

AI has been touted as the technology that can transform the way we work and live. Massive investments are made infrastructure, large language models and applications. The runway for payback for this is likely to be long.

The Grey Wave

Demographic changes happen slowly but once a trend is set it will be decades before its course alters. The world population, especially in rich countries, is ageing. There will be 1.6 billion (almost one in five) over the age of 65 by 2050. With fewer workers to pay taxes, seniors may need more savings to prepare for old age.

Renewables

The demand for energy will continue to grow. The share of power generated by renewables are also predicted to increase thanks to improvement in technology and a meaningful drop in cost. Texas is now the nation’s leader in wind energy and is a significant player in solar power.

Electrification

The effort to reduce carbon emissions have led to increased stress on the electrical grid. Think of electric vehicles or heat pumps. Data centres including those supporting AI consume so much energy their locations may be determined by the availability of cheap power.

Shiuman’s Corner

What I read in 2024

This is the third year of my book list, in which I list what I read in the past year. It is my way of sharing what I found interesting or enjoyable, and is not meant to be a review of books. My aim is to finish one fiction and one non-fiction each month, but I fell short of that. Some of the tomes were thick, and my schedule did not always allow a block of time to read each day. Two biographies were notable, on Elon Musk and Leonardo di Vinci, both by Walter Issacson. Separated by 700 years both men have made significant contributions to science and technology. Musk is a controversial figure, but his intellect and drive has led to astounding achievements. The author’s account of the development of Space-X rockets (with repeated failures) is testament of his sheer determination. On the fiction side, two books stood out. Lessons, by English author Ian McEwan was brilliantly crafted. I was given a book by Hisham Matar, whose family was from Libya but lived in Egypt and the UK. His Anatomy of a Disappearance was delicate and moving. I saw a lot of parallels between that and his autobiographical account of his search for his father in The Return. The full list is in the Addendum. Enjoy!