Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q1 2024 edition covers Market Review for 2023, a Turning Point on interest rates, and advantages of Bonds. Plus my Book List for 2023.

Markets

Market scorecard as of close on Thursday March 28, 2023.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 22,167 | 0.8% | 5.8% |

| U.S. | S&P 500 | 5,245 | 0.2% | 10.0% |

| U.S. | NASDAQ | 16,379 | -0.3% | 9.1% |

| Europe/Asia | MSCI EAFE | 2,349 | -0.1% | 5.1% |

Source: FactSet

-

TSX closed higher in Thursday afternoon trading, a bit off best levels after touching intraday highs. Most sectors higher. Canadian equities gained 0.8% on a weekly basis. TSX recorded its fifth straight monthly gain an up nearly 6% for Q1 (after rising more than 7% in Q4'23).

-

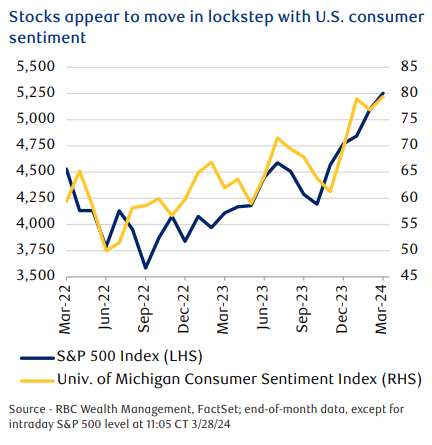

U.S. stocks have traded marginally higher with lower-than-usual volume in the holiday-shortened week, as quarter-end rebalancing prompted traders to lock in some gains. The S&P 500 posted new highs and marked a fifth straight month of gains. Stocks logged broad gains for the week, month, and quarter. Treasuries were mostly weaker, particularly at the front end.

-

Asia Pacific equity markets have traded mixed during the week. Australia led the region, while Japan lagged. After hitting a fresh high last week Friday, Japan’s TOPIX Index lost steam during the week as investors began to book some profits ahead of the quarter-end rebalancing.

Economy

Canada

-

Canada’s economy gained momentum at the start of the year. The latest figures from Statistics Canada show the economy expanded by 0.6% m/m in January, ahead of the consensus expectation for a 0.4% gain. According to RBC Economics, about half of the increase can be attributed to the return of striking public sector workers, which weighed on the economy late last year.

-

Canadian lenders are taking action to avoid systemic risks by reining in ultra-long mortgages. Loose monetary policy during the pandemic recession drove a sizeable increase in residential real estate debt, with looser conditions causing an approximate 40% increase in the value of home loans.

U.S.

-

It was a quiet week for economic data, with new home sales slightly below consensus estimates, and durable goods orders slightly above.

-

A strong employment backdrop has been one of the factors underpinning consumer confidence, and recent jobs data, while slowing, has still been surprisingly robust. Proprietary research from the RBC Capital Markets Digital Intelligence team, however, raises a cautionary flag. The team’s nowcasting work shows that job postings data scraped from the websites of 21,000 U.S. companies has taken a sudden downturn.

Further Afield

-

Some green shoots are appearing in the eurozone economy, after many months of stagnation in the wake of the energy crisis. The European Commission’s Economic Sentiment Indicator (ESI) inched up to 96.3 in March from 95.5 the previous month.

-

The yen fell this week to the lowest level against the U.S. dollar since 1990. The weakness came despite the Bank of Japan raising interest rates for the first time in 17 years. We think traders believe current monetary policy in Japan remains too loose, especially when the Federal Reserve is holding interest rates at a two-decade high.

Notes About Companies in Model Portfolio

-

Royal Bank of Canada (RY) announced Friday it had completed the acquisition of HSBC Bank Canada ("HSBC Canada”). "Today marks one of the most exciting times of our 155-year history and a pivotal milestone in our long-term growth story as we welcome 4,500 employees and 780,000 clients from HSBC Canada," said Dave McKay, president and CEO of RBC.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman