Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q1 2024 edition covers Market Review for 2023, a Turning Point on interest rates, and advantages of Bonds. Plus my Book List for 2023.

Markets

Market scorecard as of close on Friday February 2nd, 2023.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 21,085 | -0.2% | 0.6% |

| U.S. | S&P 500 | 4,959 | 1.4% | 4.0% |

| U.S. | NASDAQ | 15,629 | 1.1% | 4.1% |

| Europe/Asia | MSCI EAFE | 2,223 | 0.6% | -0.6% |

Source: FactSet

-

TSX finished lower in Friday afternoon trading, off worst levels. Most sectors lower. Canadian equities closed with a 0.2% weekly decline led by a drop in the energy sector.

-

US equities ended mostly higher Friday, near best levels. Follows a Thursday rebound that saw three of the four major indexes up over 1%.

-

Equity markets sold off sharply Wednesday afternoon following comments by Federal Reserve Chair Jerome Powell indicating he didn’t believe the Fed was likely to begin cutting interest rates in March. The comments rattled investors—reigniting fears that the Fed isn’t quite ready to move away from its “higher-for-longer” stance.

Economy

Canada

-

Canadian GDP posted a larger than expected 0.2% increase in November (the first rise since May) with the early estimate for a stronger 0.3% increase in December. Overall we (RBC Economics) continue to expect pressures from elevated interest rates to curb consumer demand, stalling growth in both output and inflation over the first half of 2024 before the BoC is expected to cut rates in June.

U.S.

-

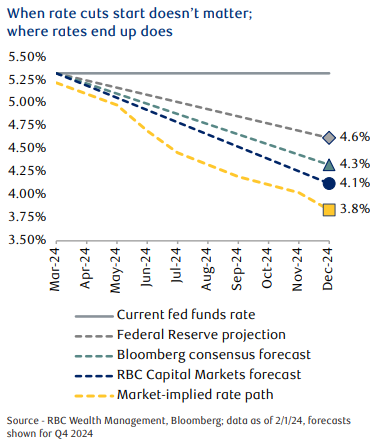

The U.S. Fed (as expected) held the fed funds target unchanged for fourth consecutive policy meeting but dropped an explicit bias to push interest rates higher. We (RBC Economics) continue to expect the unemployment rate to edge higher in the first half of this year and for inflation to continue to ease back towards the 2% inflation objective.

-

US labour market data started 2024 with a bang. The job count surged by 353k in January (roughly double market expectations) following a similar, and upwardly revised, 333k surge in December. The strong early data for 2024 points to strong momentum in consumer demand late last year potentially persisting into early 2024.

Further Afield

-

The Bank of England (BoE) kept interest rates unchanged at 5.25%. During his press conference, in a bid to keep market expectations under control, BoE Governor Andrew Bailey refrained from endorsing the current market pricing of rates cuts. He instead chose to reiterate the removal of the hiking bias in the statement and stated that the committee opts to “reserve judgement” and remain data-dependent.

-

In January, manufacturing activity in Asia demonstrated a notable improvement, primarily due to stronger demand from key markets, which helped offset the decline in China. Notably, South Korea and Vietnam witnessed a long-awaited turnaround in their manufacturing sectors.

Notes About Companies in Model Portfolio

-

Fourth-quarter earnings season is well underway with over 40% of the S&P 500 having already reported. Approximately 53% of companies have reported sales that exceeded analyst expectations.

-

Apple (AAPL) announced financial results for its fiscal 2024 first quarter ended December 30, 2023. The Company posted quarterly revenue of $119.6 billion, up 2 percent year over year, and quarterly earnings per diluted share of $2.18, up 16 percent year over year.

-

Waste Connections, Inc. (WCN) announced the closing of the previously announced acquisition of the Secure Energy Services Inc. (SES) portfolio of 30 energy waste treatment and disposal facilities in Western Canada for an aggregate purchase price of CAD$1.075 billion.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman