Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can view the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q3 2023 edition covers Market Review, Concentration of Returns in U.S. equities and Estate Planning Basics.

Markets

Market scorecard as of close on Friday September 29, 2023.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 19,541 | -1.2% | 0.8% |

| U.S. | S&P 500 | 4,288 | -0.7% | 11.7% |

| U.S. | NASDAQ | 13,219 | 0.1% | 26.3% |

| Europe/Asia | MSCI EAFE | 2,031 | -1.6% | 4.5% |

Source: FactSet

-

TSX closed lower in Friday afternoon trading. Most sectors lower. Canadian equities rose 0.8% Thursday, partly recovering from a big two day drop. TSX dropped 1.2% on a weekly basis. Slightly ahead YTD after briefly dipping into negative territory this week.

-

US equities finished mostly lower in Friday trading, coming off some morning strength but ending off worst levels. Major indices were mixed for the week and closed out September and Q3 with losses. Energy, insurers, biotech, multis, managed care, machinery, homebuilders were among the laggards. Big tech was mixed. There was some relative strength in apparel (NKE-US ), retail, drug stores (WBA-US ), regional banks, semis, entertainment, and China tech. US stocks slumped into month- and quarter-end.

Economy

Canada

-

With higher interest rates softening growth momentum, Statistics Canada has forecast stagnant growth in July. Real GDP growth in Q2 2023 came in at an annualized -0.2%, below the +1.2% consensus estimate. A higher unemployment rate and softer job creation are also producing headwinds to growth in Q3.

-

The Canadian Federation of Independent Businesses’ (CFIB) monthly business barometer, a survey-based measure that reflects business owners’ expectations for their firms’ performance over the next 12 months, fell 6.0 points to 48.7 in September. This is the first time since the pandemic that the monthly survey came in below 50.0, indicating that most owners are pessimistic on the outlook for their businesses.

U.S.

-

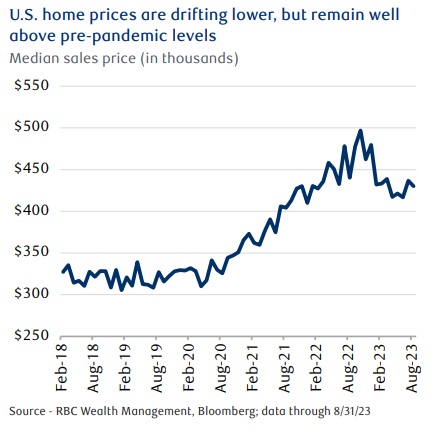

New home sales in the U.S. dropped to a five-month low in August, as historically elevated mortgage rates and persistently high prices continued to weigh on housing demand across the country.

-

U.S. consumer confidence fell to a four-month low in September against a backdrop of rising prices, most notably food and gasoline costs. Even though recent data suggests an economic soft landing is potentially on the table, Americans appear increasingly preoccupied with concerns about their finances and employment prospects.

Further Afield

-

Euro area bank lending to corporations fell 0.4% m/m in August on a seasonally adjusted basis. This suggests to us that weak economic activity and higher interest rates will crimp business investment in the short term.

Notes About Companies in Model Portfolio

-

Apple (AAPL) -- Bloomberg reports that early buyers of the new iPhone 15 Pro and Pro Max have been complaining on social media and in other media articles that the newly launched Pro and Pro Max can get too hot during use or while charging. It is believed the problems were caused by TSMC's 3nm process but rather by compromises made in the design of the phone to reduce weight, and that the company was expected to address the issues via software updates.

-

Costco (COST) – Costco reported 4Q2023 earnings per share (EPS) of $4.86 ahead of consensus. Revenue was $78.94B vs FactSet estimate of $77.72B. Big ticket (discretionary) categories remain relatively pressured, yet COST is still outperforming, particularly in e-commerce. COST is very well-positioned in the current market with high gas prices and increasing economic pressures causing consumers to seek out the company’s best-in-retail prices (gas and merchandise).

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman